What if I told you that one of the most dangerous workplaces in the world isn’t a war zone but a floating island in the middle of the ocean, drilling into the Earth’s crust?

That’s not the beginning of a Hollywood thriller. It's the everyday reality of offshore oil drilling.

Just to give the proper context let me suggest a short film which showcases what happens when things go wrong. Based on true events, please go and watch Deep Water Horizon to understand the risk part of the business first. Then we will go to the company we are talking about.

I know, I know. You might not have time right now. So let me give you a quick teaser about the movie.

It is a story of giants like British Petroleum and their offshore oil rig. A usual day that you can imagine at an offshore rig site. Crew members are running checks, engineers are monitoring pressure, and the corporate office is pushing to stay on schedule. But beneath the surface, the well was unstable. Warnings were ignored. Deadlines were prioritized. And then… everything blew.

Deepwater Horizon is the story of 126 people trapped on a rig turning into an inferno, with no escape in sight. It follows real-life hero Mike Williams, who risked everything to save his team.

This wasn’t fiction. Yes, you heard that right. 11 lives lost, 87 days of oil spill, and a $65 billion lesson in what happens when risk is underestimated in the offshore business.

If you want to understand how unforgiving this industry is, why safety and precision matter more than anything, and most importantly, as an investor, why risk is not just another word, watch this movie.

But now coming back to business, not every offshore story ends in fire.

Some are quieter. More disciplined. Built not on shortcuts, but on systems.

And that’s the company we are going to talk about today. Jindal Drilling & Industries Ltd.

While Deepwater Horizon reminds us what happens when risk is underestimated, Jindal Drilling shows us what happens when it’s engineered out, day after day, rig after rig, in the rough waters of India’s energy frontier.

Jindal Drilling & Industries Ltd (JDIL) is an offshore oil & gas drilling services provider. The company has more than 3 decades of offshore drilling experience.

Currently, the company operates a fleet of five jack-up drilling rigs. These are shallow-water rigs used for drilling oil and gas wells. By shallow water, I mean those that are capable of ~300ft to 350 ft water depth. As of now, all the rigs are contracted to ONGC. The mammoth of the Indian Oil industry.

Why mammoth? Because ONGC alone contributes around 70% of India's crude oil and approximately 84% of its natural gas production! Yes, you heard that right.

Source: Forbes

Now, JDIL earns revenue through daily charter rates paid by clients. Of course, as discussed earlier, it is primarily ONGC. These contracts are typically 3-year tenures with a fixed daily rate in USD. This is standard ONGC practice.

Importantly, ONGC contracts are on an “operating day-rate” basis. JDIL provides the rig along with crews and services, and bears the operating costs, in exchange for a higher operating day rate.

In contrast, JDIL also has experience with “bareboat” charters. In Bareboat charters, it leases out a rig without crew or operational services. This means the lessee covers operating costs.

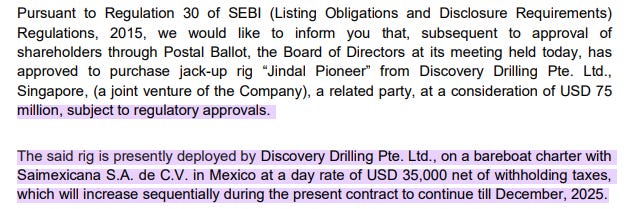

For example, the jack-up “Jindal Pioneer” is currently on a bareboat charter in Mexico at around $35k to 40k per day, which is a lower rate but incurs minimal expense to the owner.

In summary, JDIL’s rigs earn day rate revenue either from fully serviced contracts, which are higher revenue, higher cost or bareboat charter,s which are lower revenue but minimal cost, depending on contract type.

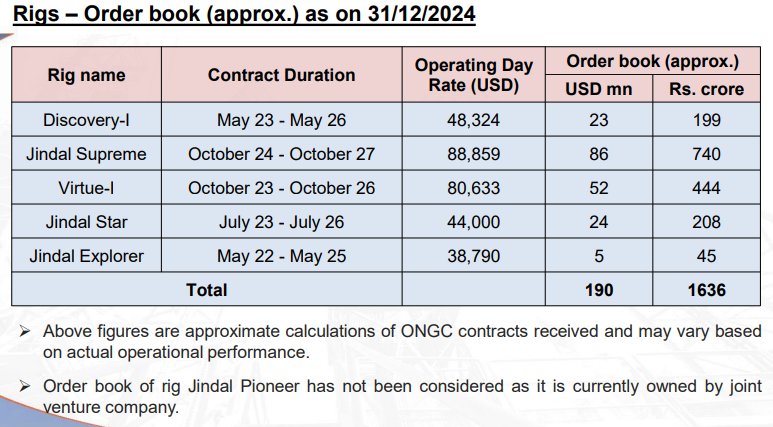

As discussed earlier, as of late 2024, JDIL’s five jack-up rigs are under ONGC contracts. This includes Discovery-I, Jindal Supreme, Virtue-I, Jindal Star, and Jindal Explorer. The table below summarizes the fleet’s contract status, which includes day rates and durations as of 31st December, 2024

All five rigs are deployed and earning revenue at nearly 100% utilization. Notably, JDIL directly owns 2 of these rigs, while the other 3 are owned via group entities like joint ventures or related parties and leased by JDIL

Now, obviously, JDIL tends to realize higher margins on the owned rigs as there will be no lease expense.

ONGC is the dominant client. No doubt about that. But do you know in August 2024, ONGC had 32 out of 37 jack-up rigs in Indian waters hired from contractors like JDIL?

But now the question arises, why Jindall Drilling now?

Because I just watched the movie Deep Water Horizon :P

No no. Actually, a couple of months back, I was having a discussion with some good investor friends and mentors, and they thought that after a prolonged downturn in 2015–2020, the offshore drilling industry entered a robust upcycle from 2021 onward.

Source: Upstreamonline

Global jack-up rig demand has risen, and as only a few new rigs were built in the last decade, it has tightened the market.

Source: Upstreamonline

Source: Upstreamonline

Also offshore spending might have picked up and jack-up utilization might have improved, aided by stable ~$70+ oil prices at that time. But ONGC, which continues drilling fairly consistently regardless of oil price, started repricing expiring rig contracts at much higher rates. Charter rates for benign-environment jack-ups have climbed from lows of ~$25k/day in 2019 to ~$80k to 90k/day in 2023–24.

This means that contracts renewed in 2023 saw a sharp jump in day rates. For instance, its rig Virtue-I’s rate roughly doubled from ~$40k to ~$80k/day in late 2023, and Jindal Supreme’s new ONGC contract, which is effective since Oct 2024, was signed at about $88,859/day. This upcycle has been transformative for JDIL’s revenue potential, after years of low rates.

But all this was happening in the industry. Toh khud ke liye kya karte ho?

Apart from these sectoral tailwinds, JDIL undertook strategic moves to expand and modernize its capacity:

Jindal Pioneer Acquisition: Jindal Pioneer is a high-spec jack-up rig (built 2015) that was owned by JDIL’s 49%-owned JV known as Discovery Drilling Pte. Ltd, JDIL pursued acquiring full ownership of this rig to consolidate its earnings. In March 2024, the Board approved purchasing Jindal Pioneer for USD $75 million, funded via internal accruals.

The rig is currently deployed in the Gulf of Mexico under a bareboat charter to Saipem (Saimexicana) at ~$35k/day, with the rate stepping by contract running until Dec 2025.

Regulatory approvals for the transfer were delayed, but as of Q3 FY25 (Jan 2025), the acquisition was in the final stages.

Once completed, JDIL will start recognizing 100% of Pioneer’s revenues and profit (versus only 49% equity-accounted profit currently) – an immediate boost to earnings. Management has indicated this could add on the order of ₹8 to 10 crore to JDIL’s quarterly PAT when consolidated

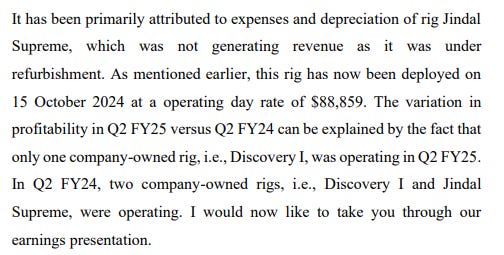

Jindal Supreme is one of JDIL’s older rigs, which underwent a significant refurbishment/upgrade in 2023-24 to extend its life. It was off-contract (idle) during this period. In October 2024, Supreme commenced a new 3-year contract with ONGC at $88.9k/day, a substantially higher rate than its previous contract.

JDIL also operates the jack-up Virtue-I via another JV called Virtue Drilling Pte. Ltd. This rig was deployed with ONGC starting late Oct 2023 at ~$80k/day.

Now, looking at JDIL’s financial performance, it clearly shows that it has moved sharply upward in the past few quarters, reflecting the higher rig rates and full utilization coming into play.

So, basically, JDIL’s Q3 FY25 was a blowout quarter, with revenue jumping to ₹254 crores a 39% sequential increase over Q2 and up sharply year-on-year. PAT surged to ₹49 crores, tripling from ₹16 cr in Q2. This step-change was driven by the deployment of Jindal Supreme in October 2024 at a high. By Q3, JDIL had four rigs generating full-quarter revenue, namely Discovery, Star, Explorer, and Virte, plus Supreme for ~2.5 months, all at strong rates. Management noted this jump was anticipated since the contract award, and indeed, Q3’s results validated the earnings power of the fully-deployed fleet

But!!

But!!

Risks abhi baki hai mere dost.

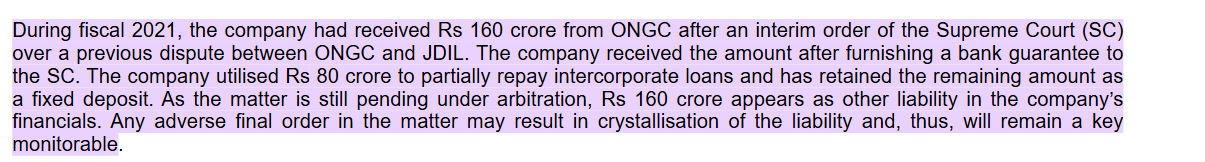

JDIL had an ongoing arbitration relating to ₹160 crore received from ONGC in 2021 under a Supreme Court interim order. JDIL had to furnish a bank guarantee for this amount; it used ₹80 crore to repay inter-corporate loans and kept ₹80 crore in fixed deposit pending the outcome.

The ₹160 crore is carried as an “other liability” on the books until the arbitration is finalized. An adverse award could force JDIL to return the money, so this remains a contingent risk.

Another dispute involved a delay in deploying Jindal Supreme in 2020, for which ONGC had withheld ₹14 crore. This was settled amicably in Q4 FY24: ONGC agreed to pay about ₹8 crore, and JDIL wrote off the balance of ~₹6 crore.

And as a wise man says, “Not everything seems rosy is a flower. Sometimes, it can also become portfolio returns.”

But here’s the thing about the offshore drilling business—it’s a game of contracts, and not every contract is a jackpot. The new ONGC contract for Jindal Explorer, while extending its deployment for another three years, comes at an effective day rate (EDR) of $35,138.71/day.

That’s significantly lower than the recently signed $88,000/day contract for Jindal Supreme, and even below the $40,000–$44,000/day range of other rigs in JDIL’s fleet.

So, what does this mean?

It means that while JDIL has locked in another multi-year contract, it’s at a far lower margin compared to recent deals. And with the current contract for Jindal Explorer ending in Q1 FY26, there could be a gap period where the rig is idle until the new contract commences in Q3 FY26. This potential downtime could dent quarterly revenue and margins, especially if other rigs also face similar renewal challenges.

In other words, just when the company is gaining momentum, there’s a pothole on the horizon. But then again, jab jab jo jo hona hai, tab tab so so hota hai. If you didn’t understand the significance of that last sentence, the image below may refresh your memory.

So, what is the moral of the story?

Risk is not just a word. It can play out in ways we cannot imagine.

P.S. As of this date, I have no holdings in the stock discussed. No recommendation to buy or sell.

The impact of lower day rate could be quite severe. See this article https://www.offshore-energy.biz/transocean-noble-valaris-borr-and-odfjell-drilling-fleets-23-billion-backlog-spotlights-state-of-play-in-booming-rig-market/. The demand for jack-ups are projected go down further. Next renewal discussions are in 2026, but if things pan out as per this article, $80K+ may not be possible anymore.

The thesis for drilling companies was that there is no more supply of new jack-ups. A new one takes about $300 million to build and needs a decade+ to recover. It is possible that this supply led bull run has already played out in the last 5 years when Jindal drilling went up 10x. Those who bought earlier in late 2024 or early 2025 (when the 2000 Cr market cap company started surfacing in social media) might have bought when all positives are already known to market.

The best time to buy Jindal drilling was when day rates were at $20K. But investing isn't that simple. Is it?

Very well written @Harshal Bhai