Tega Industries | A Long-Term Compounder in the Mining Equipment Space

Critical Consumables, Recurring Revenue & Global Critical Mineral Resources Race

I was just doom-scrolling through X, half-dead from the usual noise - political clownery in the US, a Honeymoon murder back home, football transfers in Europe - you know how the bird app is.

But then I stumbled upon a post that didn’t make me want to throw my phone against the wall.

One post stopped me cold.

It wasn’t the charts or the jargon. It was a headline was something on the lines of

KGF is coming back.

The huge fan I was of Yash in that film, I scrolled up and checked the post again to see if there’s a 3rd part coming..

Well, it was not about the movie. It was about the mine. The real thing.

So. Erm. I was today years old when I found out that KGF - yes, the Kolar Gold Fields is actually real.

Anyway, this isn’t about my Twitter feed or my favorite movies and actors (though I wouldn’t blame you for thinking so - quite a few of our blogs have been born out of some film reference or the other).

The point is simpler: if you keep your eyes, ears, and mind open, inspiration can come from the most unexpected places.

And in the market, if you’re really paying attention, sometimes the story that unfolds - the journey, the turns, the outcome - ends up being more gripping than any film you’ve ever watched.

Connecting the Dots

In a monumental moment, India is set to revive the historic Kolar Gold Fields (KGF) in Karnataka - making it the first gold mine to restart since Independence. But this isn’t just about gold or some sort of nostalgia. It is pointing towards something.

Across continents, the ground is shifting. Quite literally, actually.

The European Union, under its Critical Raw Materials Act, has fast-tracked 13 global projects spanning Greenland, South Africa, and Serbia - all focused on securing future supplies of lithium, cobalt, manganese, graphite, and rare earths. [Reuters]

At the same time, the IEA’s first Critical Minerals Review reveals that investment in critical minerals surged by 30% in 2022, with lithium investments up 50%, and strong momentum in copper and nickel. The urgency? Diversification and long-term sustainability. [IEA]

In South Africa’s Northern Cape, fresh indications of high-quality copper reserves are drawing serious interest. Copper, after all, is the artery of electrification (EVs) - and the world is bracing for a 6.5 million-tonne supply gap by 2031, as per McKinsey.

Meanwhile, India isn’t staying on the sidelines. The government is fast-tracking amendments to the MMDR Act, aiming to boost domestic output of rare earths and permanent magnets.

The PLI scheme for critical minerals is being positioned as a strategic lever - with Commerce Minister Piyush Goyal calling for global supply chain partnerships.

Source: Times of India

Even NMDC, traditionally focused on iron ore, is pivoting. After tasting success in gold mining in Australia, it now plans to expand into lithium, copper, and cobalt, using newer, more precise extraction methods.

We haven’t even touched on the US–Ukraine pact on critical minerals or the recent mining acquisitions in Greenland. But here’s the twist.

While demand for metals like copper and gold is surging, the quality of ores is quietly deteriorating. A recent S&P Global report notes that gold concentrations in mined ores are declining, making extraction more energy- and capital-intensive. Lower ore grades = more rock moved, more energy spent, more cost.

All in all, the writing is on the wall:

Mining and investment in it is only going to go up. And this is why we are writing this blog on Tega Industries.

But before we talk about the company, I think it will be extremely beneficial for the reader to understand how mineral ores are processed and what critical equipment is involved.

Ball Mill Workflow 3D Animation-Zoneding Machine [ YouTube Video ]

To those who don’t want to watch the video can picture this:

Now, think of a ball mill as a giant rotating drum filled with rocks and heavy steel balls, all tumbling around to grind the ore into fine powder. This grinding process (think of a washing machine) is intense - there’s constant impact, friction, and wear inside the mill. Without this protection, the mill’s inner shell would wear out quickly.

This is where the mill liner comes in.

Essentially, a mill liner is a protective layer made of rubber, metal, or a combination of both. Its job is to absorb the impact and prevent damage to the mill. But it does much more than just protect.

A well-designed liner controls how the steel balls and ore move inside the mill. This movement determines how efficiently the ore is ground, how much energy the process consumes, how much material the mill can handle, and how often it needs maintenance.

Mill liners, though a small fraction of operating costs (3% - 15%), can lead to substantial downtime expenses. They are a critical consumable!

Here’s an interesting case study which will probably help me drive home the point:

In the Morila Gold Mine (Mali) study, with an average gold yield of 9gms/ton and 293 tons per hour, an hour of downtime can cost up to $174,042, based on a gold price of $66 per gram.

Source: Tega Industries RHP

Thus, high-quality mill liners are essential to minimize costly downtime and maximize operational efficiency. Cheapness is not an option.

Hence, High Switching Costs! Plus, Customers DON‘T have bargaining power. Well friends, this is another point that an investor should always appreciate in a business!

With me? Great.

Enter Tega Industries: Engineering Performance Where It Matters

This is precisely what we find in Tega Industries and its business. The company specializes in mill liners and other consumables for the mineral processing and mining industries. With decades of R&D and field experience, Tega has become a critical enabler of operational efficiency in mining operations around the globe, especially through their young flagship DynaPrime product.

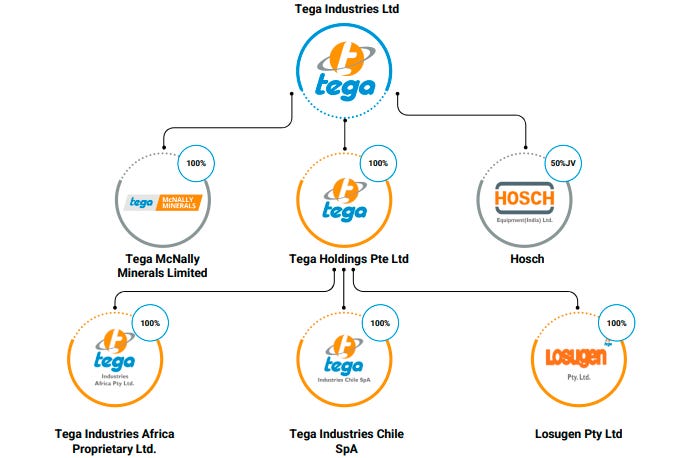

The group has expanded through a mix of organic growth and strategic acquisitions, enhancing both capability and market presence. Revenue is well-diversified geographically, with 85–90% of sales denominated in foreign currency, underlining its strong global footprint.

The acquisition of Tega McNally Minerals Ltd (TMML) strengthens Tega Industries’ presence in the mining sector by expanding its portfolio to include engineering equipment. This move enables the company to offer an integrated solution - combining equipment, wear-resistant consumables, and value-added services - positioning Tega as a more comprehensive partner to its mining customers.

Tega operates in a specialized niche at the crossroads of mining, material science, and engineering, serving over 70 countries with manufacturing bases in India, South Africa, Chile, and Australia.

Demand for Tega Industries’ products remains highly stable, with 70–75% of revenue generated from repeat orders, reflecting strong customer stickiness. Ideally, this should be a major point of attraction for any investor in a business!

Why?

Well, every time a ball mill operates, the liner is constantly hit by ore and steel balls, experiencing extreme impact, abrasion, and heat. No matter how well-engineered the liner is, it has a limited life - usually between 6 to 18 months depending on the ore type, grinding intensity, and material used for the liner. This means that Mining processing companies spend 3x the amount they spent on upfront capex for setting up their facilities.

Source: Tega Industries, Q4FY25 Investor Presentation

Once worn out, it must be replaced entirely for the mill to function efficiently and safely.

This creates a regular replacement cycle, where mining companies need to order new liners on a fixed schedule, often plant by plant, across multiple locations globally. Since mill downtime is expensive, liner replacement is planned well in advance, ensuring predictable, recurring demand.

Add to this the fact that liners are custom-designed for each mill, and clients often prefer working with the same supplier for continuity, performance data, and fitment accuracy.

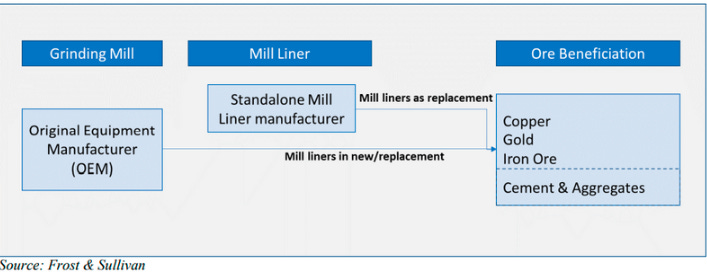

In short, mill liners are not a one-time sale - they’re part of a long-term, critical maintenance ecosystem, making them a steady and recurring revenue stream for companies like Tega Industries. Roughly, about 70% - 80% of the spending of OEMs is on replacement and 20% - 30% for new machines.

What does this mean?

OpEx for clients - > Recurring in Nature = Insulation from Cyclicality of Mining Players!

Moreover, here are some other key facts about the Mill Liner Industry:

Copper and Gold accounted for 75% of the global mill liner network. Expected to grow at 5.3% CAGR till 2030. Plus, another factor to note here is that since the quality of Gold and Copper Ores is in decline, to process and extract them - it takes a lot of wear and tear. This is only going to increase the demand or market in the time to come.

Oligopolistic Competition. (2020 Numbers). Top 5 Producers (49% Global Market Share):

Metso -Outotec (17%)

Me Elecmetal (13%)

Bradken (9%)

PT Growth (5%)

Tega Industries (5%)

Here, it has been gaining the market share. Old data, but with the revenu growth they are showing,it is clear that they are penetrating the market consistently:

Demand is primarily driven by Latin American countries which account for 40% of the global copper production and 8% of global gold production.

So what’s driving Tega’s critical consumable business?

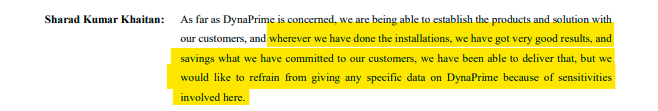

Its prized innovation, Dynaprime - a high-performance mill liner, has seen a positive response from its customers after rigorous pilots.

Source: Tega Industries, Q4FY25 Investor Conference Call

Launched in 2018, Dynaprime marked a turning point for Tega Industries. Remember the sudden surge in top-line growth and margin expansion? This was the catalyst.

Targeted at large mineral processing facilities that traditionally used heavy steel liners, Dynaprime is the world’s first composite mill liner made of both rubber and steel - a hybrid solution that significantly extends liner life.

It reduces installation downtime, cuts overall weight, and lowers power consumption - a game-changer for high-throughput operations.

Company believes that Dynaprime unlocked a new, >$1 billion addressable market for Tega, and to date, Tega remains the one of , if not the only global player offering a hybrid liner solution for both large and small mills - a unique competitive edge that’s hard to replicate.

Management believes this will be a major growth driver of their business and they are confident that it will gain traction and apparently it is growing 25+% YoY!

Dyna Prime Will Continue To Grow Above 28-30% In FY25: Tega Industries | CNBC TV18 [YouTube Video]

These innovations in a critical consumable product has resulted in a consistent 55-60% GPM we believe is a durable competitive advantage.

What else makes Tega interesting? The company still has several aces up its sleeve.

And oh. If insights like these get you thinking deeper about the businesses behind the stock tickers, we invite you to subscribe to our blog.

Steady Growth in Consumables; Equipment Segment Gaining Traction

Construction of the new greenfield plant in Chile is set to begin soon, with commissioning expected by mid-CY26. Importantly, demand is being met via de-bottlenecking at existing facilities, ensuring no business loss.

Non-mill liner products are growing in line with overall company growth. The equipment segment delivered its best-ever quarterly revenue at ₹79.3 crore (+35% YoY), with a sharp EBITDA margin expansion to 16.6% (vs. 5% YoY).

Moreover, a significant portion of the ₹120 crore NMDC order will reflect in FY26. Management wants to take the contribution of the equipment business to 25% of consolidated sales vs. 13% in FY25 in the medium term. Plus, Tega is actively pursuing domestic opportunities in power and steel, in collaboration with EPC players, and aims to enter export markets in the coming years for its equipment business.

Currently the company is undergoing a capex of ₹250–290 crore in Chile, ₹30 crore in Dahej, and ₹40–50 crore in annual maintenance capex.

From a book keeping perspective as well, Tega’s consumables segment reported modest 3% YoY growth to ₹460 crore, impacted by delayed product lifting, with revenues likely to be recognized in H1FY26. Margins remained healthy at 29.7% EBITDA, down 60 bps on a high base. The company continues to target a 15% revenue CAGR in this segment.

The legacy of Madan Mohan Mohanka, who was featured in the book "The Inheritors" by Sonu Bhasin and also , speaks volumes about the depth and character behind Tega Industries. Having built the company from scratch into a globally competitive player, his values continue to shape the organisation’s culture and strategic direction.

Today, the baton is with his son, Mehul Mohanka, who has not only upheld that legacy but is accelerating growth with sharp execution and strategic clarity. Under his leadership, Tega has expanded its global footprint, driven innovation like Dynaprime, and shown strong capital allocation discipline - all of which make the business increasingly exciting from a long-term investment lens.

Conclusion

When everyone is chasing the next shiny tech disruption or renewable energy stocks, businesses like Tega Industries quietly compound - building moats, capturing market share, and delivering consistent value through engineering brilliance and product resilience.

It may not be a fancy business, to be honest - but for the discerning investor, that’s where the gold often lies - pun intended.

Do Share if you found value as well!

Disclosure: Invested and biased. No recommendation to Buy/Sell. This is just for informational and educational purposes only.

Great post. Are their products similar to the products of AIA Engineering?

Great Write up!