Survival, Scale & Sundrop

Resilience, Regression, Reincarnation | ZN Playbook Part 3 | Special Situations

This blog is the 3rd edition of our 4-part ZN Research Playbook series.

Find the 1st and 2nd edition here:

As promised in the 1st and 2nd week, we’re opening up our research playbook - one style at a time.

Turnarounds / High-Convexity - improving ROE/ROCE flywheels.

Special Situations - corporate actions, mispricings, and catalysts.

High Growth / Industry Tailwinds (Yard Investing) - riding secular shifts, not headlines.

Deep Value - company trading at a discount, with patience as a moat.

In four Fridays, we’ll unpack case studies from our watchlist and portfolios, the four engines that will drive our Micro-cap focused (< INR 3000cr Market Cap) Stock Advisory very soon (Yes, we are finally launching). Join the waitlist before you get lost in the compelling special situation story of today’s INR 3,000 Cr microcap business.

What is Special Situation Investing?

Special situations in investing refer to unique corporate events that create temporary mispricings or opportunities outside of normal business performance, such as mergers, spin-offs, buybacks, restructurings, or bankruptcies. They often involve catalysts that can unlock hidden value or correct inefficiencies. Investors focus on understanding the event rather than predicting long-term business growth.

So fasten your seatbelt, as I take you on a rollercoaster ride of a microcap business that recently underwent a management change. Let’s begin.

If you are a real '90s kid, you will surely remember this.

Remember those warm, slightly grainy Doordarshan TV moments from the 1990s? When family rituals, kitchen smells, and a comforting sunlit logo meant "home cooking"? For millions of Indian kids of that era, the Sundrop ad was a short, emotional elevator to a kitchen where food felt wholesome and familiar. It wasn’t just an edible oil commercial. It was a memory anchor: parents cooking, school tiffins, weekend visits to grandparents. That little jingle and visual palette built decades of brand nostalgia. Which still (quietly) sits in the minds of older consumers and gives the company a valuable emotional asset today. “The healthy oil for healthy people”. Doesn’t ring a bell? Watch this 23-second clip. 🙂

Sundrop Oil Old Indian Doordarshan Ad

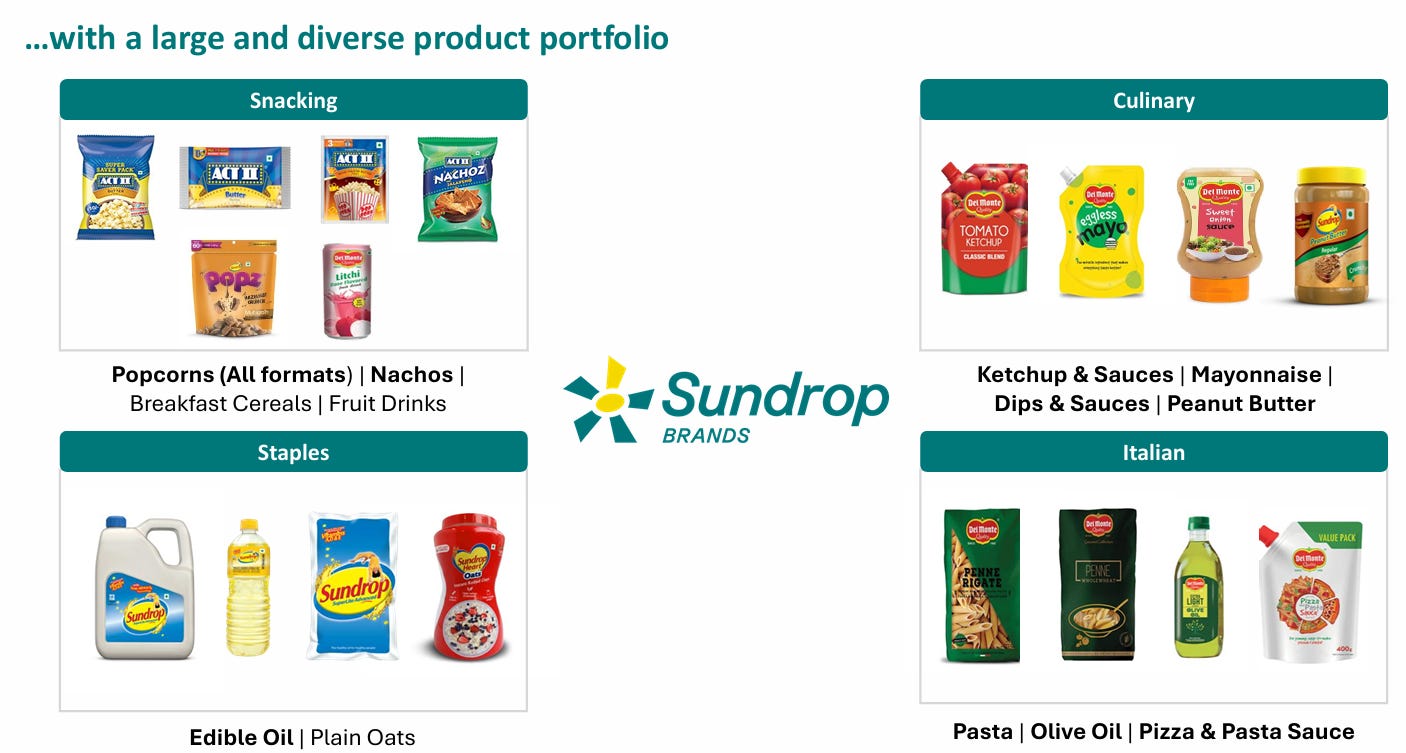

Sundrop (the consumer-facing name now elevated to a corporate platform) today sits alongside a set of complementary brands and categories spanning snacks, spreads, culinary / Italian pantry items, and oils.

Savoury snacks (ACT II popcorn, nachos, RTE snacks)

Spreads (Sundrop peanut butter and other spreads)

Italian / pantry categories (ketchups, pastas, sauces — via Del Monte)

Edible oils (Sundrop edible oil remains a core, long-standing product)

Source: Q1FY26 PPT

Sundrop Brands [SB] was formerly Agro Tech Food Ltd [ATFL], and before that, it was ITC Agrotech Food. For convenience, I will use SB or ATFL from hereon.

Source: Company website

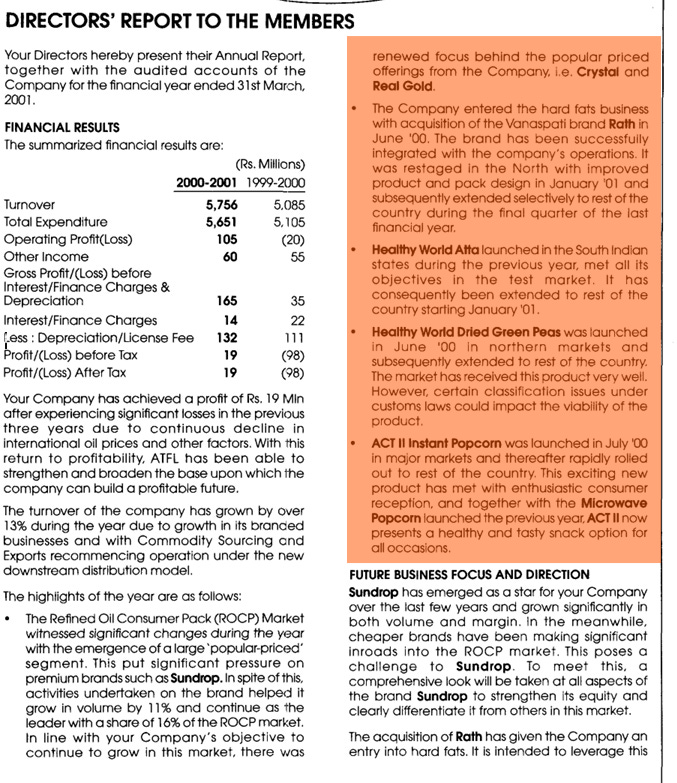

A snippet taking you almost 3 decades back to gauge what their scale was in 1997.

Source: AR 1997

Their focus on R&D at a time when I don’t know how many Indian companies have even heard about R&D.

Source: Amazon AWS

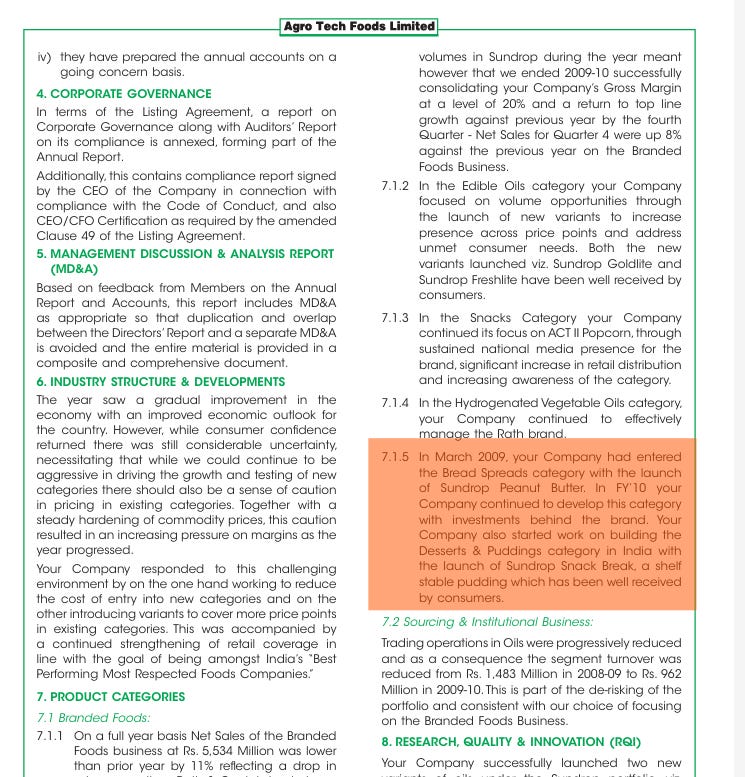

Some of the new product initiatives that Sundrop embarked upon in the last 30 years.

It entered the food business in 1999.

Source: 2000 AR

Acquires a vanaspati brand, Rath

Source 2001 AR

Entering the ready-to-eat food segment in 2003

Source: Goodreturns

Peanut Butter launched in 2009

Source: 2010 AR

More details in this news clipping.

Source: India Retailing

Launched yet another category: Convenience Meals

Source: 2012 AR

Get more details about Yumeals here:

Source: afaqs

Launched Sundrop SlimLite Cooking Spray in 2013

Source: Business Standard

New cereal category launched in 2018

Source: e4m article

I know you are tired of checking out all these new launches. But there is a reason why I shared them all.

Now look at this.

Source: Screener

Do you remember the sales figures for 1997 I shared at the start?

Never mind, it was INR 570 Cr.

FY25 Sales were INR 899 Cr. That is 1.58% CAGR over 29 years.

For a branded consumer goods business with the heritage and distribution SB had, a ~1.6% CAGR over 29 years is strikingly low. It implies decades of lost acceleration despite strong brand recall, distribution reach and category entries.

I am reminded of the legendary investor and author Philip Fisher here. His timeless book Common Stocks & Uncommon Profits had a great reference to something that has happened in SB.

Philip Fisher had a 15-point checklist for finding outstanding businesses.

Don’t worry. I am not going to bore you with all 15 of them. I will just urge you to look at the following 2 points from that list.

Point 3:

"How effective are the company’s research and development efforts in relation to its size?

In a field where technological change is rapid, a company without an adequate research and development department may find itself unable to maintain its competitive position, regardless of how effective its production, sales, and managerial organizations may be."

Point 4:

"Does the company have an above-average sales organization?

It is not enough that a company has a good product. It must also be properly merchandised. The relative efficiency of a company’s sales, advertising, and distribution is often the difference between mediocre success and outstanding success."

I think if SB takes an exam on these two points, it would probably be a topper in point 3 and fail miserably in point 4.

I hope you got the drift. While SB was ahead of its competitors in terms of new product launches and R&D, it flunked the scale and growth part.

Some questions should naturally arise in your mind now.

What, Why, Who, When, How, etc.

These are some logical questions and need a lot of deliberation.

To answer them, you have to deep dive into the whole story. I have tried to keep it as short as possible. But not shorter 🙂

Chapter I Foundation (1986–2000)

A quick timeline:

1986: ITC Agro-Tech incorporated (Nov 21, 1986 is cited in your materials). The company started as an edible oil/oilseed business. (Founder era memory: early Sundrop edible oil launch built household recognition.)

1989: The first Sundrop edible oil products hit the market and started building consumer recall.

1997–2000: Conagra invested, leading to a new phase. By year-end 2000, the company’s name and corporate posture had evolved around food products (Agro Tech Foods). ACT II popcorn appears as a late-1990s product expansion (1999). The company is already experimenting beyond edible oil and moving to convenience & snacks.

Takeaway: This period planted the seeds. Iconic consumer recall from Sundrop oil + early moves into snacking & foods.

Chapter II ConAgra-led food pivot (2000s–2010s)

Conagra’s involvement brought professionalisation and a stronger food focus (licensing and global playbook elements). Over the 2000s, the company launched and scaled some food products (ACT II, peanut butter), and analyst reports through the 2010s record steady but modest growth. The company often preferred to preserve margins and quality rather than maximize volumes aggressively.

Key facts:

The business built distribution reach (hundreds of thousands of retail outlets cited in investor docs) and seven manufacturing locations, but growth wasn’t explosive. Analysts repeatedly flagged room to expand margins and shift portfolio mix toward higher-margin foods.

Chapter III Indian foods scaling (2010s–2020)

This era saw the company do two things in parallel:

Build a branded-foods base (R&D, product extensions): ACT II and Sundrop spreads became valuable assets.

Face channel shifts: modern trade and e-commerce grew fast in India, and the business sometimes under-indexes in those newer channels relative to growth opportunities. Several research notes and investor presentations show the company was aware of the opportunity but needed more capital and sharper distribution moves.

Result: markets gradually rewarded the company for branded-foods traction, but the long-run growth rate (remember the 1.58% CAGR example earlier) showed that product wins alone couldn’t substitute for consistent channel-as-a-growth-engine.

Chapter IV New private equity chapter (2024 onwards)

This is the dramatic plot twist: in Feb–Aug 2024, a new promoter group (CAG-Tech / Samara Capital + Convergent Finance) acquired the promoter stake and re-cast the company as a growth platform. The new management set a clearer ambition: build a house of brands with Sundrop as the corporate identity and accelerate via both organic investments and bolt-on M&A

Chapter IV is our special situation. New promoter. New management. New Strategies. New Decisions.

Let’s take a note on all of them one by one.

A dramatic plot twist: Agro Tech Foods (ATFL) moved from ConAgra ownership into a new promoter structure under Samara Capital and Convergent Finance:

1. The Context Before 2024

Agro Tech Foods (ATFL), originally ITC Agro Tech (founded 1986), had ConAgra (the US foods giant) as a long-standing promoter-shareholder since 1997.

For more than two decades, ConAgra’s majority holding (about 51.8%) defined ATFL’s strategy, brand portfolio (Sundrop, ACT II), and its cautious, somewhat conservative pace of growth.

While ATFL innovated on R&D (Sundrop Peanut Butter, ACT II extensions, cereals, spreads), its growth was muted. Sales compounded at just ~1.6% CAGR over ~30 years

2. The Turning Point: Feb to Aug 2024

In early 2024, ConAgra decided to exit India.

The promoter stake (51.8%) was acquired by CAG-Tech Mauritius, an investment vehicle jointly controlled by Samara Capital and Convergent Finance.

By August 2024, the deal was completed and regulatory approvals cleared.

This marked the end of the ConAgra era and the start of a private-equity-backed growth chapter.

3. Who are the New Promoters?

Samara Capital

Founded in 2007, an Indian private equity firm.

Has invested ~$2 billion across multiple consumer, healthcare, and retail businesses.

Known for scaling brands both organically and through acquisitions (examples: Blue Heaven, Nature’s Basket).

Convergent Finance

Founded in 2018 by Harsha Raghavan (ex-Fairfax India).

Philosophy: long-term, active shareholder rather than a short-horizon PE fund.

Focus on governance, capital efficiency, and patient compounding.

Has backed listed food companies like ADF Foods and Unibic.

4. The “Recast” of Agro Tech into Sundrop Brands

Corporate Identity Shift: In November 2024, at the Investor Meet (also Founders’ Day), ATFL announced its rebranding as Sundrop Brands.

Vision: To act as a platform of multiple iconic food brands, both owned (Sundrop, Peanut Butter) and perpetually licensed (ACT II, Del Monte).

Board Overhaul:

Harsha Raghavan (Convergent) and Manish Mehta (Samara) joined as directors.

Four new independent directors inducted (incl. ex-Tata, ex-KPMG, Dr. Lal PathLabs leadership).

Management Transition:

CEO: Ashish Kumar Sharma continued.

Group MD (Designate): Nitish Bajaj (ex-Heinz, Reckitt, Piramal) joined Nov 25, 2024.

5. Strategic Shift Announced by New Promoters

Alignment of Interests: The earlier multi-level promoter-shareholding confusion ended. Now all shareholders (promoters, mgmt, public) sit at the same listed entity level.

Focus Areas:

Core portfolio (Sundrop + ACT II) – renewed focus, unlock full potential.

Inorganic growth – already demonstrated with Del Monte India acquisition.

New channels – e-commerce, quick commerce, food service.

Margin expansion – supply chain, procurement, and advertising efficiency.

Capital efficiency – disciplined allocation, ROCE focus.

6. Why It’s a Dramatic Plot Twist

After 27 years under ConAgra, the company felt like a sleepy FMCG cousin. Full of R&D and brand equity, but never scaling up.

The 2024 buyout is not just a change of hands – it’s a full strategic reset:

From a slow-moving MNC subsidiary to a nimble PE-backed growth platform.

From one-brand nostalgia (Sundrop oil) to a multi-brand packaged foods house.

From capital conservatism to disciplined yet aggressive expansion.

In short, Feb–Aug 2024 is the hinge point in ATFL’s 40-year story: the exit of ConAgra, entry of Samara + Convergent, rebirth as Sundrop Brands, and the ambition to finally break free of its value-trap trajectory.

Can they do it? Time will tell.

Do they have the Potential? Maybe Yes

Their recent acquisition says a little bit about how the aggressions seems to be there finally which was missing earlier.

Delmonte Acquisition.

Key Deal Facts

Acquirer Agro Tech Foods Limited (ATFL), soon to be rebranded Sundrop Brands Limited.

Acquiree Del Monte Foods Private Limited (DMFPL), a joint venture between Bharti Enterprises (59.29%) and Del Monte Pacific Ltd (DMPL) (40.71%).

Announcement Date November 14, 2024 (ATFL board approved the acquisition, subject to approvals)

Completion date February 6, 2025 — acquisition officially completed.

Deal Value INR 1,300 crore (≈ USD 154–156 million) all-stock deal.

Transaction Type Share-swap / preferential allotment of ATFL equity shares to Del Monte JV shareholders (Bharti and DMPL) in exchange for taking over DMFPL and its assets.

What Was Acquired / What Assets Came In

Brands and product portfolio of Del Monte India: this includes Italian foods, condiments (ketchups, sauces, dips & spreads), packaged and dried fruits, beverages.

Manufacturing & R&D facilities: key asset is the Del Monte facility in Hosur, Tamil Nadu; also facilities in Ludhiana, Punjab. These will be used for new product innovation and to scale up distribution.

License for the brand: ATFL obtained an exclusive, perpetual license for the Del Monte brand in India. That means ATFL (Sundrop Brands) now has long-term rights to use “Del Monte” in India under this platform.

Shareholding Changes & Corporate Governance

After completion, Bharti Enterprises became the second-largest shareholder in ATFL, holding about 21% stake.

Del Monte Pacific Ltd (DMPL) holds ~14% in the combined entity.

As part of the deal, ATFL (Sundrop) appointed Harjeet Kohli, Joint MD of Bharti Enterprises, as a director on ATFL’s board.

Synergies, Strategic Rationale, & Business Impact

Combined turnover: ATFL + Del Monte India had a combined revenue of ~INR 1,300 crore in FY24, with ~40% of that coming from Del Monte India. This adds substantial scale.

EBITDA contribution: Del Monte India’s contribution to the combined entity’s EBITDA in FY24 was about 38%, showing the business is reasonably profitable.

Brand portfolio complement: Del Monte brings in categories where ATFL was not as strong — sauces, condiments, beverages, spreads. These categories often have higher margins, less competition in some segments, and strong brand equity.

Manufacturing and innovation leverage: Hosur R&D / manufacturing facility will likely help ATFL scale Del Monte lines, improve cost efficiencies, and maybe drive new product development under the Del Monte name.

Leadership & Management

Nitish Bajaj was appointed as Group Managing Director of ATFL (Sundrop Brands) in connection with the transformation.

Asheesh Kumar Sharma continues as CEO/Executive Director, overseeing Sundrop & ACT II businesses.

What It Means / Big Picture

This acquisition is transformative: it shifts ATFL from being largely known for oils, snacks, and processed foods (popcorn, peanut butter) into a multi-brand, multi-category food conglomerate.

Having the Del Monte brand licensed in perpetuity gives long-term strength of branding, which matters a lot in consumer goods.

The scale, combined revenues and facilities, put Sundrop Brands in a stronger position to compete with big FMCG players, both in modern trade and in food service / institutional channels.

Key insights from the comparison above

Scale now supports margin plays: The combined top line (~₹1,410 crore proforma) gives management the runway to pursue margin-improvement levers (procurement scale, factory utilisation, shared overheads). The impairment of non-core assets signals a willingness to take short-term pain for longer-term structural efficiency.

Channel complementarity is the real synergy engine: Del Monte is stronger in modern / e-commerce/food service; Sundrop / ATFL is strong in general trade and distributed manufacturing. The actionable upside is moving Del Monte SKUs into GT and Sundrop snacks into food-service and modern channels. Management highlighted both as immediate and medium-term priorities.

Marketing + A&P re-investment seems to be working quickly: The company increased A&P in Q1FY26 and saw accelerated growth — suggesting returns to renewed marketing investments (early evidence, not a guarantee). The Q1FY26 notes mention a 58% YoY increase in A&P and improved Q4/Q1 growth momentum.

Governance changed: From being an MNC-attached business to a PE-owned, promoter-aligned entity — the new ownership structure provides board focus, capital discipline, and acquisition appetite that could unlock previously trapped potential.

The strategy ahead is very clearly articulated in the recent Q1FY26 presentation

Source: Q1FY26 PPT

Untapped & Underutilized Capacities

Source: Q4FY25

Large impairment taken in FY25. High convexity to show up from here.

Source: Q4FY25 concall

Market Share & Potential

Source: Q1FY26 concall

After reading so much in this blog, I am asking you to do more reading. Apologies. But it is important.

Check this blog post on Origin Story and Energy.

Tentative framework - Using activation energy to unlock potential energy in an asset.

Quoting two extracts from the blog here.

There are more than 5,000 listed businesses in India. In this large number, there are inevitably businesses that seem super cheap in context of the underlying value. The underlying value can be thought of as akin to potential energy.

But in most cases the potential energy remains trapped. What we refer to as 'value trap' in investing is akin to such blocked or trapped energies. The trapping of value or energy tends to occur due to misalignment - one example is the misalignment between what is good for the management / promoters and what is good for the business; or value could be trapped because of the point of time in the business cycle.

Hotel businesses are a good example of difficult-to-tap potential energy. Some listed hotel businesses have huge underlying asset values - the construction cost of land and building of a large hotel is generally a large multiple of the quoted enterprise / market value. On average, a favorable cycle or an asset sale is necessary to unlock value in owned assets in a hotel business.

In general an idea to remember is - investing in potential energy with no activation energy to unlock the energy can lead to a value trap.

There are many applications of the above framework in investing - change in management of a mismanaged quality asset, 'learning machine' management that rectify past mistakes, and others. Here is an exploration of one particular application as an example to understand the model better.

From Framework to Final Practice

Let's break down the framework - change in management of a mismanaged quality asset - into its two component parts: 1) mismanaged quality asset, 2) change in management.

A mismanaged quality asset is akin to untapped potential energy. Mismanagement leads to misalignment of energies, and potential energy tends to be trapped in the asset. In our context, the extent of untapped potential energy is the replacement / private value of the asset in relation to the enterprise value of the company at that time.

Change in management is akin to the activation energy. It pays to remember here chemistry's definition of activation energy - it's the energy of a lit match that starts a conflagration. One kind of energy changes something so as to release other flows of free energy that are much greater than activation energy (emphasis mine). When new management is brought to turn around the ship, and if they are rightly incentivised, it tends to act as activation energy.

In effect, there are two major conditions required - huge potential energy which basically means huge underlying value in the asset; and activation energy that leads to the unlocking of potential energy.

I believe Sundrop Brands beautifully falls into this framework.

But of course, I have overdosed you on the positives and potential goodies. It is fair to balance it with a pinch of risks and threats.

Execution risk on synergies. Moving Del Monte into a GT-heavy distribution and ramping ACT II into food service and e-commerce requires flawless execution. Channel expansion is harder than slide-decks make it look.

Margin squeeze from competition & raw-material volatility: Food categories are competitive; prices of edible commodities and packaging can move and compress margins. Analysts flagged raw-material inflation risk historically.

Integration risk/distraction. Integrating brands, plants and sales teams while driving growth is a juggling act. If integration distracts the team from marketing and commercial execution, growth can stall.

Marketing ROI risk. Management increased A&P and saw early signs of traction — but sustained returns on higher marketing spend will determine whether the growth is durable.

Value-trap vs value-unlock risk. The investment thesis depends on sustained activation energy: if new ownership loses patience or if synergies don’t materialize, this could return to being a “value trap.”

If you have been reading my blogs, you know that I cannot let a blog go by without a movie reference. Here’s what I want you to keep in your heart as the final takeaway.

The movie today is The Curious Case of Benjamin Button

The Curious Case of Benjamin Button follows a man who is born old and ages backwards, growing physically younger as time passes. The story explores how this unusual condition shapes his relationships, particularly with his love interest, Daisy, as their lives align only briefly when their ages cross paths. Ultimately, it’s a meditation on time, love, and the fleeting nature of life.

American comedian and social critic, George Carlin, said this once in his poem Living Backwards:

“The most unfair thing about life is the way it ends. I mean, life is tough. It takes up a lot of your time. What do you get at the end of it? A Death! What’s that, a bonus? I think the life cycle is all backwards. You should die first, get it out of the way. Then you live in an old-age home. You get kicked out when you’re too young, you get a gold watch, you go to work. You work forty years until you’re young enough to enjoy your retirement. You do drugs, alcohol, you party, you get ready for high school. You go to grade school, you become a kid, you play, you have no responsibilities, you become a little baby, you go back into the womb, you spend your last nine months floating …and you finish off as an orgasm.”

Benjamin Button lived life backward. George Carlin once wished to live life backwards too, starting with a retirement watch and a party on day one. Sundrop, too, seems to be at that stage. At 40, it has the retirement watch, but it’s also ready for its teenage years all over again. After four decades, it carries the weight of history (oils, popcorn, peanut butter), but with the 2024 rebranding and Del Monte acquisition, it feels like a fresh start, almost like being young again.

What do you think?

Share in the comments.

If you want to dig deeper, you can access all the annual reports of the last 3 decades here and all the major news articles on ATFL/SB here.

Disclosure: I, Ankit Kanodia, do not hold any shares in this company as of today. But who knows what tomorrow holds? :) This is not a recommendation to buy or sell a stock.

Before you go, here’s something important.

The blog you just read was meant to give you a glimpse into how we think and write about businesses. Over the last few months, we’ve been tracking microcaps that fit our framework and playbook.

While not every idea works out this way, the real value lies in the process behind the thesis - disciplined, research-driven, and focused on long-term compounding.

👉 Want access to more of this research?

We’re opening the Zen Nivesh Stock Advisory shortly. Join the waitlist to receive the brochure (delivered in 10 days) and a sample report of a microcap business. Also, get the first access when we onboard our inaugural batch.

Disclaimer: This is research, not investment advice. Do your own diligence; markets carry risk.

Exceptional way of story telling

Interesting read. Glad to find this stack. It worth sharing 😁