2024 saw a 22% rally, yet the Silver bros are seemingly underwhelmed today. (Jealous of the Gold Rush?)

Despite a red-hot macros and favourable fundamental setup, silver continues to underperform its flashier cousin, gold.

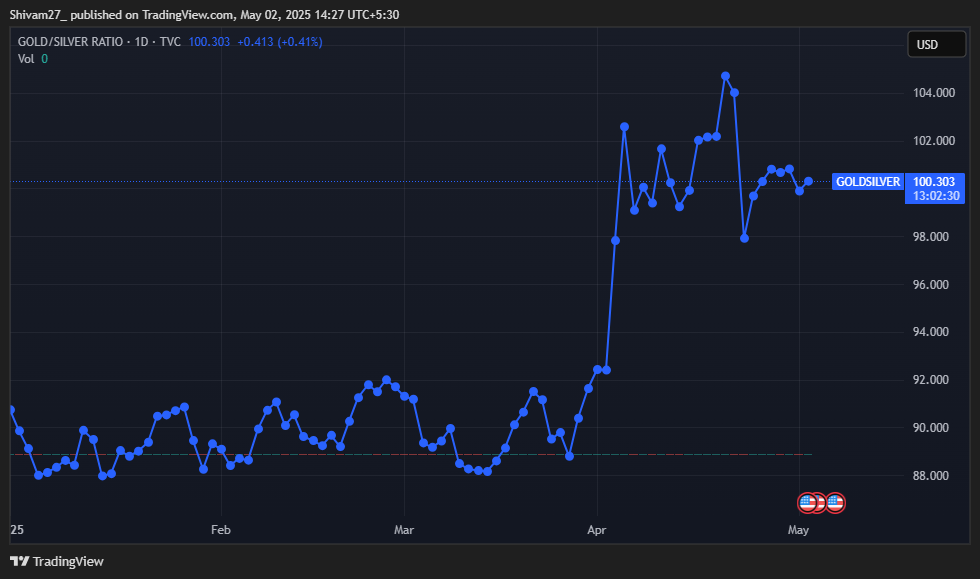

In 2025, the Gold-to-Silver ratio was already lounging in a relatively high zone of 80 to 92:1 (long term average is 65:1) - a level that usually prompts the excited CNBC anchors to scream:

"Silver’s about to play catch-up!"

But instead of responding, Silver hit snooze.

And just when you thought the ratio couldn’t stretch further, it yawned its way up to 104:1.

Still. Na- da.

Reminds of this meme:

So what gives? And why I think Silver deserves some love. Let’s explore.

The Macro Setup: Falling Yields, Soft Dollar, Rising Tensions

On the macro front as well, we’re entering the kind of environment precious metals typically thrive in. The US economy shrank by 0.3% in Q1 2025, a sharp reversal from the 2.4% growth in Q4 2024 - early signs of a possible recession or erm…McRecession as they say.

Meanwhile, inflation is cooling, with the core Personal Consumption Expenditures Price Index or CPE - a key measure the Federal Reserve uses to track inflation - falling to 2.6%, opening the door for aggressive Fed rate cuts later this year. Bond markets are already pricing this in: the 2-year yield now sits well below the Fed Funds Rate, a classic recession signal. Scott Bessent is already at it:

Add to that a highly charged geopolitical landscape and weakening real yields ( 10-Y TIPS yields have fallen from 2.15% in Jan to 1.3% now), and you’ve got a textbook case for owning non-yielding, hard assets like silver.

Okay, let me make this easy for you. TIPS stands for Treasury Inflation-Protected Securities, which are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation to protect investors from a decline in the purchasing power of their money.

If TIPS yield is high → You’re getting a solid, safe return above inflation

If TIPS yield is low or negative → Cash and bonds aren’t keeping up with inflation.

When TIPS yields fall, it means the system is quietly taxing your money. So what does this mean for Silver - Or Gold for that matter as well?

Imagine you're an investor worried about inflation eating away your savings. You want something safe, backed by the government, but also something that keeps up with rising prices.

Silver doesn’t pay interest - but it doesn’t lose purchasing power either. That is - It just sits in your portfolio hoping that prices go up. So when TIPS offer 2%+ real yield, many investors say:

"Why gamble on silver when I can get a safe, inflation-protected return from TIPS?"

But…

When TIPS yields fall (like it is doing now), that safety cushion shrinks - and silver suddenly looks more attractive as an inflation hedge or real asset play.

Also, Silver tends to move in the opposite direction of the U.S. dollar. Since silver is priced in dollars globally, a weaker dollar makes it more affordable for international buyers - naturally boosting demand and, in turn, prices.

Historically, a 1% decline in the Dollar Index (DXY), which measures the value of the U.S. dollar against a basket of six major global currencies, giving a snapshot of how strong or weak the dollar is on the world stage, has been associated with a 2–3% rise in silver prices, underscoring the inverse relationship.

Current Situation – 02 May 2025:

The DXY is at 99.72, down nearly 9% from the turn of the year

Silver is trading close to $32/oz, having gained ~12% since January ( vs 24% rally in Gold)

Given the historical precedent, there should still be some upside potential left.

What’s more?

Not Just a Pretty Metal: Silver’s Doing the Heavy Lifting As Well

Silver holds a distinctive place in the commodity markets, serving both industrial and monetary roles. Unlike gold, which is primarily held for investment and reserve purposes, nearly half of silver’s demand comes from industrial applications - making it a metal of both utility and strategic importance.

Its superior electrical and thermal conductivity make silver indispensable in a wide range of sectors. It is central to the solar energy boom, where silver paste is used in photovoltaic cells. It plays a growing role in electric vehicles, power electronics, and smart grid infrastructure. And increasingly, silver is becoming critical to semiconductors and AI hardware - found in high-performance computing systems, chip interconnects, and advanced cooling systems where reliability and conductivity are paramount.

And this is where things get interesting.

Source: World Silver Survey 2025

The silver market continues to exhibit a structural supply-demand imbalance.

For the fourth consecutive year, the market is expected to remain in deficit - registering a shortfall of 211 million ounces in 2024, easing slightly to 187 million ounces in 2025, according to projections by Metals Focus.

Supply trends remain relatively stable, with total supply expected to rise 2% in 2025, supported by a modest increase in mine production (+2%). Recycling volumes, however, are forecast to decline slightly, contributing to the tightness in overall availability. Official sector sales and producer hedging activity remain marginal contributors to supply fluctuations.

On the demand side, a notable shift is underway. While traditional investment segments such as coins and bars are expected to contract significantly (down 30% in 2024 and another 15% in 2025), industrial demand remains resilient, holding near record levels. The total industrial use of silver is projected at 677 million ounces in 2025, led by applications in electricals, electronics, and photovoltaics, which together account for the majority of this segment.

Source: Analytics Insight

Demand from solar energy, in particular, continues to be a key structural driver. In 2025, silver used in photovoltaic cells is projected to grow by 2% YoY, reflecting sustained momentum in global energy transition efforts. Silver's role in automotive electronics, semiconductors, and other advanced technologies further underpins its industrial relevance.

Other segments such as jewelry and silverware are expected to see a decline in 2024–25, largely due to weaker economic conditions and evolving consumer preferences.

But more importantly - A closer look at recent trends reveals a notable shift in producer behavior: net hedging supply has effectively dropped to zero since 2022, with no significant hedging activity expected in 2024 or 2025.

Source: World Silver Survey 2025

This suggests that mining companies may be increasingly confident in the long-term price trajectory of silver, choosing to retain full exposure rather than locking in current prices. At the same time, persistent market deficits - averaging over 180 million ounces annually in 2023 and 2024 when excluding ETP flows - are gradually drawing down above-ground inventories. Together, these dynamics point to a tightening market environment, one that could set the stage for upward price pressures if demand remains resilient.

Silver, in effect, supports many of today’s most transformative technological shifts: clean energy, digitalisation, electrification, and artificial intelligence. Its use spans solar panels, EVs, 5G infrastructure, medical devices, and data centers powering the AI revolution. As the world transitions into a more connected, electrified, and automated future, silver’s industrial relevance only deepens.

A Coiled Spring: Why Silver’s Time May Finally Be Near

In summary, while total silver demand is forecast to decline slightly over the next 1.5 - 2 years, the imbalance between stable-to-softening supply and firm industrial demand continues to support a structurally tight market.

At the same time, silver retains its identity as a monetary metal. It has historically served as a store of value and a hedge in times of macroeconomic uncertainty. In environments of falling real yields, rising geopolitical tension, or weakening currencies, silver - like gold - draws investor interest.

Still, silver’s rally remains muted - held back not by fundamentals, but by perception and positioning. Essentially, Investment demand for Silver has been absent for over 15 years. Institutional money continues to prefer gold’s liquidity and reputation as a monetary hedge.

Silver is heading into 2025 with structural tailwinds and supply-side constraints that are difficult to ignore. With five consecutive years of market deficits totaling nearly 800 million ounces, the metal's underlying imbalance is increasingly unsustainable. Mine production is approaching a peak, recycling faces limitations from depleted stock and declining scrap streams, and new supply will require capital-intensive decisions that aren't guaranteed in the current environment.

On the demand side, industrial offtake remains resilient and forward-looking - driven by the green energy transition, AI-enabled technologies, and power-intensive data infrastructure. Even if macro uncertainties bring short-term pressure, silver's embedded role in decarbonization and digitalization suggests its industrial demand will outpace global GDP.

However, the wildcard remains the price. Sustained rallies could trigger substitution risks, especially in solar and auto applications. Jewelry and silverware may see moderated volume growth, especially if prices rise sharply. Investor behavior - through coins, bars, and ETFs - will also be key in determining whether silver's momentum continues or stalls.

Also. Sahil Kapoor offers a concise, data-rich perspective on the structural silver deficit in a recent tweet - an essential read for anyone following silver’s long-term supply dynamics.

Nonetheless. Silver hasn’t failed. It’s coiled.

Which means, given that it is highly sensitive to investment demand than Gold - when it moves, it will move fast. [But given its volatile nature - it is clearly not for the faint hearted.]

Hmmm, alike thinking.

After your article on samhi, this is second note wherein you have mirrored by thought!

Informative article