Movies! And especially Classics. Not just the Hollywood classics like Pulp Fiction, The Godfather, or Scarface. Even our homegrown legends too. Johny mera naam, Tirangaa and of course, Sholay.

Call it nostalgia or something deeper. I believe even movies can teach you a lot. After all, as a wise man once said, “There's nothing in the world more powerful than a good story. Nothing can stop it. No enemy can defeat it.”

One of my all-time favourites is Sholay. It’s not just a film about dacoits and revenge. It’s about how power slips, how silence can scream louder than words, and how help often arrives when it’s almost too late.

The jailer saab - ‘Thaakur’, once the symbol of discipline and fearlessness, eventually becomes a shadow of his former self. Gabbar didn’t just kill his family. He takes his hand, his pride, and his ability to fight back.

Alone, he couldn’t do much. He needed Jai and Veeru, two outlaws with more heart than protocol, to step in. And when they did, something shifted. It didn’t happen overnight. But slowly, the balance began to tilt.

Recently, while I was going through the news, I found an interesting announcement for the telecom sector. I felt a strange déjà vu.

The story was different. But the arc felt almost identical.

A once public sector giant, stripped of its relevance, bled by the very market it helped create, now leaning on others to survive. And just like the jailer of Sholay, it wasn’t dead. It was waiting. Waiting for someone or something to fight back on its behalf.

That’s when I knew. This wasn’t just a news update. It was the prologue to another story worth telling. Its the story of MTNL: The company that forgot to die

MTNL.

My father used to work with a Power EPC company for a long time, and because of various projects running across India, he had to travel a lot. Back in those days, just to speak for 2 minutes with us, he would first call our neighbours (we didn't have a landline phone), and would ask them to call us. Neighbours will call us to their house, we will go there, wait for his call, and again after some time they will call back.

Forget smartphones, even the landline was a thing of affluent people at that time. The only thing I knew about the phone at that time was that it was invented by Graham Bell.

And today, even in distant villages, you will find kids using smartphones.

But at that time, that landline phone in my father’s office or the dead dial tone in a relative's house, it all belonged to either BSNL or MTNL, along with the buildings, the copper, the workforce, and the pride of being the capital's telecom gatekeeper.

Now, at that time, the private telecom players or those who wanted to enter this space might have felt wary of BSNL and MTNL.

But for many, it was like a miracle. Because we have just shifted from letters to calls.

Now, I don't know how much of it is true, but I feel markets do not care for these sentiments. It has its sentiments. And stories rooted in monopoly rarely end well.

The first crack came quietly in the 1990s, when liberalisation opened the doors to competition. New names like Bharti and Hutchinson began entering the scene with smooth services and better marketing. By the early 2000s, the tremor had turned into a storm.

Source: IBEF

As time passed, MTNL, once the only name in the directory of Delhi & Mumbai, found itself buried in the back pages.

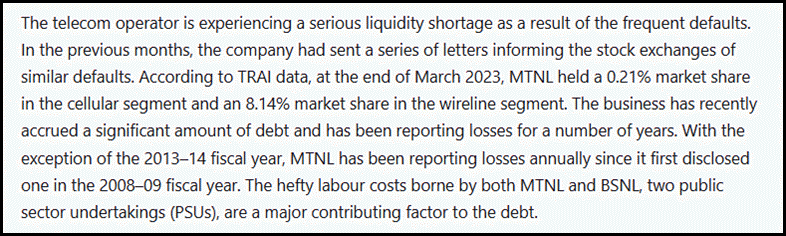

The customer exodus was slow at first. But by the time Jio entered in 2016 with free voice and cheap 4G data, it became a full-scale evacuation. MTNL could not keep up. By 2023, its mobile subscriber share had collapsed to a mere 0.21 percent. Even its stronghold, the landline base in Delhi and Mumbai, had shrunk to just about 8 percent.

Source: Startuptalky

The telecom it built had moved on without it.

Gabbar has escaped!

You could blame the technology gap. But the real story lies in how long MTNL waited. It launched the 3G when private telcos were already laying down 4G networks. It never rolled out 4G of its own. While private players raced toward 5G and fiber, MTNL was still patching up aging 3G lines.

It wasn’t just about speed. It was about experience. Long hold times, outdated systems, and the ghost of monopoly-era service haunted its customer support. In a world now run by mobile apps, MTNL was still answering complaint calls the old-fashioned way. Sometimes, not even that.

And yes, on somewhat similar lines was the case with BSNL too.

But technology delay was just the one part of the story.

The deeper rot lay in the balance sheet.

Decades of being overstaffed had left MTNL bloated.

In 1996, it had over 64,000 + employees. Yes. a telecom company covering just 2 major cities. Mumbai and Delhi with over 64,000 employees. (One of the reasons was that, at the time of formation, all the employees of DoT were transferred to MTNL)

And you must know, for many people (not for all), the main reason for getting a job in PSUs.

But the government was also trying hard to resolve this. By 2014, that number had fallen to 36,500. And yet, as of March 2024, it still had 3,309 employees on its books.

This significant cut came with a Voluntary Retirement Scheme in 2019, when the government managed to relieve nearly 15,000 employees from service. This itself had led to a 90% salary bill reduction for MTNL. But even that wasn’t enough.

Source: Business Standard

In FY24, employee expenses alone accounted for 78 percent of MTNL’s total revenue. That came to about 570 crore rupees spent on salaries, against a topline of 728 crore. Nearly four-fifths of everything MTNL earned was used just to pay people, leaving nothing for growth or upgrades. This cost burden had become structural. In earlier years, like FY18 to FY20, the company’s overhead costs had even outpaced its entire revenue.

Salaries alone were eating through what little revenue the company generated. Imagine a firm where staff costs were greater than income.

Now add spectrum debt on top. (I wanted to say cherry on top, but this was no cherry. It was a whole cherry farm.)

In 2010, the government handed MTNL a double-edged sword. It was asked to buy 3G and BWA spectrum in Delhi and Mumbai at the market price. The bill was over 11,000 crore rupees.

Source: Business Standard

Source: MediaNama

Source: MediaNama

The spectrum went largely unused. MTNL never had the technology or the plan to monetise it. Some of it was surrendered later for partial refunds.

But by then, the damage was done. Interest costs, license fees, and taxes all piled up. Revenues, meanwhile, had shrunk to under 2,000 crore rupees by 2019.

At some point, even the government seemed to step back. Of course, this is not the only thing they would be focusing on. Policy support came late and usually in the form of bailouts. It felt there was no real commercial push. No modernisation plan with urgency. And practically, when you are at such a stage, survival becomes more important.

By April 2025, MTNL's debt structure had become a maze of defaults, guarantees, and short-term fixes stretched into long-term burdens. Its total liabilities had swelled to more than 33,500 crore rupees.

Source: Economic Times

Of this, over 8,300 crore was owed to a consortium of public sector banks. Union Bank alone was waiting on more than 3,600 crore. Indian Overseas Bank had exposure exceeding 2,300 crore. All these loans were in default, both on principal and interest. The missed repayments began as early as August 2024. By February 2025, defaults had become routine.

Source: Mint

Another 24,000 crore sat in sovereign-guaranteed bonds. These were not regular market borrowings. These were structured bailouts, arranged by the government to refinance earlier debt.

In November 2022, MTNL raised over 6,100 crore through such instruments. But even this lifeline had strings attached. Interest payments were supposed to be routed through an escrow mechanism under a tri-partite agreement with the Department of Telecommunications.

Source: Economic Times

In May 2025, MTNL failed to fund even this interest reserve.

Source: Economic Times

Then there were internal government dues. Around 1,150 crore was owed to the telecom department itself. This included loans given to help MTNL pay interest on earlier bonds. When a company starts borrowing from the state to pay the state, the math becomes a circle of insolvency.

And on the other side of the ledger stood a revenue line that had collapsed to around 1,300 crore per year. Against this, MTNL had to service more than 1,000 crore in annual interest. In just one quarter, October to December 2024, MTNL earned 170 crore in income. But its finance costs alone were 728 crore.

Every quarter resembled a financial landslide.

Losses piled up. For FY25, MTNL reported a net loss exceeding 3,328 crore.

The balance sheet showed a negative net worth of more than 27,549 crore.

The numbers were becoming abstract. MTNL was now a less functioning telecom company. It was more of a distressed company wearing the uniform of a service provider.

Even the top management of MTNL said, "Even if God comes to earth and tries to address its problems, the company cannot be revived. It is a fact of life; we have to accept it."

Source: TOI

Interestingly, Creditors also had few options. Because of the MTNL's sovereign-backed bonds even banks hesitated to initiate recovery. The government kept stepping in. But each time it only pushed the problem forward.

By 2022, even Parliament had run out of patience. A committee recommended shifting MTNL’s debt into a separate holding company. The MTNL and BSNL chairmen endorsed the idea. With more than 26,000 crore in liabilities and barely 1,300 crore in revenue, the math left no other option.

Source: TOI

What MTNL needed was not more debt. They already had enough of that. It needed a burial or a balance sheet reset.

Now, everyone was waiting for someone else to do the heavy lifting. MTNL, stripped of revenue & technology, was like Thakur from Sholay, both hands cut off by Gabbar, unable to act. All it could do was sit in silence and hope for a miracle.

And in 2024, that miracle finally arrived.

Jai and Veeru rode in. Guess who? Bharat Sanchar Nigam Limited.

This is where the revival begins.

From 2024 onwards, MTNL’s story was no longer about going it alone. The government shifted focus toward operational integration with BSNL. There was no press conference announcing it as a formal merger, because it wasn’t one. But on the ground, the outcome was the same. MTNL, in function if not in form, was becoming BSNL.

BSNL’s CMD had already taken additional charge of MTNL since 2022. Its mobile networks in Delhi and Mumbai were now handled by BSNL teams. The idea was simple. MTNL couldn’t sustain itself in just two cities, but BSNL already operating across the rest of India, could.

Still, the merger had to be handled carefully. A full legal merger would have transferred MTNL’s debt load to BSNL. That would have been financial suicide. So the government chose a softer route. First, transfer operations. Then, deal with the ₹30,000 crore debt. Possibly by carving it out into a separate SPV.

As of mid-2024, MTNL’s customers were already being serviced by BSNL. The networks were being upgraded using BSNL’s procurement channels. And the workforce, now around 3,500 people, was being assessed for another VRS or potential absorption into BSNL’s rolls.

In February 2025, the Cabinet approved ₹6,000 crore for BSNL’s 4G rollout. The goal was clear: build 100,000 sites. By then, about 65,000 had already gone live using TCS and ITI equipment. The rest would now follow.

The government even signalled that 5G would follow. Meanwhile, BSNL reported a ₹262 crore net profit in Q3 FY25 its first in 17 years. The turnaround wasn’t complete, but it had started. MTNL, however, still bled money. Its own 4G capabilities were tied directly to BSNL’s rollout, and so the revival was conditional.

Conditional, but not impossible.

The government had already announced that over 100 surplus MTNL properties would be monetised. Forty-eight in Delhi, fifty-two in Mumbai. In early 2025, the Finance Ministry approved a ₹16,000 crore monetisation plan across BSNL and MTNL.

Source: Money Control

Source: Economic Times

Some assets had already gone under the hammer. A plot in Goregaon had a reserve price of ₹270 crore.

Source: TelegraphIndia

Flats in Oshiwara ranged from half a crore to over one crore each.

Source: TelegraphIndia

MTNL’s board had signed off on additional land and building sales. By March 2025, total monetisation proceeds stood at ₹2,134 crore.

Source: Mint

That wasn’t enough. But it wasn’t a small amount.

The target was more ambitious. The 2019 revival plan aimed to monetise ₹37,500 crore worth of land. That deadline had long passed. So the government extended the runway, pushed management, and began issuing reminders through the Cabinet Secretariat.

If the debt couldn’t be repaid through operations, perhaps land could shoulder some of the load.

And to make that happen, policy support was creating an entire ecosystem. State governments were instructed to give preference to these PSUs.

Source: Economic Times

The results, though uneven, began to show. BSNL turned EBITDA positive.

Source: Mint

The companies together raised nearly ₹13,000 crore through asset monetisation, most of it from BSNL’s tower and fiber assets.

Source: Mint

But the real fix was still pending. MTNL’s ₹26,000 crore debt had to be parked somewhere. Talks were ongoing. If the government agreed to transfer the liabilities to an SPV, just like it had done for Air India, then the path was clear. A debt-free, minimal-employee MTNL, absorbed fully under BSNL, running modern networks with 4G and 5G.

Source: Business Standard

But one thing is certain. The Jai and Veeru of India’s telecom battlefield are back in Ramgadh. And even though the Thakur they came to save is broke, the story is not over.

Not yet.

Because beneath the wreckage, something of value remained.

And if there is one person who seems determined to find it, it is the man at the helm of India’s telecom ministry today.

Jyotiraditya Scindia is not new to revivals.

He is the same minister who helped bring Air India back from bureaucratic limbo and market irrelevance to private-sector flight paths. The Maharaj, who once watched his royal legacy fade, now finds himself restoring public sector legacies.

In his recent interview with CNBC-TV18, Scindia ji confirmed what the market has been whispering for months: BSNL’s turnaround is real. And MTNL’s debt restructuring is not just possible, it is already in the works.

He said it plainly:

“There’s no question of revival for MTNL... As of January 1, 2025, all operations have been transferred to BSNL.”

The remaining steps?

“Renegotiate the bank debt... divest MTNL’s assets... and then, paripassu, square up the books.”

No grand promises. No denial. Just pure clarity.

Watch the full Scindia interview here

After years of drift, that clarity itself feels like forward motion.

For all the balance sheets, spectrum charts, and auction math, MTNL’s story has never been just about telecom. It is about a company that forgot to die, because the country could not afford the funeral.

Now, in 2025, the name itself may soon dissolve. BSNL might absorb its operations, customers, and networks. What remains is a debt ledger, a land bank, and a few thousand staff waiting for direction.

MTNL isn’t turning around. It’s being turned in. Debt on one side, land on the other, and policy holding the balance. It’s not resurrection. It’s reconciliation.

And yet, somewhere in this carefully managed decay lies the blueprint of something new. A debt-free MTNL under BSNL’s operational wings. A streamlined land sale that pays off part of the public sector burden. A quiet transition, not a loud collapse.

It’s no longer about reviving a telecom operator. It’s about extracting value from what remains, and doing it with dignity.

P.S. No holding, no recommendation

If you find value in our work, you may explore joining our exclusive Zen Investing Club. The only investing community in India that focuses on the niche microcap space (less than INR 3000 Cr market cap businesses).

Very well written Harshal bhai...

Learned a lot about MTNL & BSNL...

Great work!