Crude Reality: How Oil, War, and Markets Are Colliding Again

Iran's Threat to Block the Strait of Hormuz Rekindles Fears of a Global Energy Shock

It’s June 2025. Oil is spitting fire again. “Nothing Ever Happens” era is, I think, well and truly behind us. It’s as if the world can’t seem to catch a break since 2020.

Somewhere in Tehran, parliament just passed a resolution threatening to close the Strait of Hormuz - pending military nod.

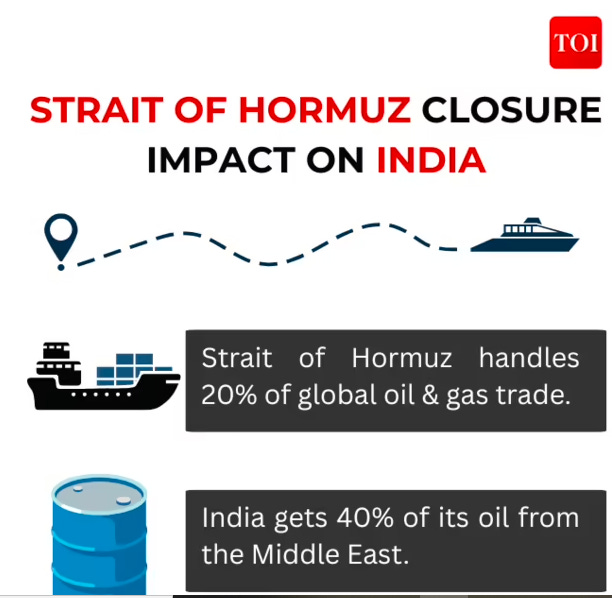

Why should you care? Because nearly 20% of the world’s crude oil flows through that narrow strip of water.

Since Israel's strike on Iran on June 13, 2025, crude prices have already surged from $64 to $78 per barrel.

If tankers stop moving through Hormuz, the economic tremors won’t just rattle global markets - they’ll knock on the doors of households across Mumbai, Madurai, and Manipur.

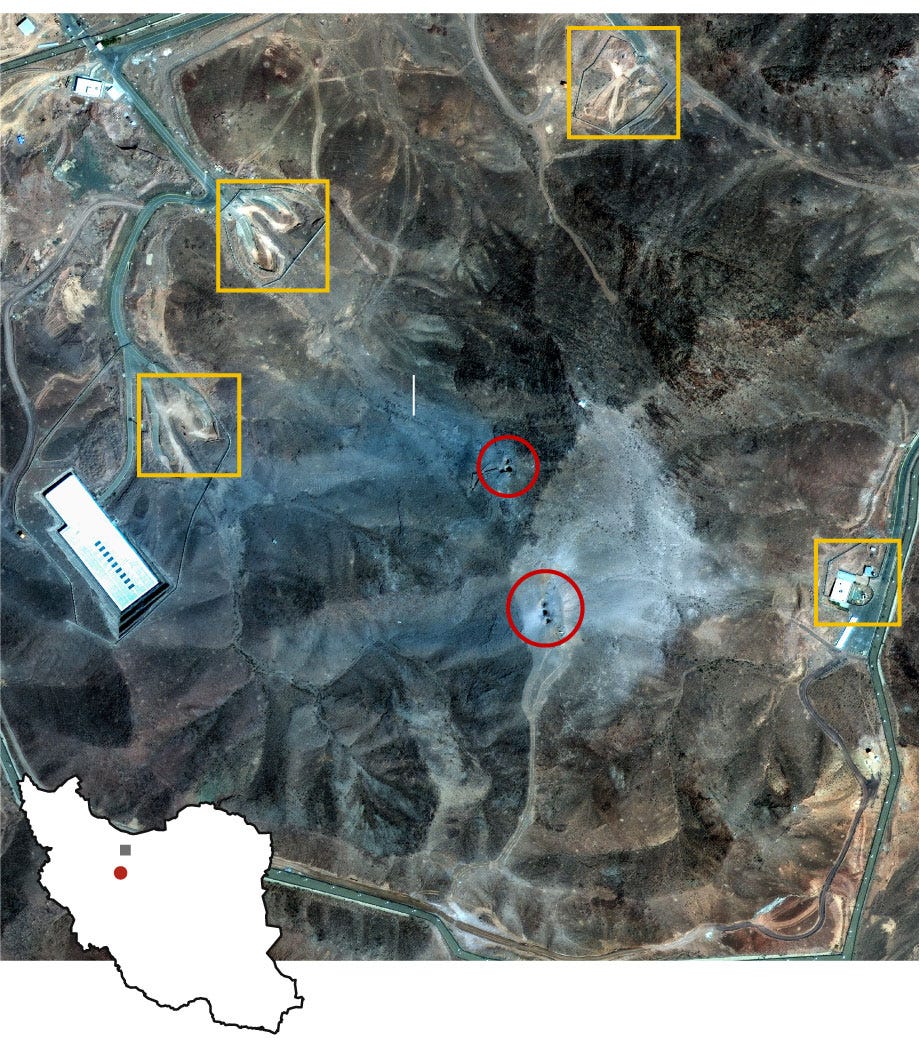

Flashpoint: U.S. Airstrikes on Iran’s Nuclear Sites

The latest turn in this ongoing conflict came when the United States launched airstrikes on three of Iran’s key nuclear facilities - Fordow, Natanz, and Isfahan.

According to President Donald Trump, B-2 bombers executed a precision strike, including six bunker-busting bombs on Fordow and 30 Tomahawk missiles elsewhere.

Though radiation hasn’t been detected, and the strikes were labelled a “one-off,” the potential for retaliation is real. Iran has already fired missiles toward Israel, and its Foreign Minister warned of “all options” being on the table. For now, the strikes have halted short of sparking a broader war, but markets are bracing for what might follow.

This event elevates two key questions:

Will oil exports from the Middle East - especially via the Strait of Hormuz - be interrupted?

Will other major powers be pulled into the conflict?

Historically, such shocks lead to a short-term spike in oil prices as markets bake in the probability of disrupted supply chains. If Iran resorts to drone or missile strikes targeting energy infrastructure in neighbouring states (as it has in the past), oil’s volatility will intensify.

While Iran’s military capacity has been dented, its ability to disrupt maritime trade remains a concern.

And if things escalate, countries like Russia might consider using oil markets as a geopolitical lever - though their direct involvement seems unlikely at this point. But you never know. Let us have a look at the map and understand what’s the matter with Strait of Hormuz now.

Strait of Hormuz: The World’s Most Dangerous Valve

It’s just 21 miles wide at its narrowest point, but it handles 17 million barrels of oil per day. That’s nearly 1 in every 5 barrels globally. A single drone strike or naval mine here is enough to throw the global oil market off its rails.

So when Iran talks about blocking the Strait or launching drones, it’s not targeting only the US or Israel but also indirectly hitting the economy of countries who are not even participating in the war.

Moreover, this war, like the one in Ukraine, has no visible endgame. And when geopolitics turns into long-form theatre with too many actors, the only constant is volatility. Because investors hate uncertainty.

If you’re an Indian investor trying to make sense of it all, you’re not alone. You’re just early. So let’s break it down.

Oil: The Wild Horse You Can’t Ignore

See, I guess we are all aware that the Crude oil sets the tone for the markets in economies like India, where nearly 90% of the energy requirement is met through imports. And of that, more than 40% flows in through a narrow, vulnerable artery: the Strait of Hormuz.

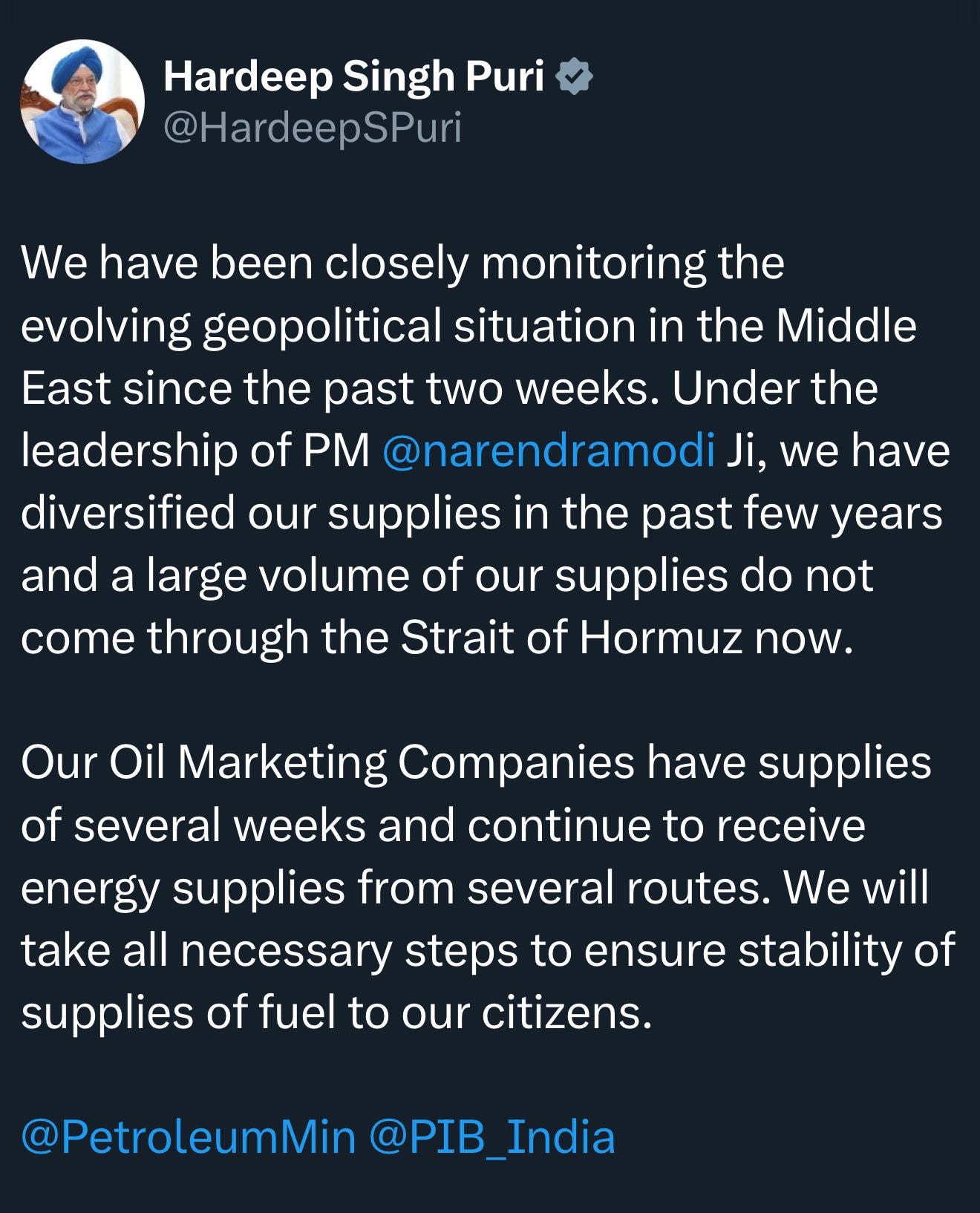

This explains why Energy Minister Hardeep Singh Puri came out on 22 June 2025, and stated that the government has been closely monitoring the unfolding geopolitical tensions in the Middle East over the past two weeks.

However, we believe that the oil and gas sector remains extremely sensitive to disruptions. Even short-term supply issues can push up global crude prices.

India’s energy security rests on two precarious pillars.

First, dependence: despite efforts at diversification, nearly half of our crude still transits the Strait of Hormuz. Any hiccup there instantly shrinks available supply.

Second, exposure: India imports over 80% of its oil needs, so global price swings hit us directly. In calmer markets, lower oil prices and opportunistic “sweet‐spot” Russian deals provided a buffer; today, with prices already elevated, there is scant room to absorb another shock without passing costs onto consumers.

Look, when global crude prices rise, the impact on India is swift and multifaceted. A one-dollar increase in Brent immediately raises the cost of imported oil, pushing the wholesale price index up by nearly a percentage point within a quarter, despite refiners drawing on existing inventories.

This upward pressure then filters through to consumer prices: although LPG and kerosene remain under price controls, petrol and diesel move in line with international benchmarks, driving higher transport and logistics costs that ultimately find their way into the cost of goods and services.

Faced with these potential inflationary forces, the Reserve Bank of India must reassess its monetary stance. Elevated price expectations make further rate cuts impractical, while a widening oil import bill puts downward pressure on the rupee.

To defend the currency and curb second-round inflation, the RBI may opt to absorb excess liquidity, effectively tightening short-term interest rates at a time when economic support is most needed, and that too when they’ve just cut rates!

Downstream, refiners such as Indian Oil, BPCL, and HPCL operate on narrow margins. When crude prices climb, they incur higher procurement costs but cannot always adjust retail prices immediately, given the potential political fallout - resulting in inventory losses that erode profitability. Prolonged periods of elevated crude often necessitate government subsidies or budgetary support to maintain cash flows. Private refiners, on the other hand, less encumbered by subsidy obligations, also enjoy enhanced margins and more rapid cost pass-through.

Beyond fuel marketers, several key industries face similar margin pressures. Fertilizer producers contend with soaring feedstock costs and rising subsidy burdens. Transport and aviation companies see fuel expenses- often 30–40% of their operating budgets - increase sharply, while cement and paint manufacturers absorb higher costs for kiln fuels. Logistics firms, too, pass on rising diesel bills through freight tariffs, contributing to broader price increases across the economy.

Conversely, upstream entities benefit from higher crude prices. With windfall taxes removed, ONGC’s earnings per share rise by approximately ₹2.4 - 2.5 for every dollar increase in the oil price, and Oil India’s by ₹3.5 - 4, providing a direct offset to the pressures faced downstream.

In sum, sustained increases in global crude prices reverberate across India’s economic landscape, influencing inflation, monetary policy, corporate profitability, and consumer spending in equal measure.

What’s a Silent Risk? Global Liquidity Tightening.

In a high-oil world, RBI’s priority will likely shift from supporting growth to maintaining currency stability. But it's not just India watching closely. Central banks across the globe are on alert. Inflation is the common enemy - and crude oil is the weapon that can sneak it back in through the backdoor.

But India is hardly alone in this predicament - major economies from Washington to Tokyo now face their own version of what I call “silent risk”: global liquidity tightening driven by elevated oil prices.

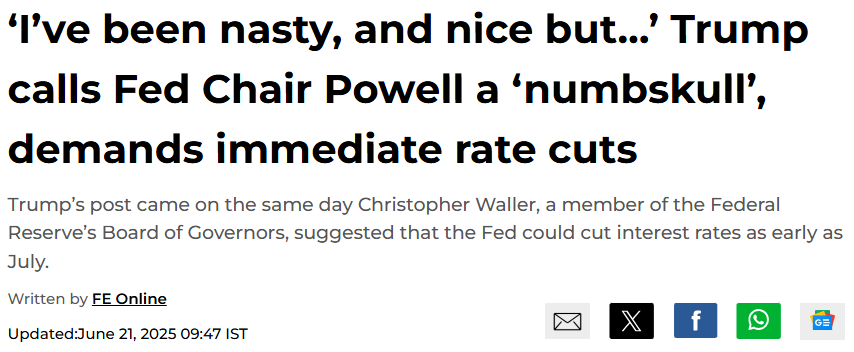

Take the United States. With President Trump publicly urging the Federal Reserve to cut rates ahead of the election, markets have been pricing in a dovish pivot.

Yet, should oil remain perched well above $80 a barrel, that government wish runs headlong into reality. A sustained spike in energy costs fuels stickier inflation expectations, compelling Chair Powell to delay any rate reduction until he can be confident that price pressures have truly abated. In practice, this means the Fed’s balance sheet normalization and funding‐rate corridor remain in place longer - effectively a drain on liquidity that undercuts the very stimulus markets are banking on.

Meanwhile, in Tokyo, the Bank of Japan confronts its own turning point.

May’s core CPI at 3.7 percent year-on-year - and even 3.3 percent when stripping out food and fuel - underscores how deep‐seated price pressures have become.

Governor Kazuo Ueda has signaled a gradual normalization or hike of rates, but the specter of higher oil complicates the calculus. A slow pace risks letting inflation entrench, yet moving too quickly could stoke a wage‐price spiral, along with another grave consequence to the world.

Yes, the yen carry trade - already strained - could collapse almost overnight.

An early BOJ rate hike would immediately begin to narrow the interest‐rate differential between the U.S. and Japan. Investors who have long borrowed cheaply in yen to chase higher yields elsewhere - read US 10Y Yields - would scramble to unwind positions. When that capital suddenly leaves, local markets can run low on cash, driving down asset prices and risking wider financial trouble.

In currency markets, a rapid yen appreciation often sparks further volatility: export-heavy Japanese corporates could see profit forecasts slashed, prompting equity‐market sell-offs, while global investors reassess their exposure to Asia.

It is possible that the emerging markets would not be spared. Many economies reliant on external funding could witness sudden stops in capital inflows, straining local currencies and forcing central banks into defensive rate hikes that choke off growth. In commodity-importing nations, the double burden of higher oil bills and tighter global liquidity could widen fiscal deficits, reigniting concerns over sovereign creditworthiness.

As we explained in our previous blog, Japan also owns about $1.1 trillion in the U.S. Treasury bonds. If Tokyo has to sell some of those holdings to support the yen or stabilize its own markets, U.S. Treasury yields could jump - just when America’s credit outlook is already under pressure. In other words, both Japan and the U.S. are balancing on the brink in the world’s two biggest debt markets.

Interestingly, the yen often moves alongside gold. So, turmoil in Japan’s bond market could actually boost gold, even though higher bond yields usually make gold less appealing.

Gold: When in Doubt, Go Yellow

So what we have here is the Middle East flaring up, pushing the crude oil higher, pouring fuel on inflation expectations worldwide. It is in turn forcing Central Banks to re-draw plans.

Moreover, Washington’s recurring debt‐ceiling battles and record Treasury issuance strain demand for U.S. government paper, lifting yields and undermining confidence in the US dollar.

Like it or not, Geopolitics and Geoeconomics of today is a perfect storm for one asset and that is Gold. In this environment, gold’s dual role as an inflation hedge and a safe‐haven asset comes into its own, making today’s confluence of rising oil prices, BoJ maneuvers, U.S. debt dynamics, and geopolitical risk the ideal backdrop for bullion’s ascent.

This perfect storm has propelled gold’s price up more than 30% year-to-date and ~85% in the past two years in rupee terms.

Source: Goldprice.org

Finishing Thoughts

Direct airstrikes on nuclear sites and a chokepoint that could strangle 20% of global oil. This geopolitical turbulence has once again made it clear: monetary doves may want to fly, but oil prices still clip their wings.

Two wars. No endgame. Geopolitics is the reality today and as a matter of fact it is a live variable in your portfolio.

But you don’t need to guess where the next missile lands. You just need to protect your downside and stay alert. However, the solution isn’t frantically repositioning with every headline - or trying to outguess the next flashpoint.

As Philip Fisher observes in Common Stocks and Uncommon Profits, wars and political upheavals may roil markets in the near term, but they do little to derail the long-term earnings power of truly exceptional companies. Fisher reminds us that “businesses don’t go to war - governments do,” and that it’s the underlying strength of a company’s management, innovation, and market position that ultimately determines its success.

Instead of chasing headlines, anchor yourself in a disciplined process: maintain your strategic asset allocation, concentrate on businesses you deeply understand, and let compounding work its magic over years, not days. In turbulent times, it’s this combination of rigorous research, system-driven decision-making, and firm conviction in quality franchises that protects your downside - and sets you up to harvest the upside when calm returns.

Equally important is how you allocate across asset classes. In environments marked by inflation shocks, rate uncertainty, and geopolitical risk, diversification beyond equities becomes critical. Exposure to gold, select debt instruments, and even cash equivalents can offer resilience when equity markets falter. Asset allocation helps you manage risk and prepare your portfolio for uncertain times, while still keeping you on track to meet your long-term goals. Someone has very rightly said:

“The market doesn’t care how smart you are. Only how prepared.”

Still Thinking About Joining?

Our early offer for the Zen Investing Club is still open—but only for a little longer. We’ve already crossed the 100-member mark, but many of our readers have written in asking for one last chance. So here it is.

As part of our Substack community, you can still unlock the full-year membership (worth ₹12,000) for just ₹5,000 using the code ZN100.

This is your chance to be part of a focused investing collective—where insights go beyond noise, and long-term thinking is the core principle.

👉 Apply the code ZN100 now and join the Zen Investing Club »

Only for our Substack readers. Limited seats remain.