Ramco Systems: Changing Times?

Turnarounds Seldom Turn. But when they turn… Research Lab Issue #15

There was a time, not too long ago, when if you started an investing blog with a Warren Buffett quote, you were considered well-read. Times have changed for sure. If I now start my blog with a Buffett quote, I will be considered old-school.

So the moral of the story is that time changes. It never remains the same. Like a wave in the ocean, it comes and goes. And at the risk of being called old-school, I will go ahead and share a quote from Mr. Buffett about time and businesses.

Time is the friend of the wonderful company, the enemy of the mediocre.

Do you know what is wrong with this quote?

It makes you feel that businesses are binary. 1 and 0.

Wonderful businesses use time as their ally to get stronger. They belong to Category “1”

Mediocre businesses are exposed by time, which reveals their vulnerability. They belong to Category “0”.

In reality, the above two are two opposite ends of a long spectrum. And thousands of businesses are in between. They are neither wonderful nor mediocre. Or even if they are, they keep changing over time.

Time!

Let me explain to you time in one more way. And this is the way I like the most. Not only because it is more fun, but also because it helps me remember the key lessons and patterns that get repeated in the future with some other business.

Time is known as Waqt in Hindi.

Do you know that in the year 1965, the first-ever multi-starrer Bollywood movie was made? And the name of the movie was Waqt. It featured an ensemble cast of Sunil Dutt, Raaj Kumar, Shashi Kapoor, Balraj Sahni, Sadhana, and Rehman.

And a middle-class kid who grew up in the nineties with movies being his only obsession and DD-1 being his only option to feed into his obsession, dialogues and scenes of a lot of Bollywood classics remain etched into his mind and heart forever (almost). And he can’t help but draw parallels between those movies he watched as a child and real case studies of businesses he studies as a professional.

What if I told you that a few famous dialogues of the movie Waqt convey the story of Ramco Systems so eloquently?

Let me share a few of them.

Dialogue One:

“Waqt hi sab kuch hai... waqt hi banata hai... aur waqt hi bigaadta hai.”

(“Time is everything… time creates… and time destroys.”)

The story of Ramco Systems is a tale of ambition, reinvention, excess, failure, and perhaps, redemption. From 2012 to 2025, time has been both a benefactor and a brutal judge. What began as a promising enterprise software company tried to punch above its weight globally, only to discover how unforgiving the ERP battleground can be.

Ramco had the pedigree, a legacy, and deep domain expertise in manufacturing, logistics, aviation, and payroll. By 2015, it had shed its image of a traditional software vendor and began to pivot, rebranding itself as a cloud-first, AI-led, niche ERP provider. The aviation MRO and payroll verticals, in particular, showed early signs of breakout potential. And the time changed again. Unfortunately, for the worse.

Dialogue Two:

“Kismat hatheli mein nahi... insaan ke baazuon mein hoti hai.”

(“Fate is not in the palm, but in a man’s arms.”)

Ramco didn’t rely on destiny. It doubled down on product innovation. Its payroll platform gained clients in over 35 countries. Aviation MRO software found favour with airlines in the Middle East and Southeast Asia. Analysts started noticing. Investors were intrigued. Revenues climbed steadily, margins improved, and the company broke even.

But building a globally competitive product company out of Chennai was never going to be easy.

Dialogue Three:

“Main jitni mohabbat karta hoon... utni nafrat bhi kar sakta hoon.”

(“The extent to which I love you… is the extent to which I can hate you.”)

Post-COVID, in 2020, Ramco Systems became an overnight darling. The stock rallied 8x within a year. From the ashes of the pandemic, it was seen as the phoenix of Indian SaaS. Investors, flush with liquidity and optimism, saw a "mini-Freshworks" in the making.

But euphoria doesn’t write code. Operational discipline faltered. Sales momentum fizzled. Execution gaps widened. From FY22 onward, the numbers turned messy—revenues stagnated, losses ballooned, attrition grew, and investor faith evaporated.

Those who once loved Ramco dumped it with equal passion.

Dialogue Four:

“Hum wahan hai jahan se humko bhi kuch hamari khabar nahi aati…”

(“I am at a place from where I don’t even get news of myself…”)

FY23 and FY24 were years of drift. Leadership churned. New logos dried up. The company seemed adrift, much like its own software updates—always promised, rarely stable.

But in the background, something was brewing. In FY25, the next-gen Ramco product went live. A sharper GTM strategy was unveiled. Costs were cut. Governance tightened. Most importantly, the leadership baton passed to a younger face, P.V. Abhinav Raja, who brought a sense of realism and rebuilding.

There are no promises. Only quiet execution.

While all the above 4 dialogues are very good and relatable to Ramco Systems, my favourite and probably the most popular one is the fifth dialogue.

Dialogue Five:

“Jinke apne ghar sheeshay ke ho… woh doosron par patthar nahi phenka karte.”

(“Those whose own houses are made of glass don’t throw stones at others.”)

This one is more for investors like you and me who are quick to throw stones (read “pass judgments” ) at other investors and businesses.

What we fail to realize and admit is that most of our investment theses are like houses made of glass.

Shiny, attractive, but also fragile.

So don’t throw stones (err, your judgment) on Ramco Systems yet.

Let’s go to Neptune and then look at Earth (the business and journey of Ramco Systems). And from there, let’s try to dive deep.

Are you ready?

Ramco Systems had a revenue and loss ( yes, loss, not profit) of 263 Cr and 24 Cr, respectively, in FY14. 11 years later, the numbers haven’t changed much. It had a revenue and loss (yes, still a loss) of 591 Cr and 34 Cr, respectively, in FY25.

Ramco Systems is the same company whose product was once launched by the famous tech tycoon Bill Gates.

It is also the same company that the famous management guru and strategist once mentored, Mr. C.K. Prahlad.

Why did this happen? Where did they go wrong? Are there any signs of a turnaround?

Let’s find out.

The Long Road to Reinvention: The Story of Ramco Systems

There’s a certain romanticism attached to turnarounds.

The idea is that a business that is beaten down, perhaps forgotten, can rise again, correct its mistakes, and become stronger than ever. It appeals not just to investors or business watchers, but to anyone who believes in the power of resilience.

Ramco Systems, a Chennai-based enterprise software company, is currently living that story.

In a world dominated by tech giants like Oracle, SAP, and Microsoft, Ramco appears to be an unlikely hero. A mid-sized Indian company trying to sell enterprise software to global clients? It sounds ambitious, maybe even foolish. But behind that ambition is a rich story spanning three decades, filled with high hopes, hard knocks, leadership experiments, and, more recently, a quiet but determined turnaround effort.

It’s a story about vision, missteps, change, and an evolving cast of leaders, some seasoned, some young, trying to make their mark. If you’ve ever wondered what goes on behind the scenes of a company that’s fighting to stay relevant in the global tech race, this is it.

I have broken it down to 9 chapters. I know, slightly long. But I guess it’s worth the read. Bring your coffee or munchies if you like. I can wait. 🙂

Chapter 1: The Rise: Building Something Special

Rewind to the late 1990s and early 2000s. India’s IT industry was booming, but nearly every major player, Infosys, Wipro, TCS, was in the services business. They made money by writing code for other companies, not by building their own products.

Ramco Systems wanted to be different.

It was part of the Ramco Group, a well-established industrial conglomerate in South India with interests in cement, textiles, and fiber cement boards. Ramco Systems started as an internal IT division, but soon aspired to be India’s answer to SAP. They believed they could build an end-to-end enterprise resource planning (ERP) software suite and sell it to the world.

And for a while, they did just that.

Ramco’s ERP platform was used by companies in India and Southeast Asia. They even had a brief moment in the sun when Bill Gates himself launched one of their products on stage, an incredible validation for a company based in Chennai.

But what came next wasn’t a fairy tale.

Chapter 2: The Slide: Brilliant Tech, Broken Business

By the early 2010s, cracks had started to show.

Ramco had talented engineers, but the company wasn’t profitable. Many of its deals were stuck in execution. The software was powerful but not user-friendly. Investors joked that Ramco’s "turnaround story" had become never-ending. (On a side note, investors still think the same in the year 2025).

They weren’t entirely wrong.

In 2012, the board brought in a new CEO, Virender Aggarwal, a senior leader from HCL Technologies. Aggarwal saw the potential but also recognized the core issue:

Ramco was great at building products but terrible at selling them. The user interface was outdated, the brand wasn’t known outside of India, and the sales team lacked global muscle.

So Aggarwal made some bold moves.

He cut back on low-margin IT services work, shifted the entire company to a product-first model, and invested in usability, mobile interfaces, and even AI features. This was years before these trends became mainstream in enterprise tech.

It worked. But only for a while.

Between 2013 and 2016, Ramco swung from losses to profits. Revenue grew 40% in FY2015. The company landed big-name clients in the Middle East, Southeast Asia, and even North America. They were featured in Gartner’s Magic Quadrants for three of their products: ERP, Human Capital Management (HCM), and Enterprise Asset Management (EAM).

Source: Screener

It seemed like Ramco had cracked the code.

But soon, ambition outpaced execution.

Chapter 3: Overreach: Running Before Walking

Flush with optimism, Ramco went global. Fast.

They opened offices across 24 countries, from Vietnam to China to Dubai to the U.S. They expanded product lines. They hired more engineers. Their R&D spend ballooned to over 25% of revenue, far higher than most software companies.

But there was one problem: Sales didn’t keep up.

For all its technical brilliance, Ramco still couldn’t build a world-class sales engine. Revenue flatlined. Cash flow became tight. Their cost structure, built for a fast-growing global SaaS business, became a burden.

Even worse, they were trying to do too many things: ERP for manufacturers, aviation software for airlines, HR for multinationals, logistics systems for warehouses, and more.

By 2018, the fatigue was showing. Revenue growth slowed. Margins shrank. Profits were tiny and not consistent.

Source: Screener

When COVID-19 hit in 2020, it hit Ramco hard.

Chapter 4: The Fall: When It All Came Crashing

COVID was devastating for enterprise software companies, but it was especially brutal for Ramco.

Their biggest vertical, aviation software, saw revenues evaporate as airlines grounded fleets and postponed IT spending. Implementation delays, client attrition, and rising costs piled up. At one point, Ramco’s order bookings fell by over 40%, leaving the pipeline dangerously thin.

The company posted a loss of ₹206.8 crore in FY23, followed by another ₹241.9 crore loss in FY24.

That’s nearly ₹450 crore of losses in two years.

The balance sheet took a beating. Receivables shot up. The cash buffer they had from a prior rights issue was almost fully used up.

Source: Screener

In 2021, CEO Virender Aggarwal stepped down after nearly a decade at the helm. Ramco didn’t immediately appoint a replacement. For a while, the company was run by an interim group of senior leaders, including the promoter’s son, P.V. Abhinav Ramasubramaniam Raja, who had quietly been involved since 2017 as a Whole-Time Director.

It was a turbulent, uncertain time.

The once-promising product company had become a turnaround candidate again.

Chapter 5: The Rebuild: A New CEO, A New Hope

In July 2023, Ramco finally brought in a new CEO: Sundar Subramanian, a senior IT executive with deep experience in operations and transformation.

Sundar was not a flashy hire. But he was what Ramco needed. A calm operator focused on execution.

His playbook was simple:

Cut the fat.

Focus on core products.

Modernize the tech stack.

Improve collections.

Rebuild customer trust.

And it worked.

In FY24–25, Ramco’s revenue grew 12.5%—their first meaningful growth in years. More importantly, their operating loss shrank from ₹229 crore to just ₹27 crore. In Q4 FY25, they posted a net profit of ₹5.3 crore—the first in a long time.

Cash flow improved. Receivables came down. Unbilled revenue dropped. Employee costs were rationalized. Sundar had steadied the ship.

But then came a twist.

Chapter 6: Enter the Next Generation: Abhinav Raja Steps In

In November 2024, Ramco Systems made a surprising announcement.

Sundar Subramanian would step down as CEO, and the board had decided to elevate P.V. Abhinav Raja as Managing Director, effective January 2025.

Abhinav, the 30-something son of Ramco Group chairman P.R. Venketrama Raja, had been involved with Ramco Systems since 2017. He also ran Ramco Industries Ltd as its Managing Director since 2017 and co-founded Lynk, a B2B logistics platform, later acquired by Swiggy in 2023.

But now, he was being handed the reins of the group’s most complex and troubled company.

Was he ready?

Chapter 7: Who is Abhinav Raja?

Abhinav is not your average promoter’s son.

He graduated with a degree in Industrial Engineering from Northwestern University. He interned at Enam Holdings and Ramco Cements before returning to India.

At just 23, he was appointed MD of Ramco Industries, a manufacturing company in the group. There, he was reappointed after five years with positive feedback from independent directors.

But perhaps his biggest achievement was Lynk, a tech startup he co-founded that built a digital B2B commerce and logistics platform for Kirana stores. It served over 150,000 retailers and was eventually sold to Swiggy.

That experience of building a tech product from scratch, scaling it, and exiting gives Abhinav something most second-generation leaders lack: real entrepreneurial battle scars.

And he wasn’t just a board member at Ramco Systems. He served as a Whole-Time Director, actively involved in strategic planning and operations since 2017. When there was no CEO, he was one of the people steering the company.

Even after taking charge in 2025, his remuneration remained modest—just ₹17.7 lakhs per year, compared to ₹6.4 crore paid to the outgoing CEO. That tells you something about his approach: frugal, grounded, and focused on long-term value.

Source: FY25 Annual Report

But the real test lies ahead.

Chapter 8: The Financials: Cleaning Up the Mess

Let’s talk numbers.

1. Revenue and Profitability:

FY23: ₹492 crore revenue, ₹-207 crore net loss

FY24: ₹526 crore revenue, ₹-242 crore net loss

FY25 ₹591 crore revenue, ₹-34 crore net loss

The trend is encouraging: revenue is growing (albeit slowly), and losses are shrinking.

2. Cost Cutting:

In FY24, the company spent over ₹679 crore on operating expenses.

In FY25, that number dropped to ₹514 crore.

That’s largely driven by:

Lower employee expenses (rationalization)

Less R&D overspending

Streamlined sales and marketing

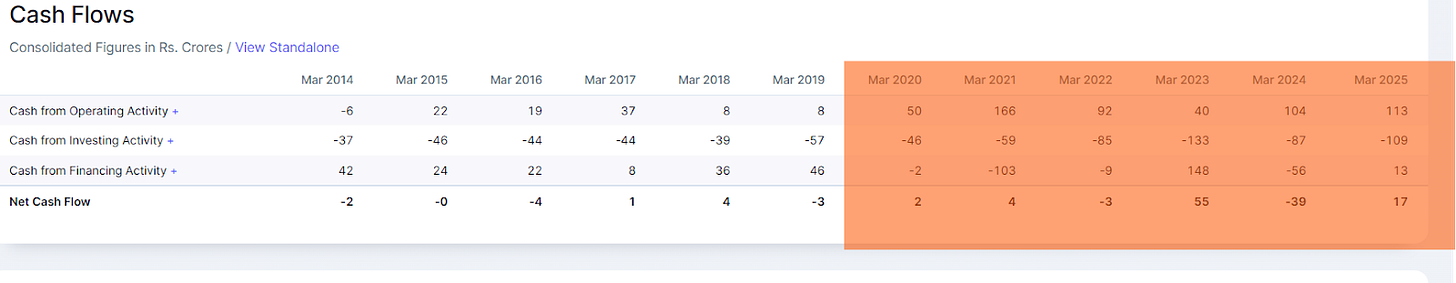

3. Cash Flow & Working Capital:

The company had high receivables but has brought them down by improving collections.

No major inventory (being a software company).

Chapter 9: The Real Question – Who Will Buy from Ramco?

This is the elephant in the room.

Even if Ramco fixes its products and financials, who will buy an ERP system or global payroll software from a relatively unknown Indian company?

The answer lies in specialization.

Ramco has stopped trying to be everything to everyone. Instead, it focuses on three niches where it has a fighting chance:

1. Aviation MRO (Maintenance Software):

Used by 7 of the top 10 global helicopter operators.

Clients include Indamer Technics, Malaysia Airlines, and even the U.S. Navy.

New version (Aviation 6.0) launched in FY25 with AI-driven features.

Let us understand this with a recent case study.

How Philippine Airlines Took Off Digitally—One Jet at a Time

In the world of aviation, keeping planes in the sky isn't just about flying, it’s about managing what happens on the ground. For Philippine Airlines (PAL), especially its regional division, PAL Express (PALEx), it was becoming increasingly difficult.

Their planes flew just fine. But their operations? Not so smooth.

Behind the scenes, PALEx was tangled in complexity. Multiple AOCs (Air Operator Certificates), various AMOs (Approved Maintenance Organizations), and a patchwork of legacy systems made it tough to run a tight ship.

Every maintenance update, every parts replacement, every log entry it all passed through different systems, teams, and processes. The result? No centralized control. Slow decisions. Limited visibility. And that meant lost time, grounded planes, and mounting inefficiencies.

PALEx realized something crucial: if they wanted to be future-ready, they couldn’t keep flying with systems from the past.

That’s where Ramco Systems stepped in, not just with software, but with a vision.

They didn’t offer just another IT solution. They brought in a cloud-based, next-gen Aviation Suite, a platform designed specifically to manage the intricate, moving parts of an airline’s operations.

From Engineering and CAMO (Continuing Airworthiness Management) to Maintenance Planning, Supply Chain, Quality Control, Component and Hangar Maintenance, and even Finance, Ramco’s solution covers the entire fleet lifecycle.

But the real magic? Mobility. Real-time visibility. Centralized control. Suddenly, PALEx had its cockpit for operations.

Once the platform went live, the change was palpable.

Technical records were digitized.

Operational planning became sharper.

Resource utilization improved.

Frontline teams used mobile apps to manage tasks in real-time, from hangars to terminals.

What used to be delayed or disconnected now flowed through a single, configurable, data-driven system. Decisions became faster. Processes turned smarter. PALEx wasn’t just running smoother—they were flying higher.

And they weren’t stopping there. Ramco’s system worked so well for PALEx that PAL is now looking to extend it to their mainline fleet, too.

2. Global Payroll & HR:

Serves 50+ countries with localized compliance.

Clients include Standard Chartered, a Big 4 firm, and large Indian conglomerates.

The new platform “Ramco Payce” was launched in 2024.

How Hitachi Energy Rewired Its Global Payroll in Record Time

When Hitachi Energy carved out of ABB, it inherited a world of challenges, especially in managing payroll across its sprawling operations.

They had 20 countries to cover—across Southeast Asia, the Middle East, and Africa—and very little time to do it. With legacy systems from ABB, a complete overhaul was required: new platforms, full compliance with local laws, and zero room for payroll errors.

The pressure was on. The stakes were high. And the timelines were tight.

Ramco stepped in with its cloud-based global payroll platform, built with native compliance engines tailored for each country’s laws and norms.

In one seamless move, 20 different country operations were brought under a single system. Integrations with Workday HCM, ADP eTime, and SAP S4 HANA ensured that data moved smoothly. A Center of Excellence was created to manage governance, long-term scalability, and region-specific compliance support.

What could’ve been chaos turned into coordinated execution.

Zero payroll failures. Zero compliance breaches.

Harmonized payroll across 20 countries.

Improved efficiency, transparency, and accuracy.

Built-in M&A readiness and future expansion capability.

And now, Hitachi Energy is scaling further, expanding the Ramco model to more regions, thanks to its repeatable design and statutory robustness.

In short, Ramco didn’t just help Hitachi Energy run payroll. It helped them build a resilient, future-ready backbone for global HR operations, all while keeping employees paid and compliant from Nairobi to New Delhi.

3. Logistics & Mid-Market ERP:

Winning deals in India, the Middle East, and Southeast Asia.

Focused on project-based businesses and cost-conscious enterprises.

These are niches where Ramco doesn’t face SAP or Oracle head-on. Instead, it offers better localization, faster deployment, and lower cost.

How Freight Specialists Found Control in the Chaos

For Freight Specialists, a well-known distribution and warehousing provider in Australia and New Zealand, success had always meant staying ahead of customer expectations. But as service demands grew and new regions opened up, so did the cracks in their systems.

Multiple disconnected platforms. Manual workflows. Billing delays. Real-time insights? Practically non-existent.

It wasn’t just a tech issue—it was a customer experience risk. And for a logistics company, that’s a deal breaker.

Ramco stepped in with a solution built for scale and complexity, a cloud-based Logistics ERP platform designed specifically for freight service providers.

This wasn’t a patchwork fix. Ramco replaced fragmented systems with a unified digital backbone, covering:

Transportation & Warehouse Management

Contract & Invoice Management

Finance & Accounting

Real-time data access. Mobility for ground teams. Analytics that helped decisions. The transformation wasn’t just technical; it was cultural.

With Ramco in place, Freight Specialists:

Gained full control over transport and warehouse operations

Improved billing accuracy and turnaround times

Empowered teams in the field with mobile-first access

Reduced manual errors and silos

And, most importantly, became a modern, tech-enabled logistics partner ready to scale with evolving needs

What began as a struggle with visibility turned into a strength. Freight Specialists is now delivering not just goods, but confidence, powered by a platform that moves as fast as their trucks.

Source for all three case studies above: FY25 Annual Report

Yes, it’s still hard to sell to Fortune 100 clients. But Ramco has over 1,000 global clients, including Dabur, Swatch, Panasonic, Honeywell, and others.

So yes, some people do buy from Ramco. And more will, if execution improves.

Chapter 10: What Lies Ahead

Abhinav Raja has a tough but exciting road ahead.

Ramco has cleaned up its books. It has launched modern products. It has refocused its sales engine. The bleeding has stopped.

Now comes the real challenge: sustainable growth.

That means:

Growing sales 15–20% year-on-year.

Keeping costs in check.

Monetizing past R&D investments.

Building a high-trust sales channel.

Convincing new customers to take a chance on a reinvigorated Ramco.

The next two years will determine whether this is a short-lived bounce or the start of a true rebirth.

Epilogue: The Verdict

Ramco Systems is not out of the woods. Not yet.

The company has done the hard things:

Admitted its mistakes.

Changed leadership.

Cut unnecessary costs.

Focused on what it does best.

In Abhinav Raja, Ramco has a young, smart, battle-tested leader who understands both technology and business.

Time will tell if the turnaround is real and lasting. But one thing is certain:

This is not the Ramco of yesterday. And that, in itself, is a promising start.

But for the first time in a while, it’s probably facing the right direction.

I presented on Ramco Systems in November 2024 here.

From then till now, the direction has been promising.

I started this blog with the focus on time.

I want to end this blog with a focus on direction. And I will take the help of my friend, Vikas Kasturi, who has explained it eloquently, so I don’t want to change even a word from that.

In Physics (and/ or Math), we learnt the concept of Scalar and Vector. A scalar only has magnitude. A vector has magnitude and direction.

Speed is a scalar because it tells you how fast you are going. Vector tells you how fast and, more importantly, in what direction you are going.

Therefore, direction is most important; fast or slow is secondary.

—

What are these businesses and “right” direction?

When a company starts to move in the right direction, there are a few noticeable improvements. It’s sales and profits start growing faster, it’s cash flows improve, it’s debt reduces, it has higher margins and higher profits, it becomes more efficient at deploying capital as measured through working capital days, ROCE, ROE etc.

Momentum = Mass X Velocity.

Momentum simply means that you are likely to continue doing what you have been doing. If you have the right direction and right speed, you likely have the right kind of momentum.

You may like to read the full blog here.

I believe Ramco Systems is in the right direction. It is probably gaining some momentum, too.

Are you watching closely?

Disclosures: No holdings. No recommendations.

Thanks for reading!

I had a few questions

1. Is recording all employees and consultancy expenses as R&D expense is right? Can you explain why it is so?

2. Why did the company have such a large provision in the last 5 years? Is it only a sales problem?

Great write-up. If they grow 13-14% in the next 4 years and do a peak NPM of 9%, then also an EPS of 18 and a PE of 22-23 will fetch us a 400-450 kind of price. I know everyone has different mechanisms for valuing a company. Just putting out my thesis, nevertheless a great write-up.