IRIS Business Services: A Deep Dive

From a quiet innovator to a RegTech trailblazer, a story you cannot ignore!

Sometime in 2021, when the share price of IRIS Business Services was about 140, a friend, who wants to be both rich and anonymous, first told me about this business. He is one of the most hard working and smartest investors I know personally. That is why I pay close attention to what he says about any business.

However, at that time, I could think of two big reasons not to dig deeper. Firstly, I thought that the TAM was abysmally low and would take a lot of time to increase. Secondly, I thought IRIS was in a catch-22 situation. There was no money to spend on marketing to grow sales, and stagnating sales would ensure that no money was being made.

And please don’t tell to my friend that in the next few months, when the stock fell from 140 to 80-odd levels, I took it as an evidence of my brilliance. I was secretly thinking that I was right. And this is what happened next.

In less than 2 years, the stock became a 7-bagger.

Yes!

And I let it pass by just like that.

If by any chance Charlie Munger is watching this from upstairs, in his trademark style, he would show me this.

Yes!

I was sucking my thumb.

Indeed.

Not just this. My FOMO was at its peak in November 2024 when I saw their first investor day’s recording.

Whether you read this blog post on IRIS or not, I would very strongly recommend that you watch this video. Do not summarize it using AI, do not watch it at 1.5X speed. If anything, I would say watch the video at 0.75x speed. And pause in between to think and reflect.

The stock peaked in January 2025 at INR 574 and started a steep fall. And then last month, in April, came a shocking news about the unfortunate demise of Mr. S Swaminathan, the CEO. He was the face of IRIS and a very strong, honest, transparent, and candid individual. If you have watched the investor day video, you would know that I am not exaggerating. After the sad demise of Mr. Swaminathan, the stock has fallen further. The tragic incident has made most investors react in panic. When a tiny microcap company loses its founder and CEO, who was instrumental in building the business, investors find it difficult to imagine the business without him. I, however, beg to differ here. That is why I will dwell a little more on this before moving to what IRIS does and how that is very interesting and difficult to ignore.

When IRIS Meets Godfather

Have you read Mario Puzo's The Godfather?

If not, odds are high that you would have at least watched the movie, The Godfather.

In The Godfather, the death of Don Vito Corleone in 1955 marked a pivotal transition for the Corleone family.

Put yourself in the shoes of the Corleone family. What would you feel?

Or, imagine you are reading this part in the book where Don Vito Corleone dies. Or assume that you are watching that scene in the movie, where Vito Corleone (portrayed by Marlon Brando) dies. What thoughts would run through your minds?

Let me guess. Two things.

First, no one can replace Don Vito Corleone. Your heart aches to come to terms with the fact.

Second, the Corleone family will find it very tough to survive after this.

But this is what happened.

Upon Vito's passing, Michael, his son, played by the legendary Al Pacino, swiftly orchestrated the elimination of key rivals and internal traitors. During the baptism of his nephew, Michael ordered the simultaneous assassinations of the heads of the rival Five Families—Barzini, Tattaglia, Cuneo, and Stracci—as well as Moe Greene, who opposed the family's interests in Las Vegas. He also sanctioned the executions of Salvatore Tessio and Carlo Rizzi for their betrayals. This decisive action reestablished the Corleone family as the most powerful crime syndicate in the nation.

Michael Corleone's tenure as Don was marked by a ruthless consolidation of power, strategic expansion into legitimate businesses, and a leadership style that combined tactical brilliance with personal sacrifice.

I know, at this point you must be thinking that how can I relate a fictional novel or movie with a real business and a real person.

Ok. Fair point. Let me share a real story about a real person and a real business.

From Turnaround to Turmoil: Yogesh Mahansaria's BKT Journey

Yogesh Mahansaria played a pivotal role in transforming Balkrishna Industries Limited (BKT) from a modest, loss-making scooter tire manufacturer into a globally competitive player in the off-highway tire (OHT) segment. In 1993, at just 18 years old, Mahansaria joined BKT, a company co-promoted by his family. Recognizing the limited global demand for scooter tires, he identified a niche opportunity in the OHT market, which includes agricultural, industrial, and construction machinery tires. Under his leadership, BKT shifted focus to this segment, leading to a significant turnaround. By 2000, he was appointed CEO of the tire business, and over the next six years, he increased revenues 6-fold and substantially boosted profitability. Despite his success, Mahansaria and his father, Ashok, exited BKT in 2006 due to internal family disputes. The Poddar family, majority stakeholders in BKT, sought greater control over the company. With the Mahansarias holding only a 5.4% stake, they lacked the influence to counter this move and were effectively ousted.

Again, a similar kind of story. The architect who built the empire is gone.

Do you know what happened to BKT after that?

I am not saying that just because the Corleone family did well even after the demise of Vito Corleone, and BKT did well even after the ousting of the person who turned around the company, you should buy IRIS when Mr. Swaminathan is no more.

My point is simple. As much as we are human and our hearts go out to our heroes, as investors, we must focus more on the future business potential and succession planning than ruing the past that won't return.

I know, I kept you waiting for long, but finally we are on to the story of IRIS Business Services.

And I have kept it very simple. Just 9 short chapters explaining the story of IRIS.

From a Quiet Innovator to a RegTech Trailblazer, a story you cannot ignore!

Prologue: The Digital Compliance Revolution

Imagine a world where every business, from a tiny Mumbai startup to a global automaker in Germany, speaks the same digital language when reporting to regulators. Imagine a future where financial data, ESG disclosures, and tax filings flow seamlessly across borders—instantly comparable, error-free, and accessible at the click of a button. This is not a distant dream, but a reality being shaped by a handful of visionary companies. One of them, IRIS Business Services, has quietly built the backbone for this digital compliance revolution.

Chapter 1: The Genesis – How IRIS Found Its Calling

Founded in 2005 by three industry veterans—S. Swaminathan, K. Balachandran, and Deepta Rangarajan—IRIS began its journey with a simple but powerful insight: regulatory reporting was broken. Each country, each regulator, each company had its own formats, leading to inefficiency, opacity, and frustration for everyone involved.

The founders saw the potential of XBRL (eXtensible Business Reporting Language), a global standard for digital business reporting. While the world was just waking up to the power of structured data, IRIS took the plunge, betting that XBRL would become the “HTML of financial information.” They were right.

Let me dwell a little more on XBRL here.

If you are an Indian investor, odds are high that, just like me, you get annoyed when you see INR Million or INR Billion in annual reports and corporate presentations. It is basically to impress foreign investors who do not understand it fully. It is not that you cannot calculate or convert them into INR Cr or INR lacs. It is just that it’s not convenient for you when your natural bent is towards lacs and crores. That is where XBRL comes in.

XBRL is the global standard for digital business reporting, making business data computer-readable, easily accessible, and highly analyzable.

Its main benefits and usefulness include:

Consistent, Comparable, and Computer-Readable Data

Efficiency and Accuracy

Universal Standard

Wide Applicability

Enhanced Transparency and Market Efficiency

Global Adoption: XBRL is used in 65 countries

Data Validation and Multilingual Support

And most importantly, it is a Win-Win Proposition for all 3 stakeholders.

Investors gain easier, faster access to comparable data for better decision-making.

Regulators achieve more efficient, effective oversight and risk assessment.

Corporations can improve their access to capital and go beyond compliance by leveraging digital reporting for performance monitoring and benchmarking.

In essence, XBRL is the gold standard for digital business reporting, enabling transparency, efficiency, and high-quality analysis across the global financial ecosystem.

Chapter 2: Building the Three Engines – Collect, Create, Consume

IRIS didn’t just ride the XBRL wave; it built three powerful engines to harness it:

1. SupTech (Collect)

What it does: Powers regulators—central banks, business registries, securities commissions—to collect, validate, and analyze data from thousands of entities.

Flagship clients: RBI, ACRA Singapore, South African Reserve Bank (SARB), regulators in Mauritius, Bhutan, and more.

Revenue model: Large, multi-year contracts (often $1–5 million), with recurring annual maintenance.

2. RegTech (Create)

What it does: Empowers enterprises to prepare and submit digital filings—financial, ESG, and tax—across multiple jurisdictions.

Flagship products: IRIS CARBON (for disclosure management and ESG), IRIS iDEAL (for banks), IRIS GST (for Indian tax compliance).

Revenue model: SaaS subscriptions, pay-per-use, and value-added services.

3. DataTech (Consume)

What it does: Unlocks the value of regulatory data for lenders, investors, and corporates through analytics, APIs, and workflow tools.

Flagship products: IRIS Credixo (MSME credit analytics), IRIS Peridot (compliance tracking), custom data APIs.

Revenue model: API subscriptions, outcome-based fees (e.g., for MSME lending pilots).

Key differentiators:

Only listed pure-play RegTech SaaS company in India with presence in 54 countries.

Proprietary XBRL expertise – the "HTML of financial data" used by 70+ regulators globally.

95%+ customer retention across marquee clients like RBI, BMW, and Reliance.

Let me summarize the product engine in one table for your memory

Chapter 3: The Numbers Behind the Narrative

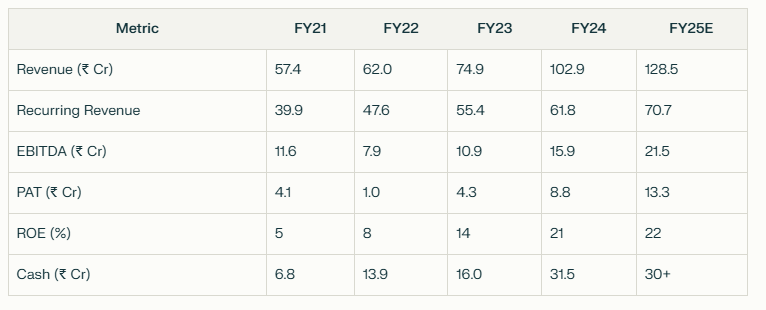

The growth engine in the business has started firing all cylinders. Especially in the last two financial years. Revenue grew at a CAGR of 22%. Latest EBITDA and PAT margin are 17% and 10% respectively.

Chapter 4: Why IRIS is Special?

A. Riding Global Regulatory Megatrends

Digital compliance is going mainstream: From India’s GST and BRSR to Europe’s CSRD and US SEC’s iXBRL mandates, regulators are demanding digital, structured, and comparable data.

ESG is the next frontier: Europe’s ESG mandates (2025 onward) will bring tens of thousands of companies into the XBRL fold. IRIS’s multi-mandate, multi-jurisdiction platform is ready.

B. SaaS Economics and Scalability

High gross margins: SaaS business model means each new client adds incremental margin.

Operating leverage: As recurring revenue grows, costs rise much slower than revenues.

Sticky client base: 3–5 year contracts, 95%+ retention, deep integration with client systems.

C. Global Footprint with Indian DNA

Export powerhouse: 70%+ of revenue from outside India.

Reference clients: From RBI to South African Reserve Bank, IRIS is trusted by the world’s top regulators.

D. Product Innovation and AI Integration

AI-powered compliance: Litigation management, auto-drafting for GST, predictive analytics for regulatory risk.

Disclosure management: IRIS CARBON is now a full-suite solution for financial and ESG reporting.

E. Robust Financials and Order Book

Order book: ₹120+ Cr, providing 1-2 years’ revenue visibility.

Cash flows: Operating cash flow doubled in FY24, supporting reinvestment and growth.

Chapter 5: Risks – The Other Side of the Coin

Revenue lumpiness: Large SupTech contracts can make quarterly numbers volatile (but annual growth trend is strong).

Regulatory dependency: Growth is tied to new mandates and RFP cycles, which are unpredictable.

Global competition: Facing global SaaS leaders (Workiva, Vizor) and IT majors (TCS) in select markets.

Talent and execution: Scaling globally requires world-class sales, marketing, and product talent—an ongoing investment area.

Valuation risk: After a sharp rally and recent correction, IRIS trades at ~38x P/E (TTM), which demands consistent execution.

Chapter 6: The Power of Capital – Recent Equity Infusion

In 2024, IRIS raised ₹20 Cr through a preferential allotment, bringing in institutional investors. Why does this matter?

Purpose: To supercharge international sales, invest in AI/ESG modules, and pursue strategic acquisitions.

Impact: Strengthens the balance sheet, reduces reliance on promoter funding, and signals confidence to the market.

Result: IRIS is now better positioned to chase large global contracts and scale its SaaS business faster.

Chapter 7: The Journey So Far – Key Milestones

2005: IRIS was founded, pioneering XBRL in India.

2010s: Wins major contracts with RBI, ACRA Singapore, and other regulators.

2017: Listed on BSE SME platform.

2020: Returns to profitability after years of investment.

2023: Wins landmark South African Reserve Bank contract.

2024: Crosses ₹100 Cr in revenue; launches Malaysia e-invoicing; raises growth capital.

2025: Expands ESG/disclosure management modules; achieves record revenue and profits.

Chapter 8: Competitive Positioning – What Sets IRIS Apart?

India’s only listed RegTech SaaS company with a global footprint.

End-to-end platform: From taxonomy creation to analytics, few global peers offer this breadth.

Reference clients in 54 countries: Regulatory trust is hard-earned and easily lost—IRIS has both.

Continuous innovation: Regularly adds new modules to stay ahead of regulatory trends (ESG, AI, etc.).

Chapter 9: Valuation – Is There Any Upside?

IRIS (22nd May 2025)

Market Cap ₹491 Cr

P/E (TTM) 38x

ROE (FY25) 22%

Current Price ₹240

IRIS is no longer a deep value play, but in my view, with a robust order book, global tailwinds, and new capital, it remains a high-quality growth story.

We should, however, keep a close watch for sustained margin expansion and ARR growth to justify premium multiples.

Epilogue: Should You Check out IRIS Today?

If you’re looking for a pure-play Indian SaaS company with global ambitions, sticky revenues, and exposure to the digital compliance megatrend, IRIS Business Services is a compelling candidate. The journey won’t be linear, there will be quarterly volatility, intense competition, and high expectations.

But for patient investors, IRIS offers a rare combination: scalable technology, global reference clients, and a business model built for the future.

Oh, I forgot to share what I liked most about the business. It is “skin in the game” and “soul in the game”. Three friends spent close to 25 years in a business that did not take off at all in the first 20. That didn't stop them from trying and staying put. In fact, in tough times they stopped taking salaries. Not just that, at one point of time, they didn't have money to pay salaries of their employees. Even the employees didn't leave. They stayed together as a family. Isn't that inspiring? That's the DNA of IRIS for you. :)

Afterword

When I started writing this post, I thought it was not for me. However, the more I read on it, the more it impressed me. And now I am confused. Should I buy it or not?

Valuation does not look cheap. The CEO passed away last month. The sentiment around the stock remains weak.

After Vito Corleone’s untimely departure, will it get a Michael or not?

Or, just like 2021, will I be left thumb-sucking here?

I am now getting tempted to buy the shares. So, all I need from you is to temper my excitement and share with me some disconfirming evidence in the comments section.

Thanks for reading.

Happy Investing!

P.S. I do not own the shares of IRIS Business Services. This is not a recommendation to buy or sell.

Some insights from AI comparing user preferences.

-Iris is better for smaller businesses or those in specific regions (like India) who need affordable, focused tools for compliance and tax filings. Users like its cost-effectiveness and support but want better marketing and a more modern interface.

- Workiva is preferred by big companies needing a powerful, all-in-one platform for complex reporting. It’s user-friendly for enterprises but can be pricey and less specialized for regional needs.

- If you’re a small business or in a market like India, Iris might feel more tailored and budget-friendly. If you’re a large corporation with global operations, Workiva’s robust platform is likely the better choice.

PS: Loved your article. :) I am also in a similar dilemma of wanting buy shares but not very fond of valuations. I would look at it by P/S metrics which is still higher than median.

I have been invested in IRIS for the last year and closely following their conferences, investor day meetings, etc. Have a massive respect for the company and its promoters. I think it will take time for the management to return to their spirits. They are deeply affected by the sudden demise of their ex-CEO. You also cannot rule out the possibility of IRIS being acquired by a larger firm. So I am holding on to the stock and waiting