India at the Crossroads:

Seizing Opportunity in a Post-Globalization World | Part 2.0 of Trump Tariffs

The headlines (and Social Media) are screaming “Trump!!” “Trade War,” “OMG” “U.S. Markets Tanking.” And they are also memeing, to be fair. Which is essential in these times.

Funny.

The Trump Derangement Syndrome has surely made everyone pull their hair once again - but what if the chaos that looks self-inflicted... isn’t entirely?

Just scratch beneath the surface, and you’ll see this may be less about domestic pain and more about external pressure - a slow, calculated economic ambush aimed squarely at China, with a side of resentment towards Europe (especially France), for hiding behind the dollar while outsourcing both their security and monetary pain to the U.S.

In Part 1, I wrote about how America - the empire that built the global playbook - has now flipped the board mid-game, accusing others of cheating at a game it created.

I’ve war-gamed this scenario in my head (and let’s be honest, with a few late-night YouTube rabbit holes featuring Geopolitical/Macro gurus who the world thinks were probably bullied at school) - and hey, I know I could get disowned and kicked out of my (small) tribe too.

Yeah. I’ll just say it - I really think the U.S. has just attacked China.

Just… not your classic guns-and-boots-on-ground kind. While the world stares at Wall Street, what if the real target was the factory floor of the Dragon?

“Oh, but the judiciary will pull this executive order down… it’s illegal!”

“Haven’t you seen Trump’s first term? He always backtracks….”

Today, we go a layer deeper.

Because markets crash quickly. But power - that shifts silently.

And it is a power play. Let me tell you why I think so.

Return to Sender: Nations Fire Back at America’s Tariff Wall

France to U.S.: “Non, merci!”

On April 3, 2025, President Emmanuel Macron basically told EU companies to pack up their investment bags and hold off on doing business in the U.S. until Washington stops acting like a bully. This dramatic call came right after Trump’s 20% tariff salvo on foreign goods.

Source: The Guardian

"What message would we send by having major European players investing billions of euros in the American economy at a time when [the US] is hitting us?" he said.

Porfavor!!!

Is it French? No? Oh Okay. Then he didn’t say that.

Hmm. Next.

Look at this guy. I mean. Since when did Canadians start to have 0 self awareness?

Interestingly, he doubles down and says that the world's trade, previously anchored under the U.S., is also "over," saying, "The 80-year period where the United States embraced the mantle of global economic leadership is over."

However, the Japs are…… disappointed. No pushback, no false bravado like the ‘West’... but perhaps an acceptance…..

Source: AA.com

The Penguins and the Aussies are scratching their heads, and the UK is just …erm not relevant anymore? But they’ve all reacted in one way or the other.

Source: X/@Maine

But there’s the Dragon in the Room…who has just slapped retaliatory tariffs on US goods.

Source: CNN.com

Both the countries are at each other’s throats.

Source: NDTV

Odd isn’t it?

Now three points anchor the discussion today in the media (that includes Social Media):

1. "It has nothing to do with the exporting nations. It is the US citizens who have to pay for these tariffs and it will lead to inflation."

2. "It will be a source of revenue for the Trump administration which might save close to $600b (or thereabouts)annually and help them reduce their deficits"

3. "The US runs a large trade deficit... it is unfair...." Says the MAGA.

However, the reader should be asking this - If tariffs fall on U.S. citizens, raising prices yet generating revenue, they could theoretically cut fiscal deficits (e.g., $600 billion yearly) and narrow trade deficits by leveling the playing field - deterring imports, boosting domestic production. If at all, if there is a line of thought that is dominating the current discourse is that Trump has just nuked the stock markets and by extension the US economy!

Breaking down the 4th wall equivalent of Cinema:

Despite concerns of a market crash, the Trump administration remains unfazed post-tariffs - signaling that their priority lies with their heartland voter base, not Wall Street. Trump’s message to the market was to…..take a medicine. Very helpful, Mr. Trump :)

Sovereign Debt of Developed Nations Is the New Subprime

Anyway, So why the fierce retaliation from specifically these countries?

I mean, I get it. These nations see their economies threatened - Canada exports $400 odd billion and China’s $438 billion.

Source: US Office of Trade Rep

Source: US Office of Trade Rep

Apparently, even France is aggrieved as it barely exports $50b worth of goods to the US… and then along with the EU (Brussels, Belgium), it has been acting - erm a little unhinged since a while.

Source: Trading Economics

Well, maybe you shouldn’t be surprised when you look at the below data from the website of the US Treasury Govt.. These are the US Treasuries held by countries as of 1st January 2025:

Source: TIC Data / Treasury.gov

There’s a saying: “When I owe the bank $100, that’s my problem. But When i owe the bank $1m, that’s the bank’s problem.”

And this is exactly what Bessent has said recently in a podcast with Tucker Carlson (Listen from 22.16 minutes) :

https://x.com/TuckerCarlson/status/1908204378613248067?t=1214

So, there is a belief that they have the upper hand in all this and they have broken China’ business model.

But, who will trust the US any more after this? We should surely not be asking the astrologers for this.

Couple all this threat with the Debt to GDP and the Debt to Service ratios of these nations and how it played out in these respective countries at the end of the GFC 2008 (The image should tell you a lot which I don’t need to type) :

Table - I : Non-Financial Debt-to-GDP Ratios for 2025 (Consolidated Estimates)*

Source: Grok But Methodology, Source and Citation Provided*

It’s a fiscal + trade twin deficit problem. Watch out for those yields!

Debt, Disruption & Detonation: War-Gaming the Next Global Shock

Look guys, the debt spiral is not healthy for us common folks..nor is it for the countries. We saw Greece, Sri Lanka and a host of other countries going down under.

When a crisis hits, countries with high debt suddenly find it much harder - and more expensive - to keep up with interest payments, stretching their finances to a breaking point.

Why?

If bond yields start rising, countries already burdened with high debt will face even steeper interest payments, making it much harder to service their debt - just when they can least afford it.

And thus, these supposed developed or advanced economies’ who have till now recklessly spent on credit, inflating away their debt by artificially depressing their interest rates - are at a risk.

Now, whether foreign countries were forced to invest in US Government bonds or forced (ahem) to keep the bond yields artificially down is not the question one must ask.

The question that must be asked now, is will there be a flight of capital from US treasuries? Will China and some of these countries sell their US Treasuries to well…survive first and then retaliate against the US?

Add to the fact that Japan is also holding 25trillion Yen or $150 billion worth of French bonds!

Source: Bloomberg/Perplexity

Important : They recently sold $30billion worth of French government bonds and reinvested in Japanese Government Bonds to bring its yield down.

Source: Trading View

What if others follow suit?.

There is a threat of de-globalization and it all depends on the Japs and the Hans.

And there is a threat of this tariff gamut that might go wrong. Very Wrong.

The 10Y is down. For now.

But beware of the Bond Vigilantes.

Because frankly, if the bond vigilantes have a sniff, ( and they will) then this entire situation is going to quickly go out of hand.

Right now, we’re in a perfect storm:

Double whammy of mounting Trade and Fiscal Deficits

A tariff war heating up

Global retaliation threats rising

Debt and fiscal deficits in the US at all-time highs

And fresh geopolitical tensions targeting China

In such chaos, investors start demanding higher interest rates to hold government bonds - because lending to a government drowning in debt during uncertain times?

And when the bond vigilantes strike, bond yields shoot up, which can further spook stock markets and pressure governments to tighten their purse strings.

Japs Selling French + US treasuries -> French Selling US Treasuries - > China Selling US Treasuries + Bond Vigilantes coming in -> Average American or Japanese or Chinese starts to default on their high debt whose credit card interest has suddenly shot up. End Game.

At the cost of being labelled as a psycho this will be the….hold your breath……

End of Globalisation. End of the financial system that we live in. Some US induced and the rest by effect and choices

The Great Reallocation: Investment Opportunities

Irony of the era: It’s the developed economies that now resemble fragile emerging markets - overspending, overleveraged, and under-reforming.

Meanwhile, countries like India, Indonesia, Poland, and Malaysia are showing better fiscal prudence and growth fundamentals.

Funny how the Anglos/West have gone on talking down on EM about “Rules based order” all this while. Some things never change…anyway.

Things can unravel fast from here.

And it can go either way.

Look guys, we never know - and I’m prepared to catch eggs while you throw them at me - but right now, all signs point not just to another market cycle - but to a potential reset of the global economic order.

If that’s the case, the world could shift away from financial engineering and inflated asset prices toward what really matters: real productivity, innovation, and human capital.

Yes, Artificial Intelligence will be a key driver, but let’s not forget - humans built AI. Mankind’s ability to adapt, reinvent, and solve complex problems has time and again surprised even the harshest cynics.

And here’s a myth that needs urgent debunking:

“Emerging markets are too risky.”

Here’s where we at Zen Nivesh think.

The next decade won’t look anything like the last.

For years, the dominant narrative revolved around financial engineering, tech-led scale, and asset-light models.

Some Predictions:

Semiconductor production, long anchored in Taiwan, is expected to shift aggressively towards the US and other friendly geographies (away from China’s influence)

Capital will slowly shift from financial/ tech to industrial regeneration.

America’s reshoring dreams will not become reality overnight. Manufacturing ecosystems are hard to rebuild. But if common sense prevails, the US may strike practical partnerships - with countries like India - to align industrial goals.

Hans (China) are cooked.

Europe is goosed.

The US might just ‘safe’- land (not in the stock market sense though) but it will not be a unipolar world any longer.

US $ was meant for imports. With America suddenly deciding to manufacture and become a trade surplus nation, it will lose its value. They will have to devalue. (Ahem, Gold)

India, UAE, KSA, Indonesia, Poland, Malaysia might do well.

Japan will be the king maker.

There will be wars.

As the global economies (ex-China) slowly keep on getting acquainted with a new reality in Trump’s rule, they will find that they’re underinvested in real things - energy, manufacturing, and skilled human capital.

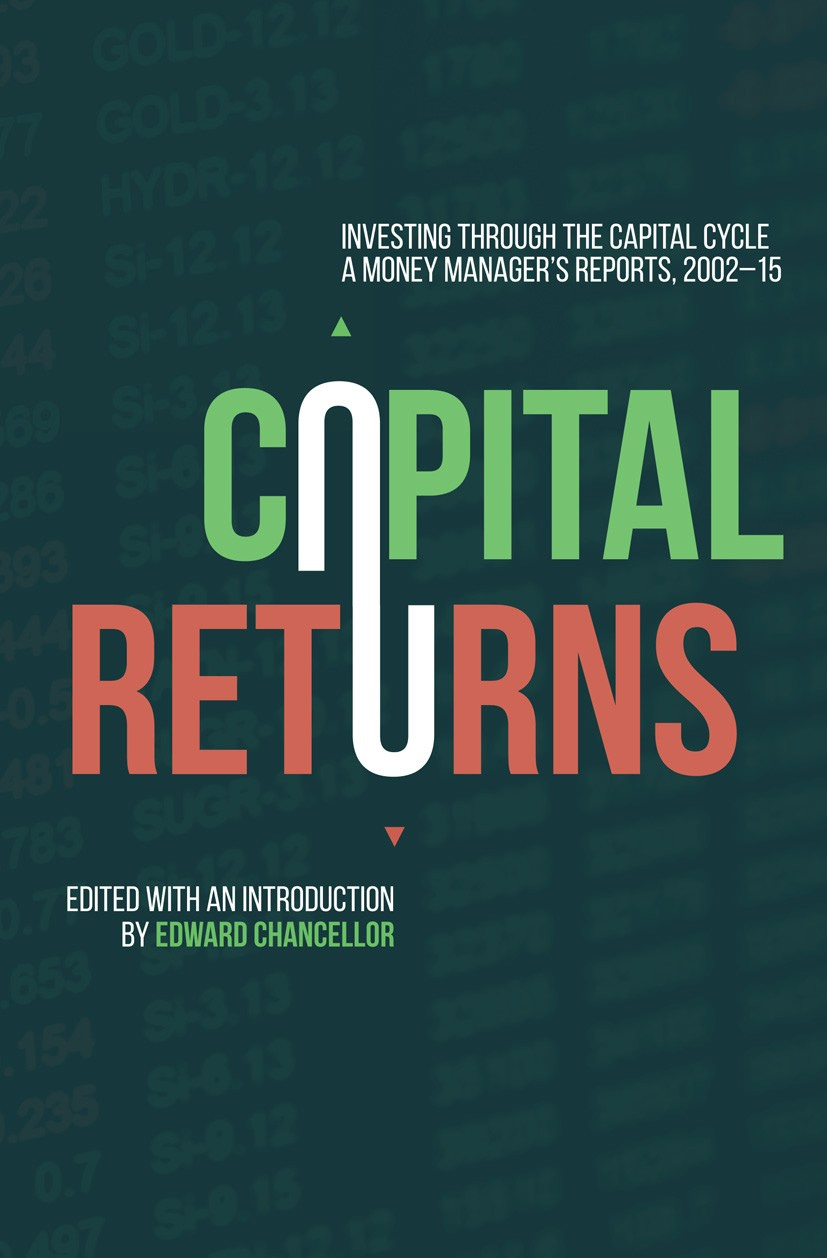

The real opportunities lie in sectors that have been starved of investment. If you’ve read The Capital Account or Capital Returns, you’ll know the thesis:

“Sustained underinvestment today leads to outsized returns tomorrow.”

This means, closely at:

Domestic manufacturing in India

Agriculture

Energy and Utilities

Logistics

Capital goods and heavy engineering

Critical raw materials and supply chain infrastructure

Sectors where governments want capital to go - because policy tailwinds matter (Defence, Electronics, Steel)

Conclusion

My hot take here is that just as the 2008 Global Financial Crisis stemmed from excesses in the housing market, today’s risks are building around unsustainable sovereign debt and the slow churn of a global financial reset.

If U.S. policy stays on its current course - marked by tariffs and rising protectionism - it signals a clear shift toward economic confrontation, particularly with China, and to a lesser extent, Europe. China will be economically hit though.

US10Y is the one to watch out for. If there is a spike, then god bless America.

Also, on the opposite side of the hemisphere, if China decides to devalue Yuan, and it also decides to go on a suicide mission like US, then “Oil up, China!”

Watch out for Japan. It is a key player in all of this.1

And more importantly for us, in this changing global order, Bharat has a real opportunity - both geo politically and economically - if it can respond with business-friendly policies and meaningful structural reforms.

The next decade will favor nations that can offer both scale and stability. India ticks that box.

And oh, keep an eye on gold.

🛑 Standard caveat applies: This isn’t advice, a recommendation, or a secret message from a gold miner. Just sharing my personal take on the chaos we're living through. Invest at your own risk—and always, always do your homework.

No recommendation to buy/sell Gold or any market.

Citations - Table - I*

Methodology

Total Non-Financial Debt-to-GDP (2025) and Expected DSR (2025):

Consistent with prior projections from BIS Q3 2023 trends, adjusted for IMF GDP growth and debt dynamics (e.g., U.S. 268%, China 315%).

DSR (Dec 2007):

Combines BIS private DSR for Q4 2007 with estimated government DSR (e.g., U.S. 25.6%, China 10.5%), as detailed previously.

Recorded Peak DSR:

From BIS historical data (1999–2023), unchanged from prior tables.

Recession After GFC (Yes/No):

Determined by examining GDP data post-2009 (GFC recession officially ended June 2009 per NBER):

United States: Yes. Recession in 2020 (Feb–April, COVID-19), with GDP dropping 31.2% annualized in Q2 2020 (BEA).

China: No. No recession post-2009; GDP growth slowed (e.g., 6.1% in 2019) but remained positive, even in 2020 (2.3%) despite COVID-19 (World Bank).

Japan: Yes. Multiple recessions, e.g., 2011 (post-tsunami, -0.1% GDP), 2020 (COVID-19, -4.5%) (IMF).

Germany: Yes. Recession in 2012–2013 (Eurozone crisis, GDP flatlined), 2020 (COVID-19, -4.6%) (Destatis).

India: No. No technical recession post-2009; 2020 saw -6.6% GDP growth (COVID-19), but not consecutive quarters per RBI data.

United Kingdom: Yes. Recession in 2020 (COVID-19, -9.8% GDP), 2023 (Q3–Q4, -0.3% and -0.1%) (ONS).

France: Yes. Recession in 2020 (COVID-19, -8.0% GDP), 2012–2013 (Eurozone crisis, -0.3%) (INSEE).

Italy: Yes. Prolonged recession 2011–2013 (Eurozone debt crisis, -2.8% in 2012), 2020 (COVID-19, -8.9%) (ISTAT).

Key Observations

Post-GFC Recessions: Six of eight countries (U.S., Japan, Germany, U.K., France, Italy) experienced at least one recession after 2009, often tied to the 2020 COVID-19 shock or Eurozone debt crisis (2011–2013).

Exceptions: China and India avoided technical recessions post-GFC, with China maintaining growth and India rebounding quickly from 2020’s single-year decline.

Dec 2007 vs. 2025: U.S. and U.K. had higher DSRs in Dec 2007 (25.6%, 17.8%) than expected in 2025 (16.2%, 14.5%), while China’s rose significantly (10.5% to 19.4%).

Caveats

2025 Estimates: Projections, not BIS-published, based on Q3 2023 trends.

Recession Definition: Uses two-quarter GDP decline where applicable; some countries (e.g., India) use broader criteria, but I’ve stuck to the common standard for consistency.

Dec 2007: U.S. DSR matches BIS peak; others are estimates due to limited total DSR data from BIS.

This table now includes the recession status post-GFC as requested. Let me know if you’d like further details!

Informative ✨

Thanks Shivam Bhai for enlighten us with the current situation and giving us another perspective of this entire situation.