Emotional Blind Spots in Investing

How to avoid near misses and derisk your investing journey?

Finding multibaggers is overrated.

Avoiding landmines is underrated.

Many investing greats have warned us with the same thought in different ways. My favourite of all is this quote by Joel Greenblatt

To put it simply, focus on controlling the downside and improving your odds of long-term survival. Then, the upside will take care of itself.

Do you know what is wrong with my statement and Joel Greenblatt's quote?

It wrongly makes you believe that share price movements or stock volatility are the real risks. Neither Joel Greeblatt nor I intends to say that. But somehow, most investors take the wrong lesson from this.

Volatility is not equal to risk. Risk is a far wider term and needs a nuanced discussion. I strongly believe that investors like you and me are often blinded by the hustle and bustle of the daily lives of average investors.

From time to time, we need to go to Neptune and then look at Earth. Just to get a clearer picture. In other words, from time to time, we need to learn from non-investing experts to get a better sense of risks in investing.

That’s what I am going to do today in this blog post. I will take this 15-minute fantastic presentation on Emotional Blindspots by Luca Dellanna. Luca is a best-selling author and management advisor. I read a couple of his books and was blown away by his clarity of thought. The books are Ergodicity and Winning Long-Term Games. So, he is an expert on risk management but has no relation to investing. And that is what fascinates me about investing. You can learn from anyone in any field and apply it to investing.

Before you assume that it is a sponsored post, let me put a disclaimer that I do not know Luca and have no financial interest in recommending his work. I genuinely learned a lot from his books and presentations, and hence my appreciation is out of a deep sense of intellectual satisfaction that learners get when they read, watch, and assimilate high-quality learning content.

Coming back to risks, blind spots, and investing.

The title of the post is Emotional Blindspots in Investing: How to avoid near misses and derisk your investing journey?

Let’s start with understanding Emotional Blind Spots.

Luca describes this in this way:

“We all know what a blind spot is. It's what we do not know. An emotional blind spot is what we don't want to know or what we know but don't want to do something about. And of course, some emotional blind spots come from fear, but there are others that come from a much more interesting place.”

And then he presents this slide. One of the simplest yet profound slides to understand about risks.

Source: Luca Dellenna Presentation

All you need to do is replace drivers with investors. I don’t have the exact data, but in my opinion, more than 90% of investors (including yours truly) believe they are better than average. This is what I call an Emotional Blind Spot In Investing because, as investors, this is something that either we don't want to know, or we know but don't want to do something about.

And how do we form this belief that we are better than average?

Based on the past track record.

We don’t realize that if we had started investing post the Global Financial Crisis (GFC) of 2008, our past track record probably would not be a great indicator of our future performance.

Another mistake we commit is how we perceive our near misses, like the COVID-19 Crisis of 2020. The COVID crash in the stock market was like a flash in the pan. Before you could make any sense of why the market fell so much so quickly, the market started its way up, and the rising tide lifted all boats ( read all portfolios).

Now read what Luca says about the near misses in driving. But don’t just think about driving, you need to think about investing when you read this part below.

“But the question is, what lesson do I take from the near miss? And the right lesson would be that the near miss is evidence I was driving too fast, and I should drive more safely. But it's so tempting to instead take the near miss as evidence that my reflexes are good and therefore can get away with unsafe driving. This is a mistake we do all the time. So it's why it's important to always interpret near misses as signals of danger, a signal of a structural problem. And as I'm fond of saying, problems grow to the size they need for you to acknowledge them. And if you acknowledge problems early, you will only encounter a little.”

For example, I started investing a few years after the GFC of 2008, and I luckily survived the COVID crash. I would be a fool to believe that my investing strategy is risk-free and that I can survive the next GFC 2008-like crash. The right approach would be to recognize my vulnerability during the COVID crash and see that as a sign of potential danger in my investing journey.

I will again borrow the subsequent slides from Luca’s presentation to drive home my point about emotional blind spots in investing.

Source: Luca Dellenna Presentation

Source: Luca Dellenna Presentation

Source: Luca Dellenna Presentation

Near misses are like cockroaches. If you find one in your kitchen, expect several others hidden at the moment. They will only be revealed in the future. So when, as an investor, you get saved from a COVID-crash, your job is to recognize that many such crashes in different forms will occur in the future. Getting saved from one crash is good, but not sufficient for long-term survival.

And how do you make sure that you change your behaviour against these crashes and your investing journey?

Luca offers a neat answer here, too.

Source: Luca Dellenna Presentation

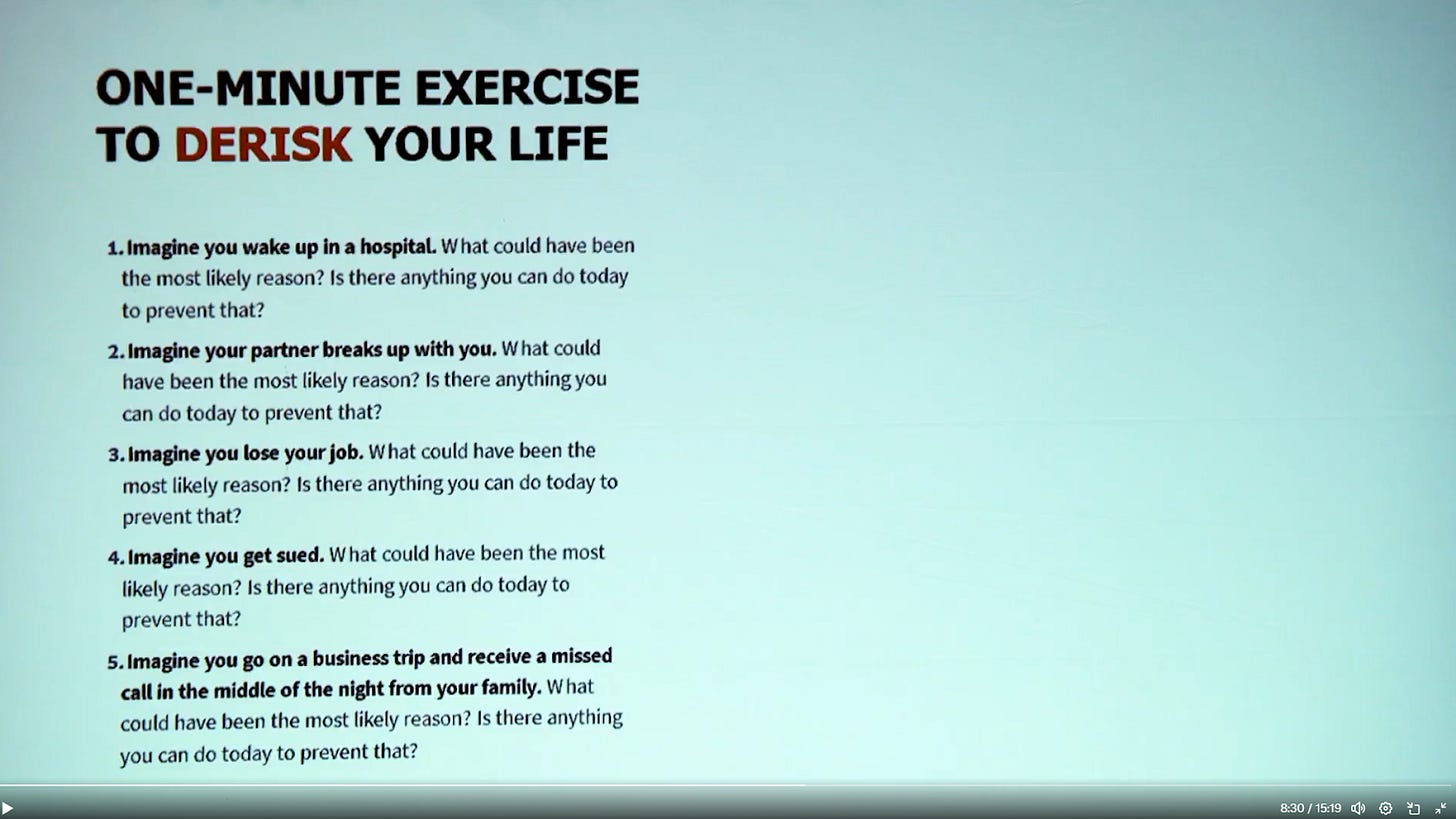

Luca doesn't stop there. After accurately identifying the problem, he comes up with a practical solution. He offers a 1-minute exercise that he suggests one should do regularly to be better prepared for risks in their lives.

Source: Luca Dellenna Presentation

Does it ring a bell?

Check this out.

If you have read Daniel Kahneman's book, Thinking Fast and Slow, you know about this premortem technique already.

However, if you don't, just watch this 3-minute video to hear from the horse’s mouth.

Nobel laureate Daniel Kahneman - Premortem to eliminate thinking biases.

Now, if I had to go back to the five questions which Luca wrote for his 1-minute exercise to derisk his life, and rewrite them to derisk my investing journey, I would come up with these 3 questions:

Imagine that it is not an exact repeat but maybe a near-exact scene of the GFC 2008. Your investing portfolio is reduced to 30% of the value it was before the crash. Just to make things clear INR 1 Cr (10 million) portfolio has come down to INR 30 lacs (3 million) only. And over the next few quarters or years, you do not see the economy getting back on track. How will you feel about that situation? Can you do something today to face the same situation in a better way?

Imagine your highest conviction stock idea is a big flop. The management did not execute well, the business was not as strong as you thought, and with the benefit of hindsight, you realize that you paid too much for growth. If this is going to happen to one of your high-conviction ideas in 2028, what can you start doing differently in 2025 to de-risk yourself?

Imagine you have a family emergency or a large business loss, or you lose your job. Whatever the reason, the outcome in all three cases is that you will be staring at months or maybe a year of no incoming cash flows. How will it affect your investing portfolio? Now that you know of it today, what changes would you like to make in your portfolio?

If you look closely, I have covered three different types of risks in the above questions. First is macro risk, the second is risk of wrong analysis, and the third is risk of personal liquidity crisis.

I need not share my answers with you. You need not have the same questions. But what both you and I can have in common is to have a few well-thought-out questions like this, and a robust system to maybe answer them at least once a year.

I hope this helps you in understanding a few emotional blind spots we have in investing. This is by no means an exhaustive list. Take this as a starting point and create your list of emotional blind spots in investing.

But before you do that, let me summarize the learnings.

We all have emotional blind spots in investing.

Don’t be over-optimistic about your abilities as an investor.

Pay attention to near-misses in investing.

Learn from not only the successes but also the failures of others in investing.

Pre-mortems are lifesavers for investors. Do not ignore them. Use them.

Thanks for reading.

Happy Investing!

EDWIN CASTRO CHARITY HOME changed I and my family’s lives for good. Thank you so much for the work you do! I love your charity because it’s efficient, dedicated, honest, and it’s spiritually motivated, but doesn’t force one set of beliefs upon the recipients of your assistance.' I will continue to tell the world about your good work.