AI & Investing!

In this never-ending debate of AI's capabilities in disrupting the investing landscape, where do you stand?

Progress often, if not always, grows upon widespread suspicion and criticism.

Let me share a few examples.

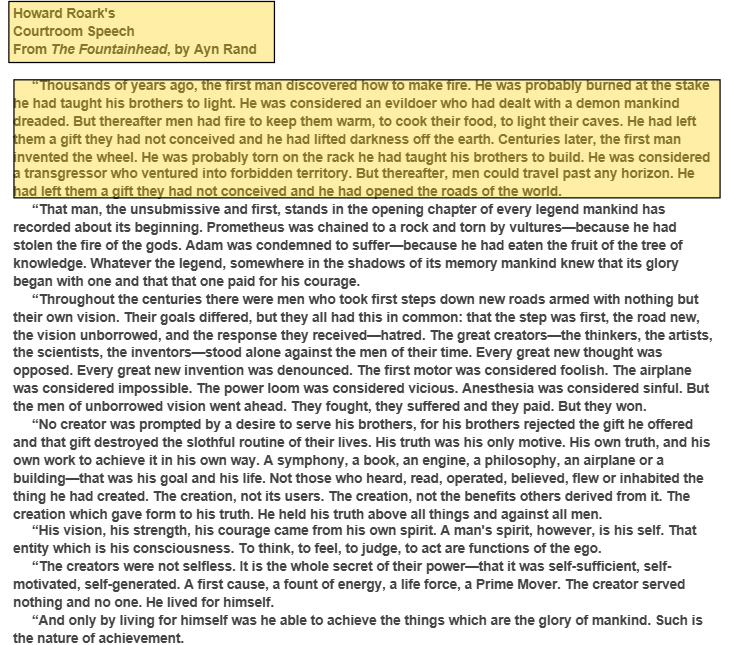

Example 1

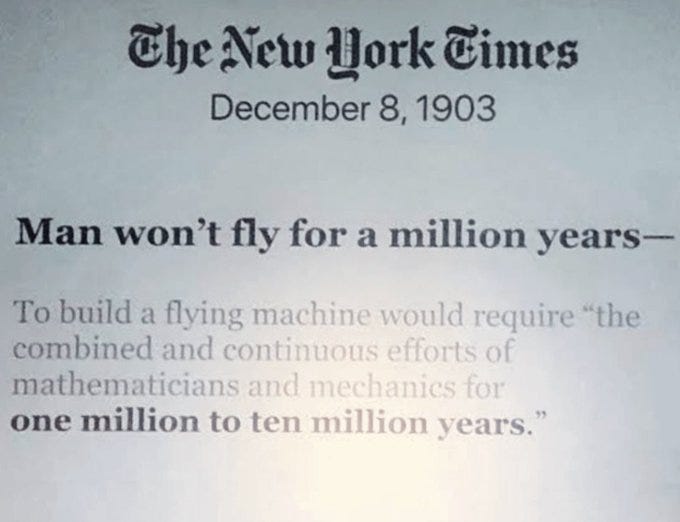

Example 2

Sources: https://timesmachine.nytimes.com/timesmachine/1903/10/09/102025405.html?pageNumber=6

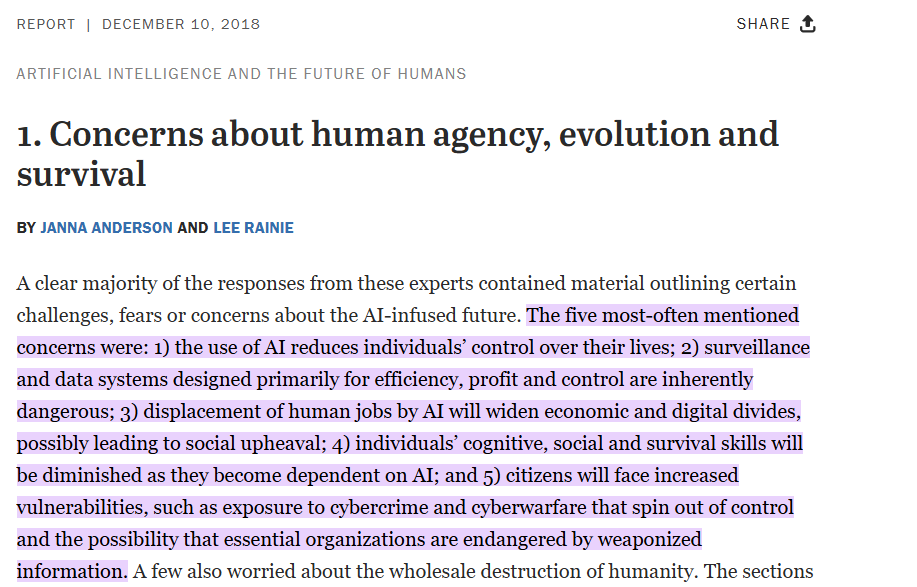

Example 3

Example 4

Source: https://www.pewresearch.org/internet/2018/12/10/concerns-about-human-agency-evolution-and-survival

I can go on and on, but I guess you get the context.

If the above 4 examples were on the suspicions and criticisms of human progress, here are 4 super bullish predictions that failed miserably too.

Example 1: Overly optimistic timelines for self-driving cars and complete replacement of human drivers

Example 2: Car ownership will plummet drastically due to ridesharing, self-driving cars, and Transportation as a Service.

Example 3: The paperless office and the death of physical retail

Example 4: Technological singularity, where AI surpasses human intelligence and leads to unpredictable changes

At least, at the time of writing this post, I see these bold, over-optimistic predictions have been proven wrong. They may materialize far into the future, of which I don’t have any crystal ball gaze capabilities. But the fact of the matter is that people went from one end of the spectrum of extreme pessimism to the other end of the spectrum of super-bullishness in quick time.

Now, coming to “AI and Investing,” that is gaining a lot of ground over the last few months, my observations are similar.

At the start, investors were not sure of AI’s capabilities in investing and research.

Today, on the flip side, maybe we are overestimating its capabilities.

Does that mean there is no meaningful progress of AI in investing?

Of course not. AI is making a lot of progress. And fast.

Let me share a couple of them.

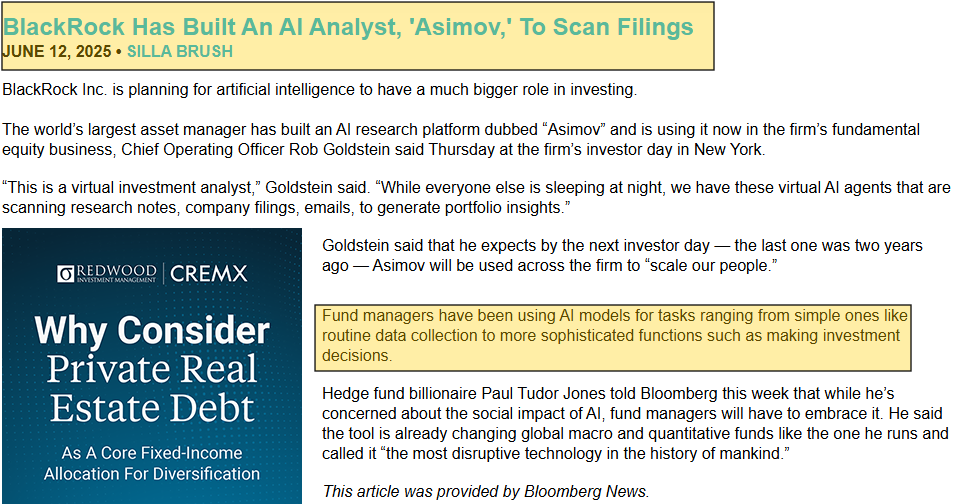

Progress No 1

Source: https://www.fa-mag.com/news/blackrock-has-built-an-ai-analyst---asimov---to-scan-filings-82891.html

Progress No 2

In the above Morgan Stanley report, it further mentions something which piqued my interest.

Let me reproduce the text below for your reference

AI is all around us.

AI listens to you.

AI sees your face and body.

AI knows where you are right now.

AI can read. AI can write. AI can talk.

AI can make a picture of cats wearing little cowboy hats playing Canasta.

But other than running loads of algos and activating a few switches, AI rarely ever actually moves.

In nature, "motility" is an organism's ability to move independently under its own energy.

According to fossil records, the earliest evidence of motility on Earth traces back to bacterial flagella (spindle-like extensions used for locomotion) in the Precambrian era.

The lines between mobile devices and robots are beginning to blur.

I wrote a LinkedIn article last month titled, “AI is Eating the Jobs in Equity Research!”

Link: https://www.linkedin.com/pulse/ai-eating-jobs-equity-research-ankit-kanodia-bzigc

And I continue to believe that AI is a very efficient tool to help you gather information from different sources on topics you are researching. And we are still in the early days. This efficiency will continue to explode in the years to come. So, investors or research analysts are going to benefit a lot from this emerging trend.

But as investors, our job is not just to collect information. There is more to it.

I think we go through the three stages in investing.

Stage 1: Information Stage: Where we collect information about a business from multiple sources like annual reports, corporate presentation, quarterly concall transcripts, website, other freely available information on the internet, and so on and so forth.

Stage 2: Knowledge/Analysis/Insight Stage: Where we convert the information into processed knowledge or analysis, or insight. The information stage helps immensely in building up this stage.

Stage 3: Behavioural or Wisdom Stage: This is the last stage. This stage is so different and diverse for different investors that, for the same information and insight, different investors opt for different choices. For the same information and the same analysis, one investor may opt to buy another chooses to sell. And you cannot decide who is right and who is wrong just based on a short-term portfolio return percentage. And this is a very simplistic example. There could be further complexities and subjectivity that make investment decision making more a personal decision than a standard logical algorithm.

At the time of writing this post, I see huge value in AI when it comes to Stage 1 and a good role in building up Stage 2. In Stage 2, you cannot rely solely on AI. You have to do the thinking part. But AI can surely play a good supporting role. However, I do not see any contribution of AI in Stage 3 at the moment. And I don’t see that happening, at least anytime soon.

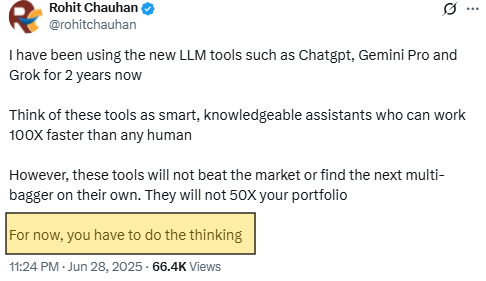

This image on the internet sums up the capabilities of AI in investing today.

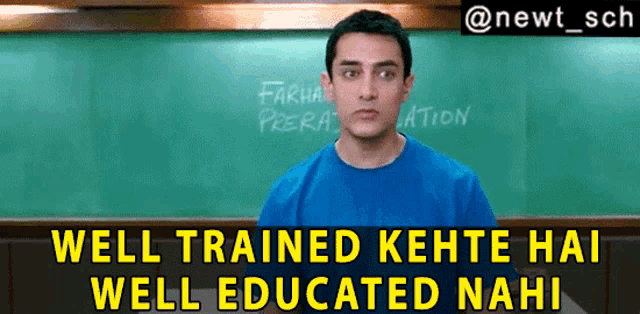

Rather, I would tend to agree with Prof Sanjay Bakshi and Rohit Chauhan on this.

Source: https://x.com/Sanjay__Bakshi/status/1939047214502027453

Source: https://x.com/rohitchauhan/status/1939019481243689013

The movie “The Matrix” was way ahead of its time in the year 1999.

That is where I first heard the phrase:

“The Agents Are Coming!”

Today, after 26 years, in 2025, I am still hearing that the agents are coming.

But my points about AI agents and investing are pretty straightforward.

Sometime far into the future, or maybe sooner than that, agents may come.

But odds are high that we will have our own Neo, The One. He will alter the Matrix’s [read AI] code.

Thanks for reading.

P.S. If you find value in our work, you may explore joining our exclusive Zen Investing Club. The only investing community in India that focuses on the niche microcap space (less than INR 3000 Cr market cap businesses).

Enjoyed it thoroughly 💯