Last month, I wrote about an NBFC that is a secured MSME lender, utilizing technology efficiently to chart its story. In case you missed it, you may read about it here. Today, I am writing again about a similar business.

What’s the difference?

Of many, the one that stands out is this.

SBFC Finance, which I covered last month, is an INR 13,000 Cr market cap company.

Purple Finance, which I will cover today, is a tiny microcap company of just INR 200 Cr market cap.

At the cost of repetition, I will start with the same exact points with which I started the SBFC blog post. But with a minor twist. Read on!

“Lending is a strange business. Unlike any other business, here, the money leaves the company when a sale is made. And that’s the easy part. The tough part is to bring it back on time and with sufficient profit.

Whenever a lending transaction takes place, one guy walks away with money, and the other walks away with a promise. A promise that the money, which has been lent, will be utilized wisely and returned with interest to the lender appropriately.

But does that always happen?

No!

That’s why we need bankers or lenders who can distinguish between the good and the bad borrower and lend wisely. And this is hard. And that is why we have very few names in India whom investors can trust for their ability to lend wisely.

A few names that we all know are:

HT Parekh & Deepak Parekh of HDFC Ltd

Aditya Puri of HDFC Bank

Uday Kotak of Kotak Mahindra Bank

Rajeev Jain of Bajaj Finance”

Do you see a common theme here?

All quality lenders focus on understanding one type of loan or asset first before moving to another type.

HDFC Ltd first focused on housing finance only

HDFC Bank first focused on the retail loans only

Bajaj Finance first focused on consumer durable loans only

Shriram Transport Finance first focused on CV financing only

Muthoot Finance first focused on the Gold loan only.

I have respect and admiration for all the lenders of the above kind who start with one type of asset first. Become a master of it. And then slowly move to other types. Watch this 2-minute clip, which very simply conveys what I want to tell you.

The wise and experienced uncle tells this to the young boy who is lost:

"तुम जो भी करो, अच्छा करो। अगर वैज्ञानिक बनो तो अच्छे वैज्ञानिक बनो। अगर घास काटने वाले बनो तो अच्छे घास काटने वाले बनो। वरना क्या फ़ायदा?"

If you do not understand Hindi, here is the English-translated version of that great advice from the old wise man.

“Whatever you do, do it well. If you become a scientist, be a good scientist. If you become a grass-cutter, be a good grass-cutter. Otherwise, what’s the point?”

SBFC has also shown similar traits with a razor-sharp focus on the secured MSME loans first, becoming a master in its field, and then adding something new, like a gold loan. It is too early to say the same for Purple Finance, when the company has barely walked on Earth. However, in their annual reports, corporate presentation, and management commentary, they do want to position themselves as “a single secured product-lender focused only on smaller tier II to tier IV markets”.

This single-product and smaller geography focus was the second reason that motivated me to deep-dive into the business. The first reason was, of course, when I saw a 200-Cr tiny microcap business come out with a detailed Annual Report and elaborate corporate presentation, I knew the least I could do was study it in detail.

In an insanely difficult business like lending, I don’t like lenders who have not been able to create anything meaningful in any one type of asset and start chasing several other types of assets. You can guess my dislike for IDFC First Bank and Piramal Finance from this.

Anyway, this blog is not about my view on different lending businesses. It is a deep dive into this tiny microcap business, Purple Finance.

Let’s get started.

Prologue: When Giants Fall and Minnows Rise

In the busy financial world of Mumbai, where fortunes change every minute, an unusual story was taking shape in 2022. While big companies grabbed headlines and investors hunted for the next startup success, a small and nearly forgotten company called Purple Finance Limited was quietly working on something different. But let me take you a little further back into their origins.

The Genesis: From Dormancy to Destiny

The year was 1993. India was just beginning to embrace economic liberalization, and in Mumbai, a company called Devipura Balaji Securities & Investments Private Limited was born. For nearly three decades, this entity existed in relative obscurity, occasionally dabbling in financial services but never quite finding its true calling. It was the financial equivalent of a sleeping giant, present but not powerful, existing but not excelling.

Then came April 2022, a date that would forever change the trajectory of what we now know as Purple Finance Limited. Purple Finance was not a listed company in April 2022. But it all changed in two years. And I am not talking about the traditional IPO route.

The Reverse Merger Masterstroke

When Conventional Wisdom Meets Unconventional Strategy

March 2024 marked one of the most significant chapters in Purple Finance's journey: the completion of its reverse merger with Canopy Finance Limited.

The Canopy Connection: A Shell with a Story

Canopy Finance Limited was incorporated in 1981 as Kanisk Udyog Viniyog Limited. It had undergone multiple name changes before settling on Canopy Finance Limited in 2016. With its RBI NBFC registration obtained in 2017, Canopy was the perfect vehicle, a clean, listed shell with all the regulatory approvals but minimal operational baggage for Purple Finance.

The Execution: Precision Under Pressure

The reverse merger process began in April 2022 with board approvals and culminated in March 2024 with NCLT's final sanction. RBI NOC in January 2023, NCLT orders in October 2023, shareholder approvals in November 2023, and finally the NCLT approval in February 2024 paved the way for the reverse merger.

The result? Purple Finance emerged as a listed entity without the time, cost, and market dependency of a traditional IPO. The merger increased Purple's share capital from ₹23.02 crore to ₹33.61 crore. It also set the base for Purple Finance to go for future fundraising, which I will cover later.

Connect the Dots: Important Timelines

I will take a short detour from Purple Finance here to explain to you a little bit about Reverse Mergers, as I believe it is something important and many new investors are not fully aware of its structure.

Why some Companies prefer Reverse Mergers over Traditional IPO

What Is a Reverse Merger?

A reverse merger is a corporate maneuver where a private company becomes public by merging with an existing listed company, often a dormant or minimally active “shell” entity. Instead of going through the traditional IPO (Initial Public Offering) route, the private business essentially “absorbs” the listed company, taking over its public status and regulatory approvals.

Why Do Businesses Prefer Reverse Mergers?

The allure of reverse mergers lies in their speed, cost-effectiveness, and flexibility. For many ambitious businesses, especially those in fast-moving sectors or with urgent capital needs, the traditional IPO route can feel like running a marathon in slow motion. In contrast, a reverse merger can be completed in as little as 9–12 months (sometimes even faster for smaller entities), often at a fraction of the cost and with less dependency on bullish market sentiment.

The Step-by-Step Process

Identification of a Suitable Shell: The private company scouts for a listed entity, often one with a clean regulatory record but minimal business activity.

Drafting the Merger Scheme: Legal teams prepare a detailed scheme of amalgamation, outlining how the merger will occur and how shares will be exchanged.

Board and Shareholder Approvals: Both companies’ boards and shareholders must approve the merger plan.

Regulatory Filings and Approvals: The scheme is filed with the NCLT, SEBI, and, where relevant, the RBI. This stage includes public notices and opportunities for creditors or other stakeholders to object.

NCLT Sanction: After reviewing the scheme and any objections, the NCLT gives its final approval.

Implementation: The merger becomes effective, shares are exchanged, and the private company’s management takes operational control of the listed entity.

Rebranding and Compliance: The new entity may be renamed, and must comply with all ongoing listing and disclosure requirements as a public company.

Advantages of Reverse Mergers

Speed and Efficiency

Lower Costs

Market Independence

Retained Control

Instant Access to Capital Markets

Enhanced Credibility

Risks and Pitfalls to Watch Out For

Due Diligence Hazards: The shell company may harbor hidden liabilities, legal issues, or compliance lapses that become the new entity’s problem.

No Guaranteed Capital: Unlike an IPO, a reverse merger itself doesn’t raise fresh funds; it simply provides a platform for future fundraising.

Regulatory Scrutiny: The merged entity must meet all the compliance and disclosure norms of a listed company, which can be resource-intensive.

Market Skepticism: Investors and analysts may be wary of reverse mergers, sometimes perceiving them as shortcuts or attempts to bypass rigorous scrutiny.

Integration Challenges: Merging two corporate cultures, systems, and stakeholder groups can be complex and risky.

Potential for Illiquidity: If the new entity fails to attract investor interest, its shares may remain thinly traded and volatile.

Why It Matters for Investors

Reverse mergers are not a magic bullet, but they are a legitimate, often smart alternative for companies with the right vision and discipline. For investors, they offer early access to emerging businesses that might otherwise remain private for years. However, the usual caveats apply: do your homework, scrutinize the management and financials, and be mindful of the unique risks that come with this route. In a market as dynamic as India’s, reverse mergers are likely to remain a favored play for ambitious founders and savvy investors alike, provided everyone keeps their eyes and ears open.

Now that you have some idea about reverse mergers, you may now have a glance at the merger timelines of Purple Finance and Canopy Finance

Merger Timelines of Purple Finance and Canopy Finance

Did you notice one thing?

We have covered a lot of ground already, but you still don’t know what exactly Purple Finance does. So, let’s not waste any more time and dive deep into the business of Purple Finance.

MSMEs: The Market Others Fear to Tread

Purple Finance claims to be a digitally enabled secured lender for MSMEs in India. While India's large NBFCs and banks were busy competing for the same prime customers in metro cities, Purple Finance made a contrarian bet that would define their entire strategy: they would go where others feared to tread, the Tier II, III, and IV cities of India.

Let’s peel the onion. Bit by bit.

Who is their target customer?

Their target customer is a micro-enterprise with an annual turnover of not more than 40 lacs.

What are their preferred sectors or industry segments?

Purple Finance claims that they are sector-agnostic. Manufacturers, traders, wholesalers, and service providers of each and every sector/industry can avail loans from Purple Finance.

But you can’t take a loan for just anything. Even if it is a secured loan, it has to be for purposes that work well with Purple Finance.

What are the key purposes for which the loan can be sanctioned?

Business expansion

Asset Purchase

Construction/renovation of business/residential premises

Working capital requirement

Purple Finance positions itself very strongly as just a one-product company: tech-enabled loans against properties for MSMEs. Nothing less. Nothing more.

Product features: The product has the following features-

Loan up to Rs. 30 Lakh

ROI 19% to 23%

Door to door

Tenor of up to 10 years

Flexible repayment schedule

Can be availed by First Time Borrowers

Cash flow-based assessment

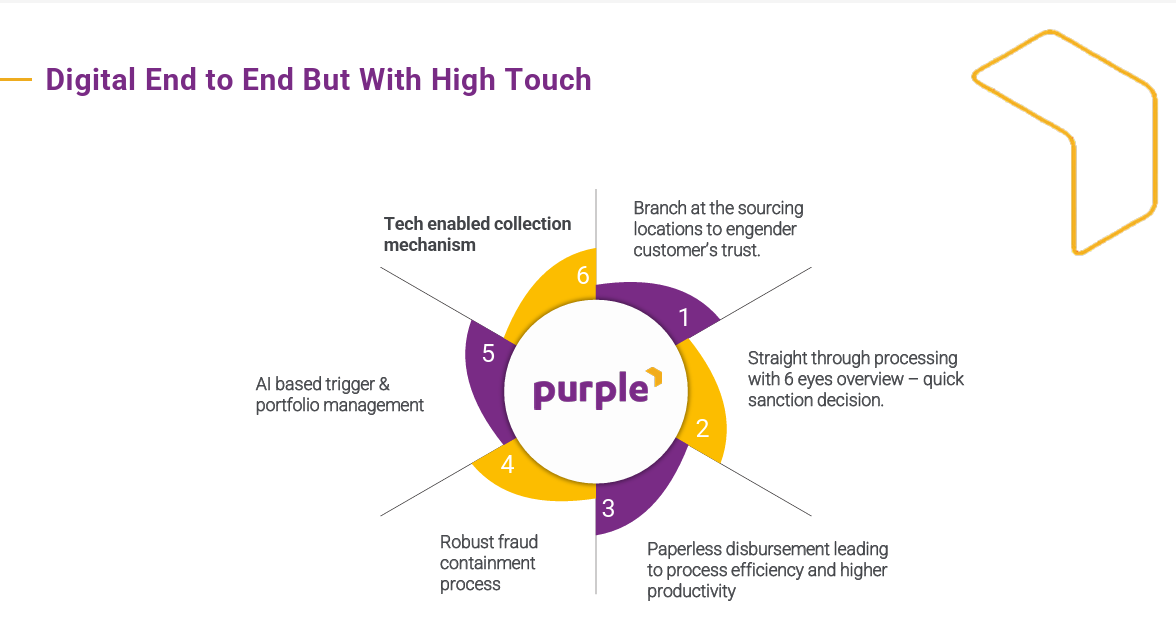

Now comes the time for understanding their execution strategy. Here we go.

3 Key Pillars of Purple Execution

Differentiated strategy to enter the market and operate

Single secured product & focused on smaller markets

360-degree customer engagement program

Adopting a high-tech, high-touch strategy

Tech-as-an-enabler for lean and agile operations

Clear go /no go decision in < 5 hours

Uberization of the customer journey

Customer interface in vernacular

Strong risk & governance for sustainability and profitability

High-caliber board

Strong risk & governance as culture

AI-based underwriting & early warning process

Source: Latest Presentation

A glimpse of the Customer Profile

Source: Latest Presentation

Board of Directors, Leadership Team & Current Presence

Source: Latest Presentation

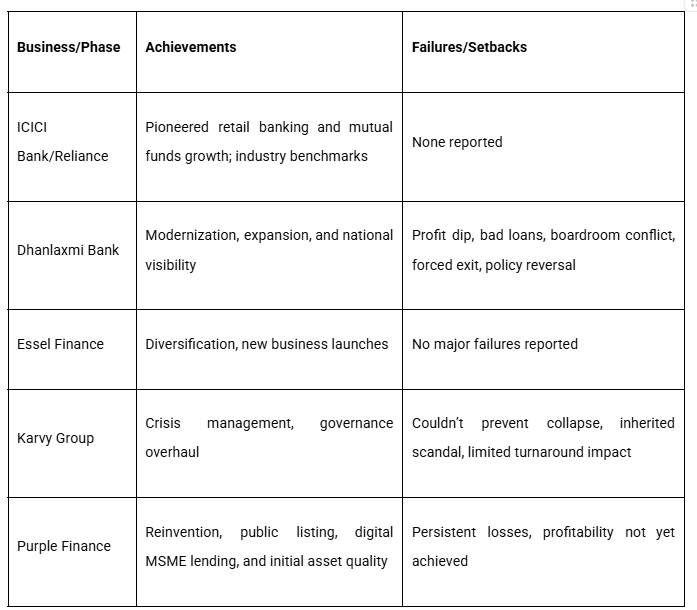

A Background check on Amitabh Chaturvedi, the Chairman, his achievements, failures, or setbacks.

So far, so good. Now let’s move our eyes for some time to the ugly part.

Remember, I told you that Purple Finance came to the stock exchange not through the traditional IPO route but through a reverse demerger. And what about funds or fuel for the future?

Purple Finance raised approximately ₹85 crores in 2024-25. Some more details here:

Rights Issue 2024 - Phase I

Issue Size: ₹44.82 crores through 11,204,985 equity shares

Issue Price: ₹40 per share

Entitlement: 1:3 (one rights share for every three existing shares)

Timeline: October 4-11, 2024

Outcome: Oversubscribed 1.5 times, indicating strong investor confidence

Rights Issue 2025 - Phase II

Issue Size: ₹40.34 crores through 96,04,273 equity shares

Issue Price: ₹42 per share

Entitlement: 3:14 (three rights shares for every fourteen existing shares)

Timeline: June 2-10, 2025

Current status: Completed with allotment on June 18, 2025

Rights issues are not just about capital infusion. It is also about dilution.

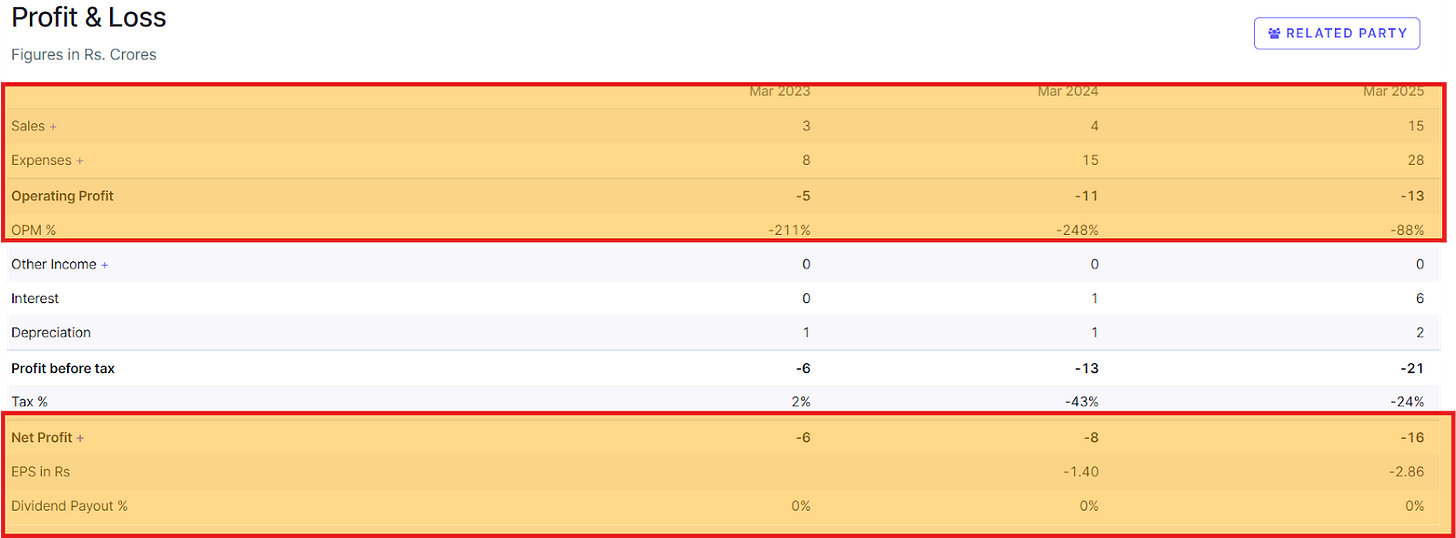

Source: Screener

Look at how promoters’ shareholding has gone down in just one year. From 70% to 50%

And if they continue to grow similarly, odds are pretty high that they will continue to do rights issues and dilute their holdings even further.

This is probably the most important key monitorable for me, and maybe you as well, if you are interested in tracking this business.

As an investor evaluating Purple Finance for your microcap equity portfolio, you ideally want two things to happen:

Firstly, they must show high growth in business and come out of the large losses they are currently generating, as initial investment in team, physical infrastructure, and tech is high. Only growth can solve this problem.

Source: Screener

Secondly, you know that shareholding for a lender is a currency for growth. They have to dilute from time to time because money is raw material for the lending business. Check the history of HDFC, Bajaj Finance, or any other quality lender; even they have diluted in their journey of growth. What separates the men from the boys is the quantum of fundraising, the valuation at which it is raised, and the amount of dilution. For a tiny micro-cap business like Purple Finance, these points are furthermore important.

Source: Screener

Source: Screener

That’s Purple Finance for you. :)

Source: Latest Presentation

If you have read my past blogs, by now you know how much I love watching movies. And not just that, I also like connecting businesses with movie scenes. 🙂

I wanted to end the blog on a lighter note. Hence, I tried to rewrite the famous Deewar movie scene between two legendary actors, Amitabh Bachchan (Vijay) and Shashi Kapoor (Ravi), in the context of Purple Finance.

Jokes aside, SBFC Finance is a pretty good horse with a great jockey. Can you say this about Purple Finance today, even after reading such a long blog post?

The clear answer is no. The reason is straightforward. While the sector tailwind appears to be very long and strong, the history of the company is too short to take any call at this juncture.

However, due to such a tiny base of just 100 Cr AUM and 200 Cr market cap, a couple of years of explosive growth and near-zero hiccups, it can catch the market’s attention in a jiffy.

On the flip side, building something like what SBFC has done is not easy. So blindly buying Purple Finance today just because of low base and high growth prospects is in Sunil Gavaskar’s (one of the best test cricket batsmen of India) favourite style: STUPID, STUPID, STUPID!

You might be wondering why, in a deep dive, I have not touched upon valuation yet. I guess you would have understood by now. However, just to be clear, at this stage, valuation doesn’t matter to me. A 3 times price to book of Purple Finance does not tell me anything about how the book value will behave in the near term, how the incremental funding and dilution will impact earnings and book value, and how many quarters or years it will take to stabilize the business model. As I cannot find answers to these questions today, I won’t make any judgment on the valuation. It doesn’t matter to me.

However, remember that when a sector is in a strong tailwind, if tiny companies in that space can get their act together, a fortune can be made.

So this one goes into the watchlist, and I would love to track it closely.

SEBI Disclosure: No Holding, No Recommendation

P.S. We, at Zen Nivesh, have taken a pledge to cover at least one interesting small company (preferably, less than 3000 Cr market cap) every week for our loyal Substack subscribers. Our effort is always to write primarily on those businesses for which you won’t find brokerage reports or institutional coverage. You probably won’t believe but it is true that Zen Nivesh, our 4-month-young baby, has already covered 2 dozen microcap companies through blogs, webinars, research notes, management meets, plant visits, etc. Know more about us here and here.

Thank you for reading!

Had fun researching and writing ✍️ on this tiny microcap business. Let me know your views. Here for honest candid feedback on the research and the business. 😀

Brilliant write up Ankit. Thanks for sharing 🙏🏻