Survive To Thrive

In constructing a portfolio, always optimize for survival, not for rationality

“Survive To Thrive” is my favourite phrase. This is the 6th blog post I am writing with the same title. The first 5 blogs on the same title are shared below, along with the year of publishing, and a quick summary.

By avoiding debt, sticking to your expertise, valuing business properly, and staying patient through market volatility, you give compounding the time it needs to grow your wealth over a long horizon. Don’t Quit. Survive. Survive to Thrive.

Thriving isn’t just about enduring tough times; it’s about combining survival with purposeful growth, fostering resilience, and actively seeking opportunities for development beyond mere survival.

Take a systematic, long‑term approach to investing by: 1) regularly investing (e.g., via SIP) in fundamentally growing businesses, 2) tracking their performance, and 3) trimming underperformers instead of obsessing over valuation. This simple three‑step process may be all you need rather than hiring a professional.

I draw a parallel between Navy SEALs’ “drown-proofing,” a brutal test of emotional and physical endurance, and an investor’s ability to withstand severe market drawdowns, emphasizing that survival through panic-inducing losses is more critical than conventional know-how. Ultimately, the key lesson is that in both extreme stress for SEALs and investors alike, "surrendering" to forces beyond your control, i.e., remaining calm and refraining from rash decisions, can prove wiser than futile resistance.

Consistent, above-average performance over decades and avoiding short-term temptations leads to success. Drawing parallels from Rahul Dravid’s enduring cricket career and Siddhartha’s patience and self-control, one core message to zero down: survive long enough, and you’re far more likely to thrive

Also, my friend, Vikas Kasturi, allowed me to write the 100th blog post on his website. Here I elaborated on the three main principles of my investing:

Don’t Predict Prepare

Do Few Things, Do Them Well

Consistency> Intensity

Enough of gyaan on my investing philosophy and style. I guess, the famous author and philosopher, Nassim Nicholas Taleb, said the following to shut me up:

“Don’t tell me what you think, tell me what you have in your portfolio.”

So let me shut up on my philosophies and come straight to the portfolio.

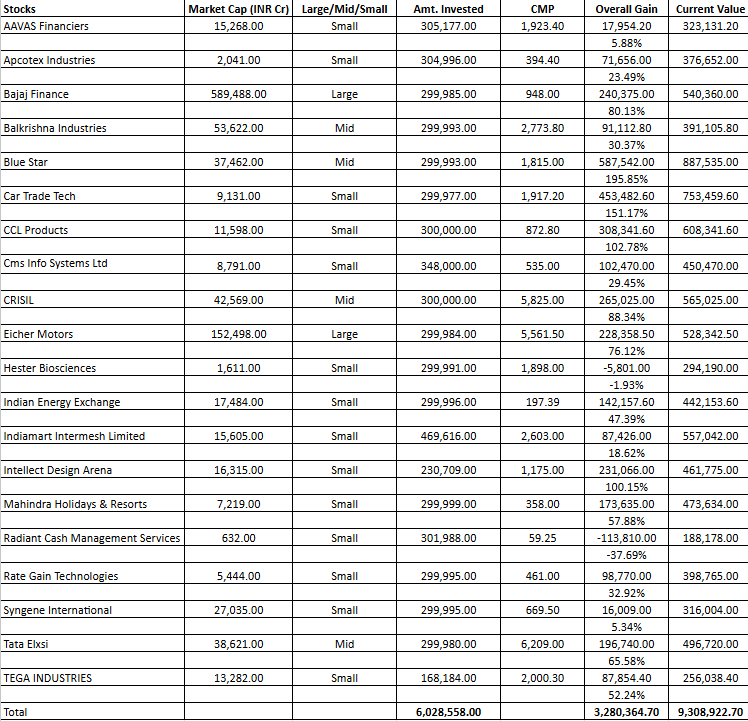

This is the Stock SIP Portfolio. I started this on 01.08.2020. And this month it will complete 5 years.

If you have been following me, you would have noticed that, except, Bajaj Finance, Blue Star, CRSIL, Syngene, and Tata Elxsi, which are fairly large businesses and known to all, I have either written or spoken publicly about all the other holdings of my portfolio. So, 15 out of 20 stocks, openly shared. An open book. That’s what I call my investing portfolio.

Source: Zen Investing Club WhatsApp Group

But the above holding sheet does not truly portray what an SIP portfolio looks like. Let me share more context.

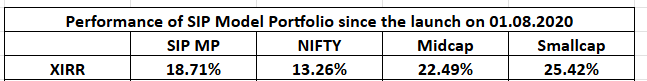

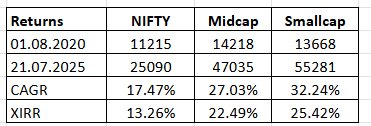

Rather than absolute return or return%, one should look at XIRR in the case of an SIP portfolio. And not just that, one should compare it with the XIRR of different indices. So here is the data.

So, I outperformed NIFTY50, but underperformed Midcap and Smallcap indices. And I am not going to give you any excuse as to why I underperformed the small and the midcap indices. This is the plain truth. I observe it and accept it.

However, I have found it difficult to explain it to my friends how an 18.71% XIRR over the last 5 years is completely different from a CAGR of 18.71% in the last 5 years. I will come to it in a bit.

Let me first share with you how SIP investing happens.

Every month for the last 60 months [5 years], you invested a fixed sum at the start of the month in 20 stocks, equal-weighted. Remember the three principles?

Don’t Predict, Prepare [Don’t predict crash or boom. Be prepared by not putting everything in one go.]

Do Few Things Do Them Well [Focus on your circle of competence, 20 stocks]

Consistency> Intensity [In all weathers, just keep buying]

Now that you have some sense of how a Stock SIP Portfolio works, let me get back to explain the XIRR Vs CAGR thing.

Whenever I say to any friend that XIRR and CAGR are not the same, he thinks only from a mathematical point of view and nods his head that he knows. But with all due respect to him, he doesn’t.

Let me explain.

No. I am not going to explain the formulas. You can ask ChatGPT if you don’t know yet. I am going to explain how an 18.71% XIRR over the last 5 years is completely different from a CAGR of 18.71% in the last 5 years. In August 2020, because of the sheer undervaluation of the broader market, whatever you would have bought and held till now would have given you decent returns.

I am just sharing the CAGR returns vs XIRR returns of three indices to make things clear for you.

A seemingly rational, mathematical, but also a monkey mind, will jump at it and say:

“See, CAGR trumps XIRR in this.”

That’s my main problem with everyone who only looks at one aspect and comes to a conclusion that SIP is not efficient. That’s 100% incorrect.

Why do we invest?

If I cut the gyaan, and come to the real reason, it is to multiply or grow our networth. Right?

How do you do that?

By earning, saving, and investing the rest.

Did you earn, save, and invest only until August 2020?

No, Right?

What about the earnings, savings, and investment after that?

You invested the incremental savings in the market after August 2020 as well. Right?

So, the learning is that you do not invest once and forget it. It is a continuous process.

A portfolio XIRR of 18.71% generated through monthly SIP investments over the last 5 years is far superior to a CAGR of 20% achieved by investing one-time in Aug 2020. There were times like September 2021, September 2022, and September 2024, when the market made intermittent tops and remained either sideways or downward sloping for months.

By doing SIP every month, you manage to invest regularly through ups and downs. There is no doubt that doing SIP through Mutual Funds is far more convenient, affordable, and tax-efficient.

However, let me share a rough idea about the tax you would have to pay if you were investing in SIP through this model.

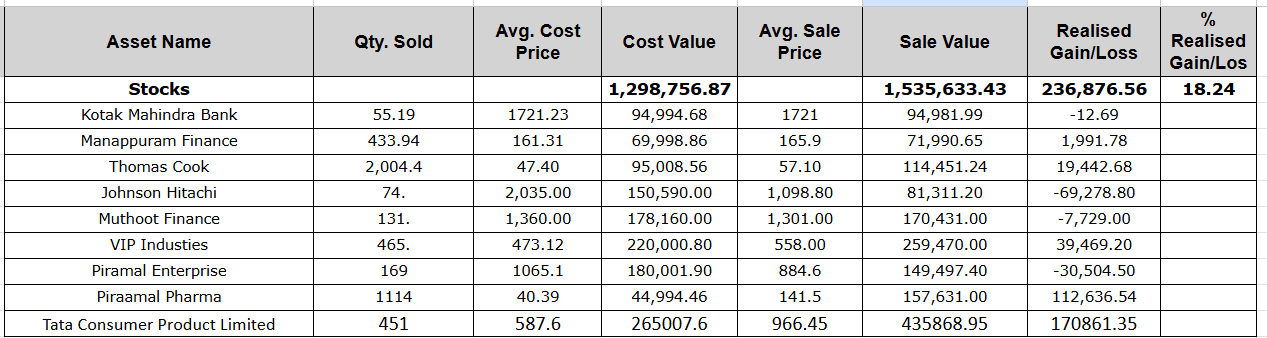

Out of the original 20 SIP stocks, 5 years later, today, 13 stocks are still the same. Let me share the details of all the changes.

In the last 5 years, if you had invested INR 1 lac every month in this Stock SIP portfolio, you would have invested INR 60 lacs. The current value of your investments would have been INR 95 lacs, thereby helping you generate roughly 35 lacs. The realized gain on the same would have been just 2.5 lacs. And even here, the majority of the gain happened in FY24 and FY25 when Piramal Pharma and Tata Consumer Products were sold respectively. So, net net, insignificant tax to be paid.

And, the above returns do not take into account the dividends you would have made over the years on all your long-term investments.

So, what do you say now?

Have a look at the portfolio stocks again and try to observe.

Let me give you a clue on the observation you need to make. It’s not what you see. It’s what you don’t see.

Ok. I guess some of you would have noticed, but for the benefit of all, let me reveal.

In the above portfolio, there are:

No defence stocks

No railway stocks

No PSU stocks

No construction stocks

No real estate stocks

No infrastructure stocks

No deep-cyclical stocks

This was a clear rule I decided for myself when I started this stock SIP portfolio. In cyclical businesses, you cannot do an SIP. As there, your entry point and exit point matter a lot. If you cannot time the entry and exit, the whole purpose is defeated.

You may think, “What a silly little bugger”. Missed out on such a big rally.

Yes, I missed out on the cyclical rally. I won’t justify anything.

This is again a truth that I observe and accept.

Another truth that I also observe is the insane amount of money new or old market participants are losing in high-frequency trading and futures and options. SEBI shares a detailed analysis every year.

Morgan Housel puts it well here:

But reading SEBI’s reports of the last few years on how much money people have lost trading in the market, that too when India was witnessing one of the best bull markets in its history, I believe that an 18.71% XIRR already puts me into probably the top 5-10%.

Why do I need to try harder?

Whatever I shared until now has been strictly focused on the investing side of things. Let me end my note with something beyond investing.

I started this stock SIP portfolio in 2020, because I realised a few things about myself:

I can hold on to businesses for the long term. More than a decade, if required. [Two of my stocks have been in my portfolio since 2013.]

I hate looking at the screen.

I disabled CNBC and ETNow from my TV plan in 2014

I love building an investing community and sharing my learnings, hits, and misses.

I love reading books. Not necessarily investing books

I love writing. Not just about markets.

I love thinking. Not just about markets.

I love spending time with my family.

I love going for vacations.

I love talking nonsense endlessly with sensible friends.

How will I do this if I keep staring at the screen all the time or keep thinking about the market all the time? The SIP portfolio helps me follow a seemingly dumb process with a satisfactory outcome.

And on the side, it helps me enjoy a happy and peaceful life.

The smart and the intelligent will oppose this. A rational mind will poke holes in the thesis.

And to be fair with the rationalists, yeah, that is what is taught in behavioural finance.

But if you take my word, the need for survival and longevity trumps rationality hands down.

Thank you for reading.

P.S.

Being a boot-strapped founder ever since I graduated, and a recent transition from one organization to another, I have not been able to invest every month in my own stock SIP portfolio because of the unavailability of spare funds. The above is a model portfolio.

SEBI doesn’t allow you to show performance and onboard clients. But let me clarify that I do not have any portfolio advisory clients at the moment. And given our focus on the microcap space (less than 3000 Cr) in Zen Nivesh, when we launch our Zen Nivesh stock SIP portfolio, it will not have the same constituents as this one.

All stocks less than 3000 Cr is a challenge, Vasanth. We are working on it. Not in a hurry to launch anything which is not properly thought out. Will keep you posted.

What would keep you going with SIPs in specific stocks when they would be sharing poor results quarter after quarter? Don’t you think SIPping is as counter effective as BUY & Hold ? Thoughts please.