SBFC Finance: A Deep Dive!

Making The “Missing Middle-class” Gain Momentum

Lending is a strange business. Unlike any other business, here, the money leaves the company when a sale is made. And that’s the easy part. The tough part is to bring it back on time and with sufficient profit.

Whenever a lending transaction takes place, one guy walks away with money, and the other walks away with a promise. A promise that the money, which has been lent, will be utilized wisely and returned with interest to the lender appropriately.

But does that always happen?

No!

That’s why we need bankers or lenders who can distinguish between the good and the bad borrower and lend wisely. And this is hard. And that is why we have very few names in India whom investors can trust for their ability to lend wisely.

A few names that we all know are:

HT Parekh & Deepak Parekh of HDFC Ltd

Aditya Puri of HDFC Bank

Uday Kotak of Kotak Mahindra Bank

Rajeev Jain of Bajaj Finance

You may add a couple of more names, but the fact of the matter is that in a country of more than a billion people, where credit is still largely underpenetrated, you have just a few quality lenders.

And what have most done? They have all played safe and lent only to people who will keep their promise of returning the loan. And how did they evaluate who would keep his promise and who would not? Based on income tax returns, bank statements, CIBIL scores, etc.

Let me drop a few truth bombs for you. As per the data of the financial year 2023-24:

8.09 crore (80.9 million) people filed IT returns. About 7% of the population.

Out of the above, 4.9 crore (49 million) pay zero tax.

About 76% of income tax collected is from those earning above INR 50 lac annually.

11.9 crore (119 million) people were actively monitoring their CIBIL score.

That means there is no system to serve the underserved. While the microfinance ecosystem does serve the bottom of the pyramid through the JLG (Joint Lending Model). The worst case is of the “Missing Middle class.”

That’s where Mr. Aseem Dhru and SBFC come in.

I am dividing the blog post into 3 broad parts.

1. From Mountains to Money: How Aseem Dhru Became the ‘Manjhi’ of India’s Missing Middle

2. I have a 10-year-old son. Here I will narrate the story of SBFC Finance to him in a simple, non-jargon way.

3. As a stock-market analyst/investor, I would do a due diligence and financial analysis.

So let’s begin with the first story.

Part 1: From Mountains to Money: How Aseem Dhru Became the ‘Manjhi’ of India’s Missing Middle

If you’ve watched “Manjhi: The Mountain Man,” you’ll never forget the image of Dashrath Manjhi, hammer and chisel in hand, chipping away at an unyielding mountain. For 22 years, he worked alone, laughed at by his village, doubted by the powerful, but driven by love and a burning desire to make life better for his people.

Now, imagine a different kind of mountain. A mountain made not of rock, but of paperwork, risk-aversion, and financial red tape. This was the mountain standing between India’s small entrepreneurs and the credit they desperately needed.

Enter Aseem Dhru.

Like Manjhi, Aseem saw the pain of those left on the wrong side of the mountain. For two decades at HDFC Bank, he watched as banks lent only to the privileged: the salaried, the urban, the “safe.” The chaiwala, the tailor, the small-town shopkeeper, these were the ones forced to walk the long, hard road, borrowing at high interest or not at all.

Aseem tried, again and again, to convince his colleagues that India’s “missing middle” deserved a path through the mountain. But the system was rigid. The tools at his disposal, new products, digital solutions, and pilot projects, were like Manjhi’s hammer and chisel against a wall of granite. He was told, “That’s not how banking works.” He was mocked, doubted, and often ignored.

But, just like Manjhi, Aseem refused to give up.

He left the comfort of a top job and set out to carve a new road. This time as an entrepreneur. In 2017, he founded SBFC Finance, not with millions in backing or a ready-made team, but with a vision: to cut through the mountain of traditional lending and build a path for the millions of small businesses banks had left behind.

The journey was grueling. The NBFC sector faced crisis after crisis. Funding dried up. Regulations tightened. The COVID pandemic hit. There were moments when it seemed the mountain would win.

But, like Manjhi, Aseem kept chipping away. He built branch by branch, customer by customer, always focused on the dream of financial inclusion. Slowly, the laughter turned to respect, the doubts to belief. Today, SBFC’s path is real. Thousands of entrepreneurs have crossed over to a better life because of this new road.

Just as Dashrath Manjhi spent 22 years carving a road for his village, Aseem Dhru spent two decades fighting to carve a path through India’s financial mountain. Both faced ridicule, setbacks, and loneliness. Both were driven by a vision bigger than themselves. And both proved that with enough resilience, even the hardest mountain can be moved, one determined blow at a time.

So, the next time you hear a story of a small business owner getting a loan, remember: behind that simple act is a mountain that someone, somewhere, refused to stop climbing.

Isn’t it inspirational?

Let’s straightaway move into the second story. My favourite.Because this one is for my ten-year-old son. 🙂

Part 2: SBFC Finance- The Friendly Money Helper for India’s Small Heroes (And Why It’s Like a Superhero in Disguise)

Imagine your neighborhood chaiwala who serves the best masala chai. Or the tailor auntie who stitches your school uniforms. Or the uncle who runs a tiny grocery shop with veggies stacked to the ceiling. These everyday heroes keep India running, but they often face a big problem: no one trusts them with money when they need it most.

Enter SBFC Finance, a friendly company that says, “We see you. We trust you. Let’s grow together.” Let’s unpack this story like a comic book!

Chapter 1: The Origin Story

SBFC Finance was born in Aseem Dhru’s mind in the early 2000s with a simple idea: “What if we lend money to small businesses and hardworking people, but do it safely?”

Think of SBFC as money matchmakers. They don’t just throw cash around. Instead, they ask for two things:

Collateral: Like your mom keeping your favorite toy as a promise you’ll clean your room.

If you’re a shop owner, SBFC might lend against your shop (“secured MSME loans”).

If you’re a farmer with gold jewelry, they’ll lend against that too (“gold loans”).

Their superpower? 99% of their loans are backed by real stuff (shops, gold, property). No wild guesses!

Chapter 2: The Growth Spurt

SBFC grew faster than a mango tree in the monsoon season:

AUM (Money They Manage): From ₹3,029 Cr in 2021 to ₹8,500 Cr in 2025– that’s like going from a bicycle to a rocket!

Branches: 200+ branches across 18 states. Imagine 200 lemonade stands, but for loans!

Customers: 1 lakh+ heroes served – from street vendors to taxi drivers.

Fun Fact: They add 15–20 new branches yearly. Why? To get closer to their customers, like Spider-Man swinging into your neighborhood.

Chapter 3: The Secret Sauce

How does SBFC stay safe while lending?

The “No-Nonsense” Rule: They check every customer like a teacher checks homework.

“Is your shop’s paperwork clean?” ✅

“Is your gold real?” ✅

“Can you repay without stress?” ✅

Tech + Human Touch: They use smart computers (AI) but also send real people to visit borrowers. It’s like having a robot and a friend watching your back.

Insurance: 90% of customers are insured. If something bad happens (like an accident), the loan doesn’t crush them.

Quote from CEO Aseem Dhru:

“Profit isn’t our only goal. We measure success by how many lives we lift.”

Chapter 4: The Villains (Risks)

Every superhero faces villains. For SBFC:

Interest Rate Monsters: When banks raise rates, SBFC’s costs go up. But they fight back by keeping loans affordable.

Fraudsters: Some people lie about their collateral. SBFC’s defense? Triple-checking everything!

Competition: Big banks and flashy fintech apps want the same customers. But SBFC wins with trust and speed (loans in 30 minutes for gold!).

Chapter 5: The Heartwarming Stuff

SBFC isn’t just about money. They’re building a legacy:

Jobs: 3,758 employees, many hired from small towns. “We train people who’ve never had a formal job,” says Aseem.

Education: Rebuilt a crumbling school in Gujarat, adding 44 new girl students. Now, kids don’t skip school because of dirty bathrooms!

Culture: “Be fair. Be transparent. Sleep well at night.”

Chapter 6: Why Should You Care?

If you’ve ever seen a small business owner stress over loans, SBFC is their Go-to man. They’re proof that finance isn’t just for suits in skyscrapers – it’s for the tailor, the farmer, and the chaiwala too.

Final Thought:

SBFC Finance is like the “friendly neighborhood Spidey” of banking. They’re not the biggest, but they’re nimble, trustworthy, and always rooting for the underdog. And in a country where 99% of businesses are small, that’s a superpower worth celebrating.

Next time, when you see someone sip a chai at a roadside stall, remember: SBFC might’ve helped that vendor buy his kettle. 🙂

Let’s now move to the third and the most important one.'

Part 3: SBFC Finance Ltd: A Closer Look into India’s Fastest-Growing MSME & Gold Loan NBFC (2025 Analysis)

Picture this!

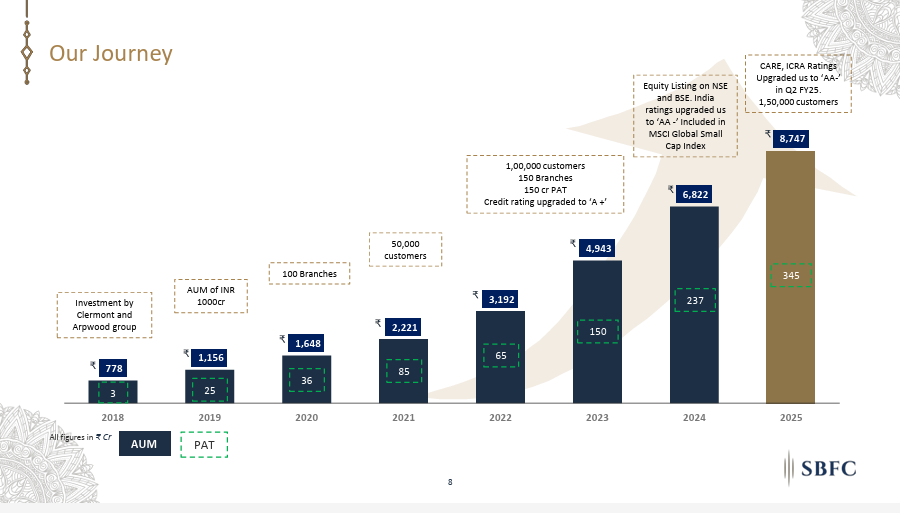

10x in just 7 years! 🤯

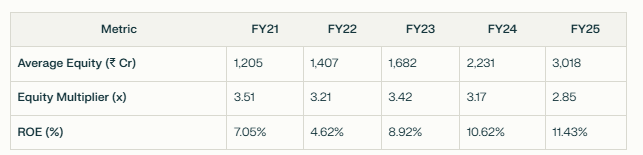

Whenever a banking or an NBFC company grows fast, it casts a doubt in our minds. But let me just share with you the ROA and ROE tree of SBFC Finance over the last 5 years.

What can you infer from this?

Let me list them here.

Key Trends:

ROA improved from 2.01% (FY21) to 4.01% (FY25) due to higher margins (cost control) and asset efficiency.

FY25 Catalyst: Operating expenses/AUM fell to 4.8% (vs. 6.5% in FY21), boosting margins

ROE improved from 7.05% (FY21) to 11.43% (FY25) due to:

Reduced leverage (Debt/Equity down from 2.7x to 1.42x).

Key Drivers of ROA/ROE Growth

Margin Expansion:

~Fee income grew at 22% CAGR (FY21–FY25).

~Asset Efficiency:

~AUM/employee rose from ₹1.5 Cr (FY21) to ₹2.3 Cr (FY25).

~Mature branches (>3 years) contribute ₹43–50 Cr AUM vs. new branches’ ₹15 Cr.

~Capital Discipline:

~Debt/Equity reduced from 2.7x (FY21) to 1.42x (FY25) post-IPO.

~CRAR remains robust at 36% (FY25) vs. the regulatory requirement of 15%

If you run any other financial metric health scan for SBFC, you will get a similar result.

A boring NBFC that doesn’t do anything flashy but keeps growing 5-7% QoQ.

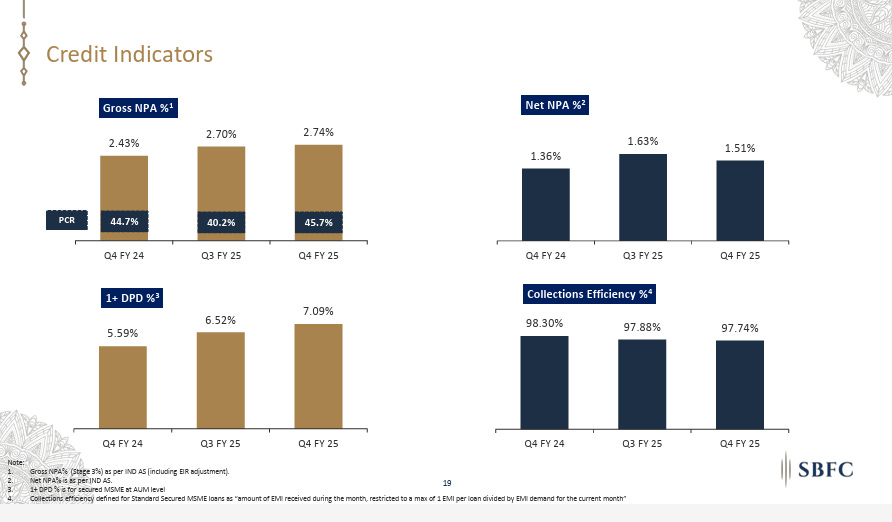

Get a sneak peek at the credit quality and the quality of the book.

Now that I have convinced you about the greatness of the business and the clarity of thought of Mr. Aseem Dhru, let us talk about risks.

Risks & Challenges

Macro Risks: Rate volatility, regulatory shifts (e.g., RBI’s RTGS disbursal rule impacting Q1 FY25 growth).

Competition: Banks/fintechs targeting gold loans; pricing pressure in prime MSME segments.

Execution Risks: High frontline attrition (40–45%); branch breakeven in 12–18 months

So this is it. I have tried my best to cover the story of SBFC Finance from three different angles.

I would like to leave you with these two thoughts.

1. Demand drives valuation, and consistent performance drives demand

This quote is taken from this wonderful book.

"In stocks and individuals, demand drives valuation, and consistent performance drives demand."

Demand drives valuation, and consistent performance drives demand. Read it again. 🙂

2.“Get good at something. That's it. Everything else is bullshit.”

“Get good at something. That's it. Everything else is bullshit.” This quote encapsulates Jerry Seinfeld's belief in the paramount importance of mastering a skill. He emphasizes that dedicating oneself to becoming truly proficient in a particular area is the key to personal fulfillment and success. In his view, many distractions and superficial pursuits pale in comparison to the satisfaction derived from genuine expertise.

I think Mr. Aseem Dhru and his team at SBC Finance are good at secured SME lending. If you think otherwise, please share it with me with reasons in the comments.

P.S. No holding, no recommendation

Aseem ,Really a gem of person..I had work under his leadership..how he converted HDFC SECURITIES A loss making subsidiary to 700 Cr reserves in just 8 year shows his vision, wisdom and leadership quality...

Lucid read Ankit bhai. I didn't feel for a moment that I am reading an investment thesis.

What differentiates SBFC from others is they do not rely on DSAs.