Apollo Micro Systems

Research Lab | Issue#11: When the World Goes to War, This Sector Grows Stronger

Russia vs. Ukraine. Israel vs. Iran. And not too long ago, India vs. Pakistan.

We’re living through one of the most geopolitically tense decades in recent memory.

Markets have become a mirror to this madness. And as Joker said, madness is lot like gravity. All it needs is a little push.

And that is the reason i guess, that one morning it’s a missile attack, and the markets open deep red. By the evening, ceasefire talks emerge, and indices recover just as quickly. If you’ve felt like you’re on a rollercoaster with no seatbelt, you’re not alone.

Now here's a simple thing that I’ve come to realise in the middle of this chaos: most sectors fear war, but one sector often feeds on it.

Yes, you guessed it right. Its the defence sector.

And to explain why, let’s borrow a concept from Nassim Nicholas Taleb . He coined a term called “Antifragile.”

It describes systems that don't just survive volatility, they benefit from it. They get stronger, sharper, more powerful every time they’re tested by external shocks.

That’s exactly what we’re witnessing with defence.

Every time there's a global conflict, countries hit pause and ask themselves a simple but existential question:

Are we prepared?

Whether they're directly involved in a war or merely watching from the sidelines, every government is now re evaluating its defence capabilities, supply chains, and battlefield technologies.

And India, in many ways, had already read this playbook.

A recent example that brought this to life was Operation Sindhoor, where India deployed indigenous technologies in real combat-like conditions.

Source: PIB

From Bangalore-based drone startups to locally developed electronic warfare and surveillance platforms, the mission became a visible reminder of how far our domestic defence ecosystem has evolved and why self reliance is no longer just a slogan, but a strategy in action.

Source: ET

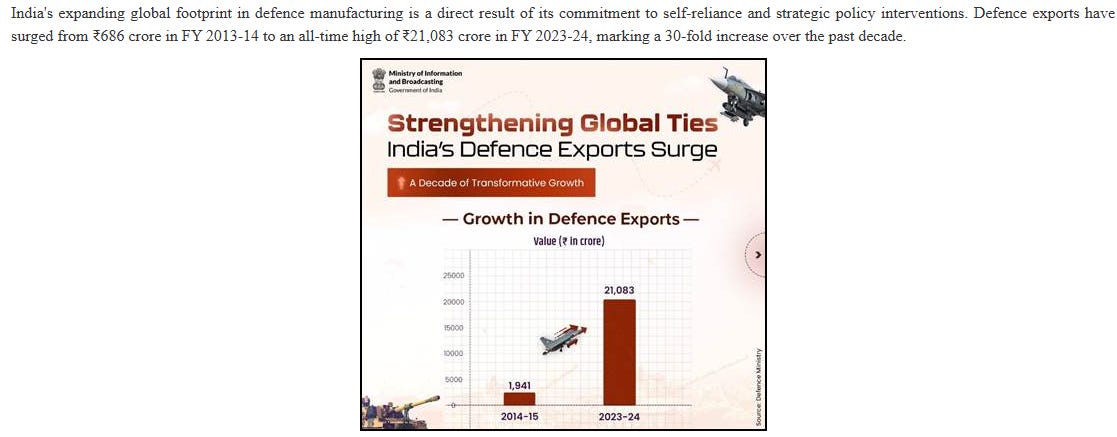

Infact over the last decade, India’s defence policy has quietly but dramatically pivoted from massive import dependence to self reliant exports.

To put that in numbers: In FY13, India’s defence exports were a mere ₹686 crores. In FY24, that number stood at ₹21,083 crores.

Source: PIB

That’s almost 30x growth in just over a decade.

Call this as a megatrend or structural shift or anything you like, but the impact was real on companies as global defence spending is only going up from here.

And India, for once, is not just buying weapons. It’s starting to build and sell them.

Source: PIB

Now of course, these are just my personal reflections that have shaped by the times i have lived in. completely subjective. But if you’re thinking what I’m thinking, and if I'm thinking what you think I’m thinking, then maybe we’re both thinking the same thing

(try to speak 5 times without a break. If you are able to do that, I have a special gift for you. use coupon code ZEN50 to get 50% discount on Zen Investing Club :) offer is open only for first 100 members and only few seats are left)

So let’s not waste a moment.

Let’s dive into the story of one such rare, critical, and rapidly evolving defence player, a company that quietly went from designing circuits to build India’s next generation of smart weapons.

Apollo Micro Systems

Long before Apollo Micro Systems became a listed company, it actually began as a small, niche engineering entity in Hyderabad in 1985. Mr. B. Karunakar Reddy, when started this journey, the Indian defence industry was far from what it is today.

Source: TheOrg.com

Indigenous manufacturing was in its infancy. Whatever little we did was also mostly monopolized by government run labs and PSUs. Private companies were barely allowed near these so called sensitive projects.

Source: Economic Times

But Apollo chose a patient path: it started by building high reliability electronic systems, the kind used in space launch vehicles, missile checkout stations, and rugged battlefield conditions. Apollo started off not as a manufacturer, but as a contract design and engineering partner to India’s defence R&D organisations, DRDO and ISRO.

The company’s first two decades were spent largely in the shadows of larger institutions like DRDO and ISRO, working on critical electronics, embedded systems, and ruggedized control units. Apollo became known for its ability to deliver highly customized, miniaturized electronics tailored for India’s extreme environmental and performance standards high altitude missile systems, naval underwater platforms, and avionics.

Source: Prospectus

In 1997, Apollo Micro Systems was converted into a private limited company, marking the beginning of its formal corporate journey. Over the next decade, as India gradually liberalised its defence procurement policies, Apollo gained deeper access to the government defence ecosystem. This allowed the company to participate more meaningfully in product development rather than just executing custom orders.

In 2000, it supplied its first indigenous Pay Load Checkout System to ISRO, replacing a foreign legacy system, a major validation of its engineering prowess.

By the mid 2000s, Apollo had begun working closely with various defence research labs.

Between 2004 to 2006 it got certified for quality and signal analyser equipment to Naval Labs. In 2012 it achieved ISO 9001:2008 certification, cementing its credibility in hardware + software systems

And along with this, it built capabilities in designing on board and ground support equipment. This included subsystems for vehicles, submarines, ships, and aircraft. These weren’t glamorous end products like we see in war and space movies nowadays, but rather the Critical electronics that control, guide, and secure those platforms.

Between 2013 and 2017, Apollo quietly positioned itself as an approved vendor for India’s most sensitive defence and aerospace programs. For example in 2013, it got registered with DRDO and Defence Electronics Research Labs as a vendor and assembler. In 2014, it got certified with Naval Dockyard, Visakhapatnam and Research Centre Imarat, Hyderabad. Between 2016 and 2017, it got registered with HAL, and secured design approval from Centre for Military Airworthiness and Certification (CEMILAC)

Source: Prospectus

The IPO and Strategic Inflection (2018)

By the time Apollo Micro Systems hit the public markets in January 2018, it had quietly built a highly specialized and deeply technical business. One that most people outside the defence corridors hadn’t really heard of, but those inside couldn't function without. Apollo wasn’t making the fighter jets, missiles, or submarines, but it was making the critical systems that went inside them. The hidden intelligence.

Source: Prospectus

The kind of systems whose significance was beautifully explained by Rajkumar in the Tiranga movie. I hope you all remember Genda Swami.

Its main strength was in what are called On Board Systems. Consider this as the brain child of the weapons. Whether it was a missile, a submarine or a battle tank, it was building the electronic systems that helped them Target, move and engage with precision. From signal processors to payload controllers, these systems ensured these machines didn’t just move, but moved smartly.

It also played a key role in Ground Support Systems. This includes the setup that enables missiles to be launched, tracked, and controlled from bases. It designed electronic units that handled telemetry, ground communications, and command systems essentially, the systems that make sure what's launched finds its way to the right destination.

Apollo was also working in Avionics segment, supplying safety critical systems for drones and aircraft. Consider them as an embedded systems that help control flight parameters in real time, ensuring safety and efficiency.

Its work with the Indian Navy included electronics for underwater weapons like torpedoes control systems that manage their launch, path, and detonation. (To understand this, you can watch the movie Ghazi Attack)

The Ghazi Attack Latest Hindi Dubbed Full Movie | Rana | Satya Dev | Taapsee | Hindi New Movies 2025

And in the aerospace sector, it was involved in building checkout systems and simulators for space applications, equipment used to test and calibrate satellites before launch.

Beyond pure defence, Apollo had also extended into Homeland Security and Transportation, offering smart surveillance and tracking systems. From GPS based mining vehicle tracking to intelligent displays in rail and road transport systems, Apollo’s technology had use cases even outside the battlefield.

In short, Apollo had become the invisible command center inside India's defence machinery. With a big portfolio complex products, it had built a vast library of technology which is upgradeable and highly specific to Indian conditions.

But what it didn’t yet have was scale. Most of this work was project based, built to order, and volume was limited. That’s where the IPO came in. The funds raised weren’t just meant for working capital, they were the fuel for Apollo’s next act: moving from engineering brilliance to manufacturing strength.

What’s Happening Now: From Engineering Lab to Defence Assembly Line

For decades, Apollo Micro Systems had thrived in a niche corner of India’s defence ecosystem building complex electronics, one critical project at a time. It was a low volume, high value game. Each order was tailored to the exact needs of DRDO,ISRO & other Defence PSUs. But there was a catch. This model might be intellectually satisfying but was difficult to scale.

High dependency on development work meant long gestation cycles, unpredictable cash flows, and a heavy working capital burden. Every rupee earned had already waited months in design labs and testing corridors. If Apollo wanted to move from a reliable defence vendor to a frontline systems, something had to change.

So the company flipped the coin. Over FY23 and FY24, Apollo began its most ambitious transformation yet: moving from one off engineering contracts to mass manufacturing of fully indigenous systems.

Source: Business Standard

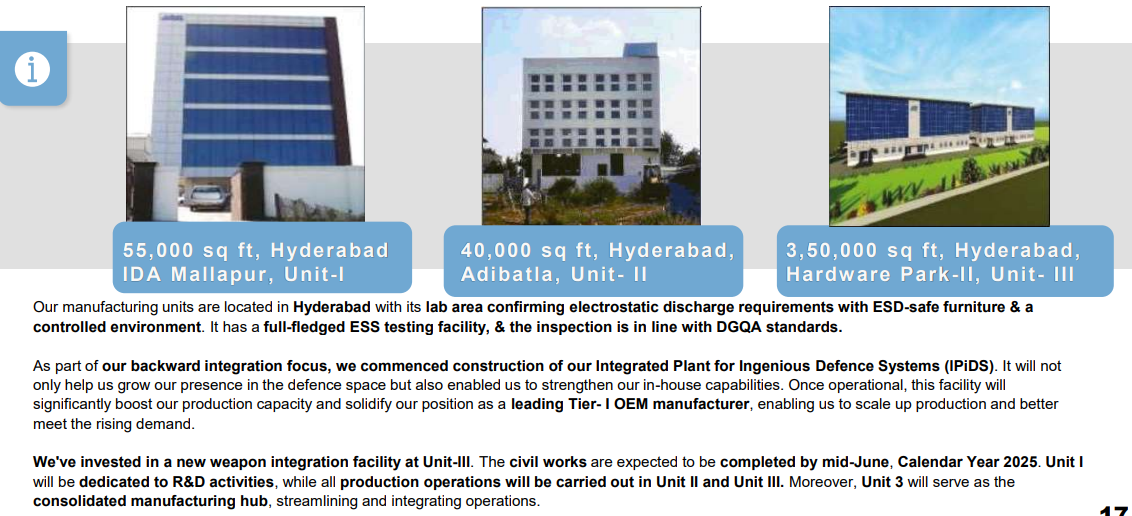

Recently the company invested in two massive infrastructure upgrades:

First came Unit 2, a dedicated production facility aimed at consolidating Apollo’s fragmented manufacturing operations under one roof. The construction is complete, partial operations have already staretd but Apollo made the tactical decision to delay its full commissioning until Q2 FY26, to avoid any disruption during the crucial FY25 year end deliveries.

Unit 3, a 350,000 sq. ft. integrated weapons manufacturing facility coming up at Hardware Park 2, Hyderabad. This plant isn’t just another extension. It’s a bold declaration. With an investment of ₹250 crores planned over two phases.

Unit I will remain the company’s dedicated R&D nerve centre. where new technologies are conceived, tested, and refined. The heavy lifting, however, will happen elsewhere. Unit 2 and Unit 3 will take on the full load of production, bringing Apollo’s designs to life at scale. Among them, Unit 3 is set to become the company’s core manufacturing command, consolidating multiple processes under one roof.

The first phase is expected to go live by September 2025, and Apollo has already started procuring test equipment worth over ₹50 crores to ensure faster product qualification and reduced dependency on third party labs.

This reminds me of a beautiful concept.

Economies of Scope > Economies of Scale

That means, Do more things for the same customer, not just more of the same thing. This is how real moats form not by scale, but by customer embedment.

Key Defence Programs: From Supplier to Strategic Partner

Now Apollo’s push into the big leagues isn’t just infrastructure led. It’s also deeply linked to its growing presence in some of India’s most ambitious and classified defence programs. Let’s decode a few of the big ones:

One of the most exciting is the Multi Influence Ground Mine project. These are advanced smart mines used in naval warfare designed to detect multiple parameters before detonation. Apollo successfully completed the final combat trials for these mines just before its Q4 FY25 results. With that, a Request for Proposal (RFP) is now expected within FY26. This marks Apollo’s entry into the lethal combat hardware space.

Then there’s the Kusha Program India’s very own version of the S 400 missile defence system. Yes, S400. You would have heard this in news recently.

Apollo has not only been selected but has become the first company to deliver subsystems for this critical initiative. The full launcher systems a complex and high margin product are expected to be delivered by September, making this one of the biggest operational milestones in the company’s history.

Another big opportunity lies in the Quick Reaction Surface to Air Missile (QRSAM) program. This platform is designed for rapid deployment against aerial threats. The Indian government has already cleared a budget of ₹25,000 crores for this initiative. Orders are expected to start flowing in FY26, most likely through Bharat Dynamics Ltd (BDL)

Apollo’s underwater warfare portfolio is also quietly turning into one of its most promising growth engines particularly through two major platforms: the Extended Range Heavy Weight Torpedo (EHWT) and the Advanced Light Weight Torpedo (ALWT).

For EHWT, all formal approvals including financial clearance from the Ministry of Defence are now in place. The lead integrator, Bharat Dynamics Ltd. (BDL), has already placed a limited initial order as part of the transition from development to production. More importantly, this isn’t a one off supply. It’s a production takeover program, where Apollo will play a critical role as volumes scale. Additional orders are expected to be placed in the near term, with significant execution lined up for the current financial year.

As for the ALWT, while the numbers are not clearly disclosed, management has hinted that the size of opportunity is “very, very large.” Apollo’s contribution is expected to be substantial, and the project is now nearing its induction and execution phase. Once BDL receives its main order, Apollo’s participation will scale in parallel.

Strategic Leap: The IDL Explosives Acquisition and Apollo’s Vertical Integration

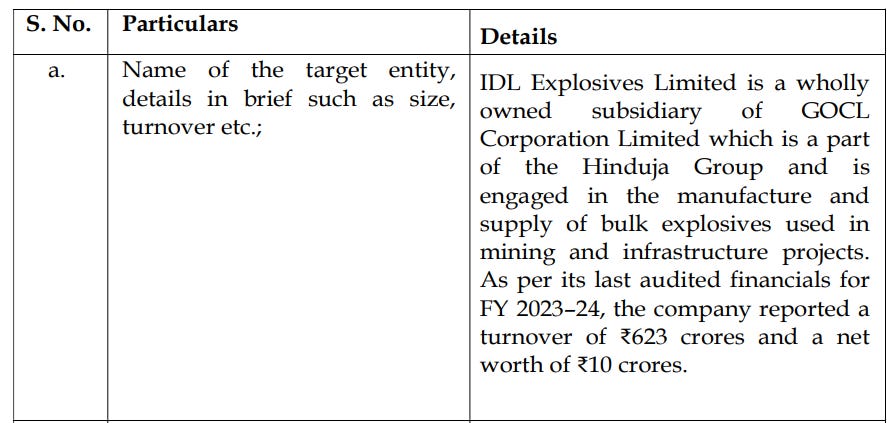

Now every person or a company has a turning point. One investment you would have made, sizeable allocation with good returns, will take your journey to another orbit. In same way for a company a move so bold, it shifts the axis of what the business can become. For Apollo Micro Systems, that moment can be with the recent acquisition of IDL Explosives Ltd.

IDL wasn’t a glamorous defence tech company. It was a legacy player, known for its work in industrial and mining grade explosives. But underneath that surface lay something Apollo saw that others didn’t: a strategic bridge into one of the most powerful verticals in the defence value chain, ammunition and warhead manufacturing.

With this acquisition, Apollo didn’t just buy a business it acquired capability. It now controls the full spectrum of weapons manufacturing, from the tip of the warhead to the chip in the launcher. This is the essence of vertical integration. Instead of just building control systems for bombs, Apollo can now build the bombs themselves.

And it’s not just about ownership. Apollo is pivoting IDL away from its volatile past in mining explosives where margins were unpredictable due to commodity price swings, and transforming it into a defence grade munitions powerhouse.

This includes producing high value materials like TNT, HMX, and RDX, which are the explosive cores of modern weaponry.

Management expects the acquisition to be a financial catalyst as well. IDL’s numbers will be consolidated starting Q2 FY26. Ofcourse, IDL has had its EBITDA challenges but Apollo plans to stabilise that by shifting the product mix, bringing supply chain discipline, and embedding it into long cycle government defence programs.

Demand will come from Apollo’s own platforms as well as DRDO collaborations. As of now, management is confident that IDL will move into positive EBITDA territory within the next few quarters.

This move, more than anything else, signals that Apollo isn’t content being a parts supplier anymore. It wants to be the architect of the entire platform.

While the IDL acquisition added depth, Apollo knew that scale and reach come from partnerships. And in the world of defence, collaboration is not just smart it’s strategic.

To expand its presence across new platforms and programs, Apollo has made some key alliances:

With Garden Reach Shipbuilders & Engineers (GRSE), Apollo is working on underwater weapon systems that is mini torpedo. This taps directly into India’s naval modernization plan and positions Apollo as a preferred subsystem and integration partner for large scale naval contracts.

With Redon Systems, Apollo is co developing loitering munitions, essentially unmanned drones that circle a target area before striking. These are fast becoming essential in modern asymmetric warfare, and Apollo’s control systems + Redon’s aerial expertise make it a potent combination.

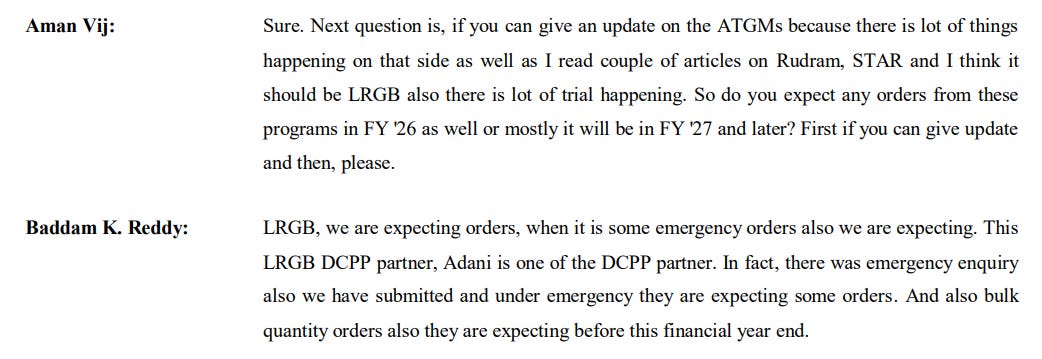

And with Adani Defence, Apollo is tied into one of India’s fastest growing private defence players. Their collaboration focuses on guided bomb systems (LGRB – Laser Guided Rocket Bomb) and smart launcher platforms, where Adani’s DCPP that is Development Cum Production Partner’s capabilities blend with Apollo’s electronics and integration strength.

What makes these partnerships powerful is that they aren’t just joint ventures. They are strategic bets on future defence tech with shared risks, shared technology, and shared access to India’s growing defence budget.

And that’s exactly how modern defence OEMs are born.

Now all this things sounds good. But how much it can turn into revenue?

Order Book Momentum: Numbers That Signal Take-off

As Apollo Micro Systems scales from a project based company to a production powerhouse, the most visible marker of this shift is its order book. And the numbers here tell a compelling story.

As of May 2025, Apollo’s order book stood at ₹615 crores, up from ₹550 crores at the end of Q3 FY25. That may sound incremental, but what’s important is the trajectory and more importantly, the guidance. Management has boldly projected a 3x expansion by March 2026.

This kind of confidence doesn’t come out of thin air. It is being driven by a powerful pipeline across major engines.

First, there’s an acceleration of orders from Bharat Dynamics Ltd, DRDO labs, and Indian shipyards. Second, Apollo is now booking contracts for physical platforms, not just electronic brains. These include torpedoes, launcher subsystems, smart munitions, all high ticket items with repeat potential.

And third, the company is starting to see early signs of global interest, especially in areas like rugged electronics and loitering munitions. With ongoing geopolitical instability, countries are looking for affordable, reliable, and scalable defence hardware, and Apollo fits that perfectly.

One milestone that accelerated this pipeline was the Transfer of Technology (ToT) for the Prachand Munition an anti tank landmine system. Apollo now has the rights to produce this indigenously, and the company expects emergency orders for this category to start flowing in soon.

Source: CNBC

Now big ambitions will also require big capital. Apollo also knows that. Which is why in May 2025, it secured approval for a ₹816 crore preferential issue. The intent? To fund its mega shift from development contracts to platform level production.

This isn’t a passive fundraising. The promoters themselves are participating a strong vote of confidence in the company’s vision. And the money is already being put to work:

Unit 3’s capex requirements are being met, IDL Explosives acquisition and related working capital needs are covered, Investment is flowing into testing equipment and defence certifications, to fast track order execution.

The company has also budgeted ₹100 crores for new product development, particularly in smart weapon systems and autonomous defence platforms.

So in all, Apollo’s leadership team has never been more vocal about its growth expectations and for good reason.

A 45–50% revenue CAGR on a standalone basis over the next two years. Doubling of consolidated revenue in FY26, once IDL Explosives is fully integrated.

EBITDA margins in the range of 25–30% at standalone level.

A complete shift in revenue model: from 75% development / 25% production in FY24, to a 60/40 balance by FY26

But as an investor, all this comes at what valuations?

Everything we’ve seen so far, Apollo’s entry into full-stack defence platforms makes for an exciting story. But if you're wondering whether this story is still under the radar, the answer is: not really.

The market has already started assigning Apollo a premium, and the price action shows it. Over the last year, the stock has more than doubled, climbing from ₹88 to ₹195 and at one point even touching ₹221.

And this is pretty evident in the valuation multiples also. Current P/E is around 104x trailing earnings. Price to Book is around ~10x & Market Cap to Sales: ~12x (on trailing figures)

These are not cheap numbers. In fact, these are premium valuations that suggest the market is already pricing in a significant portion of Apollo’s forward story.

So yes now one will say, it is more than just the numbers, it’s the strategic positioning that’s changed.

Apollo is no longer a support player. It’s now entering a league of Indian defence companies that can design, build, and deliver full stack indigenous weapon systems. In a world where defence budgets are expanding, and where self reliance is a non negotiable, Apollo is in the right business at the right time with the right technology.

Apollo Micro Systems isn’t just a defence electronics company anymore. It is becoming a full spectrum OEM, shaping how India produces and deploys its strategic assets. In a sector where trust, precision, and long gestation cycles are barriers to entry, Apollo has used three decades of credibility to power its next big leap.

But to justify the rich valuations going forward, will this also give an explosive growth with help of IDL going forward? Only time will tell.

As per 2024 Annual report company has 76% stake in M/s. Apollo Defence Industries Private Limited - any idea who own remaining stake?